The Hong Kong Stock Exchange’s Hang Seng Index (HSI) has steadily declined by 60% from 27,561 on 2 Jan to a 52-week low of 11,016 on 27 Oct.

Based on last Fri’s close of 14,758, the Hang Seng has since rebounded some 34%.

The Shenzhen Composite (SZCOMP), the Shanghai Composite (SHCOMP), and the FTSE ST All Shares (FSTAS) Indices followed a similar pattern of decline and recovery.

How will the Rmb 4 trillion package be spent?

Ten measures to boost domestic demand, with a strong focus on infrastructure were announced (see table).

|

China Stimulus Package announced 10 Nov 2008 2. Accelerate the building of rural infrastructure (methane gas safety, drinking water safety, upgrade rural highways and power grids, “transferring water from south to the north”, hydro projects, large scale irrigation) 3. Accelerate the building of railways, highways, airports and other large infrastructure (passenger routes, coal transportation routes, railways in Western China, city power grid upgrades) 4. Accelerate the development of health care and education systems (improve medical services for grass root level, education infrastructure in Mid/Western China) 5. Strengthen environmental and ecological infrastructure (waste water treatment, garbage treatment, fighting water pollution, protect natural vegetation, encourage energy saving) 6. Encourage innovation and structural adjustment in the economy (support high tech industries and tertiary) 7. Accelerate the re-building of earthquake-affected zones 8. Boost rural income (increase the minimum purchase price of grain for next year, increase direct subsidies for farmers, subsidies for better seeds, farming equipment, improve social welfare and subsidies for low income group, increase pension money for retired people) 9. Country wide reform on corporate value added tax (encourage technological improvement, reduce corporates’ burden by Rmb120bn) 10. Ease credit to sustain economic growth (scrapping loan quota restriction for commercial banks, “reasonably” expand credit growth, strengthen support to major projects, rural areas, farmers, agriculture, technological improvement and M&A among SMEs, “selectively” encourage and strengthen consumer credit.) |

Some Rmb 370 billion is earmarked for rural infrastructure and projects to improve living standards of rural dwellers.

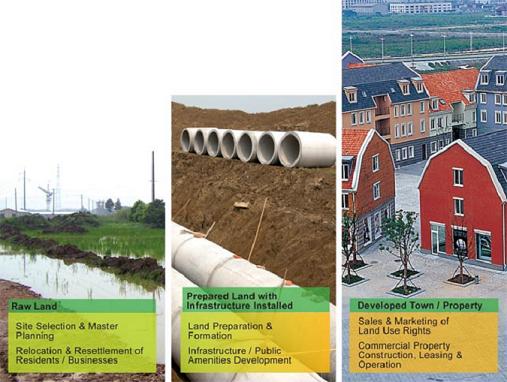

A prelude to all urbanization and infrastructure development is the transformation of farmland into new towns.

China New Town, listed on SGX with a market cap of about S$80 million currently, is in the business of preparing land in China for property developers.

The company recently delivered its third parcel of land in Shenyang to land authorities that sell them to third-party residential property developers.

The latest land parcel with a site area of 185,418 sq m was sold at Rmb 129.22 million in Oct, or Rmb 697 per sq m.

The sale is expected to contribute Rmb 90.5 million to FY08 revenues and gross profit of Rmb 23.7 million.

The group currently has projects in Luodian (Shanghai), Wuxi, Shenyang and Changchun sub-urban areas in high economic growth cities of the rapidly growing Pan Bohai Region and Yangtze River Delta.

The group’s strategic focus is on Tier 2 and Tier 3 cities considered as “hot spots” for foreign investments, with high GDP growth, easy access and infrastructure.

New town projects will involve clearing the land, and relocating incumbent residents and businesses so that the majority of residential development plots are suitable for sale by land authorities. Most projects take 5 to 7 years to complete.

Expecting new financing

In a recent interview with XFN-Asia, China New Town Development said it has sorted out its short-term financing problems after a string of losses and the repurchase of the convertible bonds.

It also said that as a result of its improved financial position it expects to secure a key loan from Chinese banks around the lunar new year to expand its business.

"We expect to obtain a 1 bln yuan loan from banks around the lunar new year to fund our projects in Shanghai," said Ben Cheng, the company's chief executive officer.

The company reported a higher than expected third quarter net loss of 515 mln yuan mainly resulted from the 5 pct US dollar settled convertible bonds.

"We have solved the problem of the convertible bonds. Now we do not have any financial problems," Cheng told XFN-Asia.

CIMB-GK valuation of 26 cents

In its Sept 11 ’08 report, CIMB-GK said: “We value CNTD based on 6x CY09 P/E, giving us a target price of S$0.26. We have conservatively applied an approximately 25% discount to the current sector average of 8x CY09 P/E to account for CNTD’s smaller size and short listing history. Stock is cheap against peers in the universe, trading at P/B of only 0.3x CY09 its dismal share performance.”