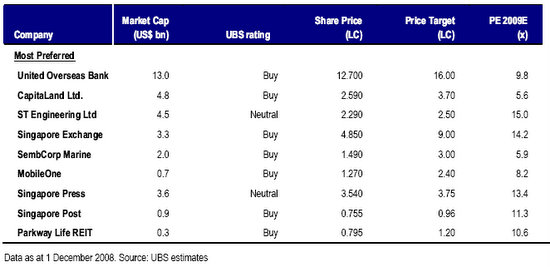

UBS Investment Research published its ‘Asian Equities Outlook 2009' report on Dec 5. The report picked 9 stocks which are blue chips.

Excerpts:

United Overseas Bank ($12.70)

Investment case: Among the three Singapore banks we prefer United Overseas Bank (UOB) as a defensive pick. It has a much smaller corporate CDO portfolio than DBS, and also does not have a large insurance exposure such as that of OCBC, which can be volatile in turbulent markets.

UOB’s management has a proven track record of having managed through the cycles and this should bode well in the current environment. UOB has a Tier 1 ratio of 11.2%, well above the minimum requirement of 6%, and we believe this reflects the strength of its balance sheet. While its loan-to-deposit ratio is only 89%, the bank in recent quarters has been a net inter-bank borrower and the recent decline in inter-bank rates should benefit.

Valuation: The stock is trading at 9.8x 2009E PE and 1.13x book. While this isin line with its peers, it is significantly below its trading history. While heightened risk aversion may limit the upside in the near term, we believe the stock remains attractive on a 12-month outlook, both on valuation and on the strength of its franchise. We derive our price target using the Gordon Growth Model, assuming ROE of 12.0%, COE of 9.6%, and growth of 4.8%.

2009 catalysts: We think signs of the bottoming of the economy and provisioning could provide potential catalysts for the stock. Another potential catalyst could be better margins via wider spreads.

CapitaLand ($2.59)

Investment case: CapitaLand (CL) has been cautious on asset markets for over 12 months. As a result, there have been proactive asset sales (that is, Singaporeoffice, China mixed use), and it has maintained a cash balance of over S$4bn.CL is therefore likely to be one of the few companies able to look beyond refinancing risk, and focus on buying distressed assets from Q209 onwards (it is waiting for the cycle to trough). This could result in CL being one of the first real estate stocks to record NAV and EPS upgrades, post the current downgrade cycle. The likelihood is the company will remain relatively inactive for the next three to six months; however, on a 12-month outlook, the market is likely to narrow the discount to NAV to some degree, with further material downside unlikely, in our view.

Valuation: Our end-2009 RNAV estimate is S$6.40. Our 12-month DCF-basedprice target of S$3.70 is roughly in line with stated book value, and at a 40%discount to our RNAV estimate.

2009 catalysts: The reinvestment of surplus cash is likely to be the main positive catalyst. Developers in general are likely to start to re-rate once transaction volume returns to the residential market, and markets can see an improvement in GDP growth on the horizon.

ST Engineering ($2.29)

Investment case: In the near term, we think ST Engineering’s (STE) Aerospace and Land Systems divisions could experience margin pressure and report weak earnings in Q1-Q209 because of the weaker global economy. Nevertheless, wethink the stock looks interesting because: 1) we believe consensus earnings estimates have been cut to more realistic levels, and we think consensus earnings downgrades should slow soon; and 2) we believe a 100% payout ratio for 2008, as guided by management, is achievable given the strength of its cashflow. We think the generous dividend payout ratio can be maintained in 2009.The stock is trading at a net yield of 7.2% for 2008E and 6.7% for 2009E.

Valuation: Our price target is based on STE’s discounted free cash flow to equity. We use a cost of equity of 8.2% based on a 3.2% risk-free rate and assume terminal growth of 3%. We believe DCF is appropriate, given STE’s strong cash generation and consistent track record of returning cash not needed to shareholders. Since 2002, STE has returned 100% of its net profit in dividends. We think this will likely be repeated in 2008, unless the cash is needed for a large acquisition.

2009 catalysts: 1) Credit quality of airline customers; 2) infrastructure spending;and 3) dividend payout ratio.

Singapore Exchange ($4.85)

Investment case: We expect trading volume to remain volatile in the near term,but it could rebound in FY10 as investors return to the relatively high economic growth region of Asia. Singapore, as a key financial services centre of Asia,should benefit. While securities volume has declined in recent months, derivatives volume has been increasing due to the popularity of futures in thecurrent environment.

Derivatives made up 20% of total revenue in FY08, and there is likely structural upside to this business as more OTC products are migrated onto regulated exchanges. We believe Singapore Exchange’s (SGX) strong balance sheet with a net cash position and monopolistic status make it an attractive stock to own.

Valuation: The stock trades at a 15.3x FY09E PE, in line with its historical average. Our DCF-based price target of S$9.00 assumes a WACC of 8.7% and terminal growth of 3%. We estimate the current share price is assuming average turnover of S$800m per day for the next five years.

This represents a 62% fall from FY08 turnover and a 37% drop from the FY09 average so far. While we expect turnover to remain weak going into the holiday season, we think there is potential for a rebound in January 2009 as investors reassess their investment allocations.

2009 catalysts: We think the main catalyst could be a rebound in securities turnover and we think this could come in early 2009 with some normalisation of risk aversion from current extreme levels.

SembCorp Marine ($1.49)

Investment case: UBS expects oil prices to remain soft through 2009. UBS’s view is for Brent crude oil prices to trend around US$60/bbl—and we expect anormalised Brent crude price of US$85/bbl. In the near term, tight credit supply means newsflow could be poor; however, we believe the quality of order books is generally good and that downside to 2009 earnings projections should be contained. The company has paid out at least 70% of earnings in dividends since1998 and we think this can be maintained.

In the medium term, we believe supply-side constraints are tight. Low oil prices in the near term would likely result in marginal activity decelerating. Over the next few years this should be a less pressing issue since demand for oil should be weak in a recessionary global economy. However, we think capex cannot be delayed indefinitely—or even beyond a few years—because of the magnitude of field decline rates.

Valuation: Our S$3.00 price target is based on our estimate of SembCorp Marine’s (SMM) discounted free cash flow to equity. We discount SMM’s equity cash flows at its COE of 8% (Singapore rf 3.1%, beta=1) and assume 3% terminal growth.

2009 catalysts: 1) Newsflow on order books; and 2) execution margins: could be helped by cost pressure.

MobileOne ($1.27)

Investment case: We believe MobileOne (M1) has an attractive mix of high dividend yield and reasonable earnings growth. The dividend yield is now 10%and the payout is likely to be sustainable given its solid balance sheet and free cash flow. Meanwhile, the yield gap against the 10-year government bond isnow at an all-time high of 780bp. We forecast a 2009-12 net profit CAGR of 9%,driven by 1) lower leased circuit costs; 2) a new revenue stream from broadband leveraging NBN (Next Generation National Broadband Network); and 3) lower capex and depreciation.

Valuation: M1 trades at 8x PE, 4x EV/EBITDA and 13% FCF yield for 2009E,which we view as attractive. Our 2009 net profit forecast is 10% below consensus, due to our more conservative stance on the competitive outlook. Our concern is that SingTel may seek to increase its subscriber base by bundling before new players enter through NBN. However, we believe M1’s valuations are excessively pricing in this risk. Our DCF-based price target assumes a WACC of 8.6% and 0% terminal growth.

2009 catalysts: We expect further details regarding NBN to emerge through thecourse of 2009. We view NBN as a good opportunity for M1 to enter thebroadband market. We believe M1 is the most credible potential new entrant through NBN as it currently has almost no presence in the broadband market while it is a sizeable player in wireless. In 2009, we expect investors to start putting more focus on M1’s potential to cut leased circuit costs and capex as the fibre optic cable rollout is complete.

Singapore Press Holdings ($3.54)

Investment case: Despite its relatively defensive qualities, Singapore Press Holdings’ (SPH) share price has fallen 22% YTD. We expect advertising revenue to be down 11% YoY in FY09 and net earnings to contract 5%. The forecast contraction in net profit is not as large as the top line because of ongoing contributions from the property development of the Sky@Eleven condominium.

While the decline in advertising revenue will depend on the severity of the recession, we believe further downside to the bottom line could be offset by a fall in newsprint prices. Newsprint prices make up 20% of total costs and have risen significantly in recent quarters. Newsprint cost rose 27% inFY09, but we think there is potential for it to be lower as global commodity prices have fallen in recent weeks. We believe SPH’s monopolistic status and strong cash flows are attractive qualities in this environment.

Valuation: The stock trades at 13.4x FY09E earnings and has a 7.2% dividend yield. Our price target is based on a sum-of-the-parts valuation, with S$1.27 for its non-core business and DCF for its core business.

2009 catalysts: A fall in newsprint price and bottoming of the economy are two potential catalysts for the stock.

Singapore Post (75.5 cents)

Investment case: Singapore Post (SingPost) is the dominant postal services operator in Singapore. We think it is attractive due to its defensive earnings and strong free cash flow generation. Revenue growth was flat during the Asiancrisis and down only 2% during SARS. On our estimates, SingPost will generate FCF of more than S$120m a year for the next five years, more than enough to cover the S$96m required to pay the minimum 5¢ per share dividend that management had committed to.

While the domestic postal sector was liberalised in May 2008, the final terms of liberalisation lead us to believe that SingPost will not be significantly affected. The company is well run, led by strong management, and we believe likely to retain its near-monopolistic market position. SingPost has low capex and refinancing requirements until 2013.

Valuation: Our 12-month price target of S$0.96 is derived using DCF,assuming 9.2% COE and 3% terminal growth. The stock trades at a PE of 10.4x FY09E and a 7.9% net dividend yield. Our price target implies a FY09E yield of 6.2%.

2009 catalysts: SingPost is exploring options to unlock the value of its headquarters, the Singapore Post Centre building. While conditions remain difficult for an outright sale, we think any positive announcement could be a share price catalyst.

Parkway Life REIT (79.5 cents)

Investment case: We believe Parkway Life REIT (PLife) is among the most defensive Singapore REITs based on strong organic growth and low near-term fund-raising risk. 90% of the trust’s income is derived from three hospitals in Singapore, where Parkway Holdings has 15-year leases, contracted to pay minimum rental growth of CPI+1% to the REIT.

For 2009, we expect PLife’s DPU to grow 8.9%: 7.5% due to 6.5% CPI growth in Singapore in 2008, andanother 1.4% from the acquisitions done in 2008. PLife has a conservative balance sheet currently with 19.7% gearing (debt of S$199m over assets ofS$1bn). In Q308, PLife entered into three-year long-term loan facilities for S$200m to refinance its short-term facilities. This ensures there is no refinancing risk until 2011.

Valuation: PLife has a 2009E DPU yield of 9.7%, and more than a 50% discount to stated NAV. We derive our S$1.20 price target using a three-stage DCF analysis.

2009 catalysts: PLife may continue to buy accretive healthcare assets in Japan and China in 2009, but has stated that it would keep gearing below 40-45%.