We may look into building special or offshore vessels, says executive chairman Ren Yuanlin, 54. Photo by Sim Kih

SHIPPING DEMAND may be grinding to a halt as importers struggle to get letters of credit and overcapacity of ships is looming. But Yangzijiang Shipbuilding chairman Ren Yuanlin is not wearing a worried look these days.

His company sits on a whopping orderbook of US$7.3 billion, and is fully booked till the second half of 2011.

Mr Ren conceded that global orders for new vessels are likely to fall by 50%-80% over the next two years, but he also believes the international trade finance scene would thaw by then.

Meanwhile, the leading Chinese shipyard is slated to deliver 85 containerships worth US$4.7 billion and 79 bulk carriers worth US$2.6 billion over the next 4 years.

In 3Q08, the increasingly busy yard's revenue grew 129% yoy to Rmb 2 billion, thanks to an increase in yard capacity.

Net earnings grew 108% to Rmb 475.3 million, translating into net margins of 23%.

A one-cent tax-exempt dividend was declared, compared to nothing in the same period last year. (No interim dividend was declared during the half-year results announcement, unchanged from the same period last year.)

Yangzijiang also announced yesterday that its had clinched shipbuilding contracts worth US$81 million to build 6 vessels in 3Q08.

”We will remain profitable as the yard increases capacity and demand-led inflationary pressures on cost of steel ease,” said Mr Ren during an analyst conference yesterday at the Tower Club.

Deputy CFO Liu Hua, 33, going through the solid financials of Yangzijiang at yesterday's briefing. Photo by Leong Chan Teik.

Below is an extract of the Q&A session attended by about 20 analysts and fund managers:

Q: How likely are customers to abandon their orders if vessel asset values crash below the contract value?

A: Shipowners may cancel an order with impunity only if delivery is delayed more than 6 months.

Orders may also be cancelled when shipyards do not require any deposit when a contract is signed. But Yangzijiang has a practice of requiring a 20% deposit as soon as a vessel-building contract is signed.

In addition, Yangzijiang requires another 20% to be guaranteed by a bank. The guarantee comes into force when works commences on a newbuild.

This practice is sharply different from that of shipyards in South Korea which require deposits amounting to only 5-10%. Each contract is on average three times the value of Yangzijiang’s typical contract. Delivery schedules are shorter.

Given those circumstances, shipowners are more likely to cancel orders if they face financing difficulties, according to Mr Ren.

Of 164 vessels that Yangzijiang has on its orderbook, only 8 are high-margin jobs which may seem more susceptible to cancellation. However, with 60% of the contract values for these 8 vessels secured already, the odds are slim that customers would now cancel the orders.

Q: What measures are in place to mitigate the risk of order cancellation?

The company has always accepted orders only from bona fide vessel charterers - as opposed to speculators - backed by banks.

Still, in the unlikely event a vessel is abandoned, Yangzijiang will work with other shipowners to take over the vessel.

Mr Ren cited an example: 60% of the contract value on two 560 million-yuan bulk carriers being built for Guangdong Power Station have been secured.

In the event these vessels are abandoned by their buyers, Mr Ren is confident many power stations will be happy to buy them at a steep discount.

Successful hedging policies have resulted in forex gains for Yangzijiang in the past 2 years.

Q: How does Yangzijiang handle forex exposure?

About 90% of its revenues are received in US dollars and the remaining 10% in Euro and RMB.

Its contracts are priced to provide buffers for the yuan to further appreciate to Rmb 6.25 to the US dollar from now to 2012.

Given the recent turn of events, the management believes the yuan’s appreciation will slow in the coming months.

Deposits for book vessels are usually collected in USD and immediately converted to RMB upon receipt. Revenue is booked much later, according to percentage of job completion.

The RMB’s rise against the USD from the time of actual collection until the time revenues are recognized is accounted for as forex gain.

For example, deposits collected for contracts signed in January 2008 may be converted at Rmb 7.20. By the time 20% of the work is completed, sales receipts may be booked at Rmb 6.80. The Rmb 0.40 difference is accounted as a currency gain.

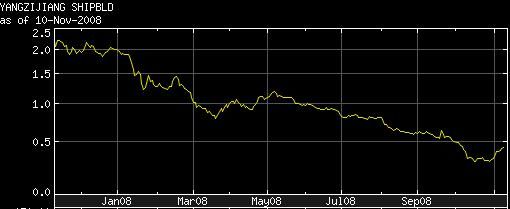

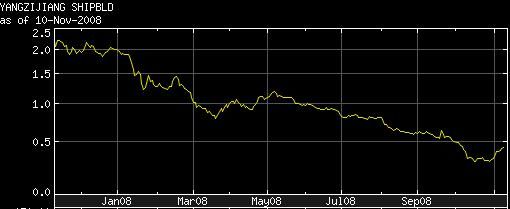

Stock is down 77% from a year ago.

Recent story: YANGZIJIANG: Bought back $39 million of shares

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors