Environmental protection features strongly in China’s 4-trillion yuan stimulus plan, with 1 trillion yuan budgeted for this over the next 3 years.

SGX-listed Sunpower stands to benefit from China’s capital expenditure on green issues.

The EPC provider of energy saving and environmental protection solutions announced this week it had secured a Rmb 45.8-million deal from China’s national energy company and the world’s largest coal producer - Shenhua.

Coal is the largest source of fuel for the generation of electricity worldwide - about 40% -- and China is the world’s largest producer.

Sunpower’s wholly-owned subsidiary, Jiangsu Sunpower Technology, will design and install a “flare gas recovery system” in Inner Mongolia from now till 2010 for Shenhua’s coal-to-olefin unit - Shenhua Baotou Coal Chemicals.

Shenhua Baotou Coal Chemicals was formed in December 2005 to set up China’s largest coal-to-alkene plant at a total investment of Rmb 12.1 billion.

Alkenes are a common industrial compound traditionally cracked from petroleum but China, which is rich in coal but strapped for oil, has poured billions of dollars into coal-liquefaction projects.

Gas flares are elevated chimneys in chemical plants that burn off unwanted or flammable gases and liquids. They are also found on oil wells, oilrigs, in oil refineries and landfills.

Converting toxic gases into useful chemicals

Sunpower’s waste gas recovery system converts toxic gases such as sulphur dioxide emitted from gas flares into industrial agents such as sulphuric acid.

Other than designing custom-made waste gas & energy recovery systems, Sunpower also manufactures and sells equipment which are part and parcel of petrochemical plants such as pressure vessels, heat pipes, heat exchangers and pipe-supports.

Industries ranging from petrochemicals to steel and transportation rely on Sunpower’s heat transfer technologies to save energy and protect the environment.

Other than Shenhua, Sunpower’s customers also include petrochemical giants such as SINOPEC, CNPC, or oil majors such as BP and CNOCC.

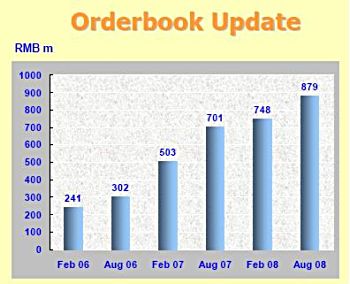

Rising orderbook

Sunpower’s revenues grew 52.9% y-o-y during 1H08 to RMb 276.8 million. Gross margin was 26.2%.

Net profit increased year-on-year by 26.9% to RMB19.9 million.

Sunpower's order book as at 30 Jun 2008 was Rmb 884 million, of which more than half would be delivered by the second half of 2008, according to the company.

This implies that its second-half revenue will significantly exceed that of the first half.