Terence Wong is with Aries Consulting in HK (

UTILITY COMPANIES are favorite investments of some investors due to their steady cash flow and high dividend payout. These offset their relatively low profit growth.

China Gas is a utility company with a difference – it is in a phase of high growth. It is starting to benefit from strong demand of clean fuel energy in China.

Its core business is the distribution of natural gas to residential, commercial, industrial users and vehiccle owners in more than 100 cities and 18 provinces and regions. The group services 3.5 million residential users, and 24,722 industrial and commercial users.

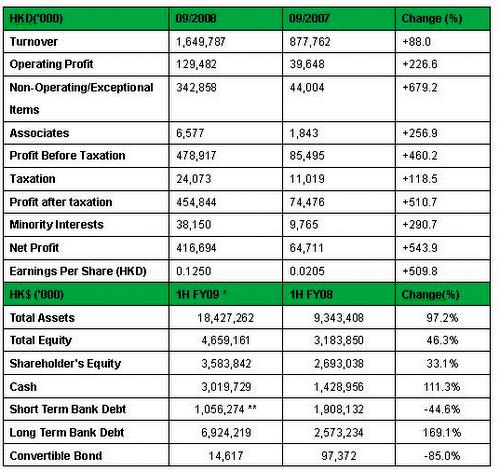

Due to its strong sale of gas, the company’s 1HFY09 total revenue increased 88% y-o-y.

China’s domestic demand for natural gas grew at a CAGR of 12.6% during 2000-05. It is expected to grow at CAGR 16% and reach 100 billion cubic meters annually by end-2010.

The natural gas share of total energy consumption is expected to lift to 5.3% in 2010 from 2.5% in 2005.

Pioneer natural gas operator

China Gas’ main revenue comes from the sales of piped gas and from connection fees.

It is a pioneer and one of the largest operators of civil-use compressed natural gas in China. Its patented "Bottled CNG Distribution Technology" being advance, highly adaptable and requiring relatively small investment and low operation cost, has become the norm for small and medium cities in natural gas supply operations.

In 1HFY2009, connection fees contributed 25% of total revenue. This percentage is expected to drop as the sale of piped gas is growing rapidly.

The total gas sale volume jumped from 380.5 to 802.3 cubic meters with a rise of 110.9% y-o-y. Coal gas and LPG sales dropped 16.7% y-o-y after some customers shifted the usage of coal gas and LPG to natural gas.

CNG has the highest profit margin of around 35% while the lowest margin cmes from residential customers at 22%. The difference in margin is due to China Gas being able to pass cost changes to its CNG customers more effectively.

It is expected that the expansion of cities and industrial areas in China will increase the usage of natural gas.

Clean energy becoming more appealing

China gas expects the sale of gas to reach 1.8 to 2 billion cubic meters for FY 2009 ended 31 Mar 09. Sales of gas is exepected to reach 3 billion cubic meters in FY10.

China Gas investor relations General Manager Frank Li said: ”The natural gas penetration rate is now 25% and it can gradually increase to 60% in six years.”

With growing awareness of clean energy, natural gas usage will keep increasing. The company will enhance the organic growth of its business in existing city gas and pipeline projects.

In addition, the company will continue to acquire six more city gas projects in the coming one year. Now, China Gas has acquired 100 projects and would like to increase it to 106.

RMB 20 billion credit line

For the first nine months of 2008, China Gas achieved a strong growth in revenue of 88%. Net profit increased more than 500%. If we exclude all non-recurrent items, net profit grew 227%.

The debt ratio, however, is at a high level after the company aggressively acquired projects. The company has a 20 billion RMB credit line from a China bank, and short-term financing is not a big issue.

China Gas paid out 32.17% of its net profit as dividend in year 03/2008.