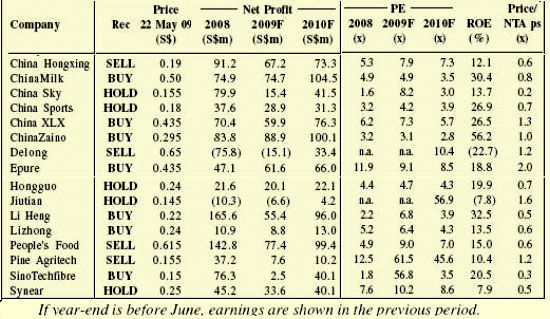

Source: UOB Kayhian report June 2.

SURE, THE corporate governance issues have not gone away but UOB Kay Hian has just issued an ‘Overweight’ rating on the S-chip sector.

Its analyst, Allen Jiao, wrote that the sector is trading at 5.9x FY09 PE and 0.8x P/B, which imply significant discounts to the market's 15.1x forward PE and 1.4x P/B.

“Thus, we believe small-cap stocks are generally undervalued and still offer sufficient upside, and expect the divergence between the sector and the market to converge.”

In addition, the analyst reiterated that China's economic outlook is bright, and that “has led us to believe that the S-share sector will continue to do well.”

However, investors should continue to pay close attention to risks associated with company management, balance sheet, cash flow and corporate governance when making investment decisions with regard to S-shares.

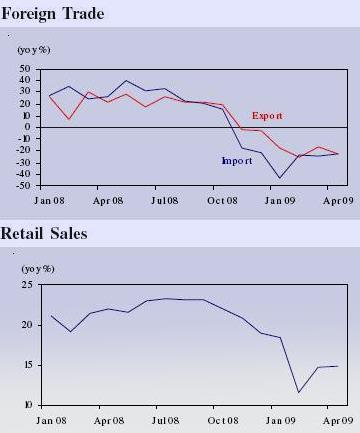

Source: CEIC

“We are selective in our stock picks. Credibility, corporate governance, and balance sheet and cash flow risks are more important than business prospects, earnings growth, valuation and stock liquidity.”

Exports declined, China consumers still strong

China's exports declined 22.6% year-on-year in Apr 09, much lower than the consensus forecast of -15.3%. Demand from G3 economies is still lacklustre.

In particular, both the EU and Japan saw export growth shrink by more than 20% in April.

The Guangzhou Trade Fair's low transaction value (-17% year-on-year) suggests exports are unlikely to recover before 4Q09. In addition, signs of rising protectionism and a strong renminbi will also hurt China's exports, noted UOB Kay Hian.

Imports, however, are showing signs of recovery as imports of primary goods and commodity products have improved significantly on a month-on-month basis, which also suggests a rebound in domestic demand.

The consumer market in China has held firm on the back of the aggressive promotions offered by brand owners and department stores, as well as the rebound in the property and automobile markets.

The government has also made efforts to support domestic consumption, such as increasing pensions for retirees and improving migrant workers' employment prospects by undertaking many infrastructure projects so that income growth remains respectable.

In Apr 09, retail sales in rural areas grew 16.7%, outpacing sales in urban areas (+13.9%). As a result, China's retail sales continued to register a steady growth of 14.8% year-on-year for Apr 09.

Taking into account the negative CPI number in April, real growth in retail sales could have come in at 16.3% year-on-year, said UOB Kay Hian. The growth in retail sales could moderate in 2H09 due to a high base and it is also uncertain whether the impact of the government's stimulus measures can be sustained in the consumer market, added the research house.

Related report: DMG report: Cheery on Longcheer, Midas touch golden