Rows of workers doing PCBA assembly. Photo by Mephisto

THE ONE-TIME fishing village of Shenzhen was identified by the late Chinese leader, Deng Xiaopeng, to be the first of the Special Economic Zones (SEZ) in China. It was originally established in 1979 due to its proximity to Hong Kong.

Rows of workers doing PCBA assembly. Photo by Mephisto

THE ONE-TIME fishing village of Shenzhen was identified by the late Chinese leader, Deng Xiaopeng, to be the first of the Special Economic Zones (SEZ) in China. It was originally established in 1979 due to its proximity to Hong Kong.

The location attracted industrial investments from Hong Kong, and propelled the opening up of China and continuous economic reform. Shenzhen became one of the largest cities in the Pearl River Delta region, which has become one of the economic powerhouses of China as well as the largest manufacturing base in the world.

We arrived in Huang Gang, Shenzhen and was fetched at the Chinese border by Mr Sunny Chan, the Chief Financial Officer of Z-OBEE, and Mr Wong Shih Zen, the Chairman.

We then set off to their factory at Xixiang Street, Jingangshan Industrial Zone, Baoan District.

Z-OBEE started off as an investment holding company in September 2002 dealing mainly in procurement and trading of electric components and mobile handsets. It ventured into PCB design solutions in 2004 and by 2006, it was able to provide full-set solutions - from product definition to production support.

To capitalise on the growth of the mobile handset industry, Z-OBEE acquired other design solutions house, Zeus, and established subsidiaries like PhoneLink and CCDH between 2004 and 2006.

Currently, PhoneLink focuses on developing 3G handset solutions while CCHD and Zeus focus on GSM solutions for different IC platforms. To differentiate itself from competitors, Z-OBEE expanded its range of services to offer customers a one-stop service solution, which includes the entire process from design to production of mobile handsets.

In March 2006, a joint venture company, Zhenhua OBEE, was established together with Zhenhua Technology and Full Wealth.

Zhenhua Technology is a licensed mobile handset manufacturer listed on the Shenzhen Stock Exchange. Mobile handsets designed by Z-OBEE can be manufactured by the Zhenhua Group and sold under the registered handset brand name of Zhenhua Technology by Z-OBEE’s distribution customers.

To strengthen its capabilities as a one-stop service centre and to improve its cost competitiveness, Tongqing Communication Equipment was established in March 2007 to provide PCBA and the assembly of semi-finished handsets.

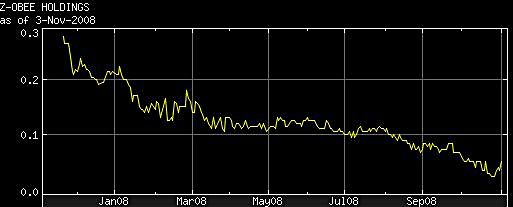

Z-OBEE was listed on Singapore Exchange on 21 Nov 2007 at an IPO price of S$0.34, and 129.0m shares were offered, of which 88.0m were new shares and 41.0m vendor shares.

The NEW Z-OBEE

At the factory, Mr Mao Hong Jian, the Executive Deputy General Manager, gave us a presentation and showed us around. We were told that the new Z-OBEE is a mobile handset solutions house that can provide either full-set solutions service or a specific service at a specific stage, based on customers’ requirements.

Its full-set solutions service comprises the entire handset design cycle, which includes industrial design, mechanical design, software design, hardware design, procurement of hardware, prototype testing, pilot production and production support, and assembly of PCBA and completed handsets.

Z-OBEE serves two major groups of customers:

1) Licensed mobile handset manufacturer customers

Z-OBEE provides solutions mainly in the form of ID/MD and PCB Assembly (PCBA) to these customers who procure the hardware components, assemble the handsets and sell them under their brand names.

2) Mobile handset distributor customers

Z-OBEE provides handset designs and also procurement and production support services to distributors who cooperate with licensed mobile handset manufacturers to manufacture and sell their mobile handsets under manufacturers’ brands. Z-OBEE's production facilities are placed in Shenzhen under Tongqing and Zhenhua Obee.

Tongqing

To expand the capacity in providing one-stop solutions, Z-OBEE established Tongqing, a wholly foreign-owned entity in Shenzhen. In the past, Tongqing did not possess a mobile handset manufacturing license and did not engage in the manufacture of finished handsets. Instead, Tongqing engages in providing subcontracted manufacturing services for hardware used in mobile handsets (mainly PCBA) and assembling semi-finished handsets.

As the PRC government has announced the abolishment of the licensing for handset manufacturing business in late 2007, Z-OBEE can provide finished handset assembly services and sell its own brandname handsets.

The factory and office premises of Tongqing are located on a leased premise in Shenzhen, PRC, with a GFA of approximately 7,872 sq m.

Currently, Tongqing has five SMT lines with a total annual capacity of approximately five million pieces of PCBA. The five lines (Fuji brand) were bought last year, each costing USD 1 million. Mr Mao explained that the current utilization rate is around 70%. Tongqing also has five handset assembly lines, which can assemble approximately 2.4 million units of semi-finished handsets per annum. The factory commenced operations in August 2007.

Zhenhua Obee

The group’s joint venture vehicle, Zhenhua Obee, in which Z-OBEE has a 42% shareholding interest, has two SMT lines to carry out PCBA operations with a combined annual capacity of approximately 2.4 million units of PCBA. The production facilities of Zhenhua Obee are leased to and operated by Zhenhua Communication for a term of three years ending on 30 April 2009 for a monthly rental of RMB 314k. The production facilities of Zhenhua Obee are located in Shenzhen, PRC.

Z-OBEE management is determined to create value for the PRC mobile handset industry. Photo by Mephisto

Large growth potential in the PRC mobile handset industry

Z-OBEE management is determined to create value for the PRC mobile handset industry. Photo by Mephisto

Large growth potential in the PRC mobile handset industry

China is the world’s largest mobile handset market. According to CCID Consulting, the sales volume in China was 150 million units in 2007 or 24.1% above that of 2006. If black-market mobiles from smuggled, unregistered brands and other illegal products were included, the figure would have exceeded 200 million units.

In addition, over 60% of users changed their mobiles with over 90 million mobiles sold for this purpose. The reasons could be faster function upgrades, higher performance-price ratio, shorter product life cycle, and customized service by the network operators.

The latest report from CCID: Mobile phone sales in China hit a new high of 43.05 million sets or RMB$49b in the first quarter of 2008, up 4.02% YoY and 7.22% QoQ respectively, due mainly to the year-end and Spring Festival promotions launched by mobile phone retailers.

The sales volume is expected to hit 180 million units by the end of the year, representing an expected growth of 20%. Foreign brands gained 65% of the mobile phone market in China in 1Q08, slightly down from 67.5% in the same period of last year. Thus, local players like Z-OBEE have a lot of opportunity to wrestle market share from the foreign brands.

From 2001 to 2007, the number of subscribers grew from 145.2 million to 547.3 million, at a CAGR of 24.7%. In 2007, the number of new subscriber reached a new record in recent years with over 86 million new subscribers. This works out to over seven million new subscribers per month.

The Ministry of Industry and Information recently reported that the number of mobile phone subscribers in China has risen to more than 616 million by Aug 2008, a huge 68.7 million more subscribers than that at the end of 2007. Additionally, the telecom industry produced revenue of RMB$194.1 billion, up 10.8% YoY.

The average number of mobile handsets held by per 100 persons in China is relatively low at 41.6 units (or penetration rate of 41.6%), compared to 80 units held by per 100 persons (penetration rate of 80%) in mature markets. Therefore, many industry players believe there is still great potential for expansion in China, which in turn is likely to increase the demand for mobile handsets.

Business Strategies and Future Plans.

I asked Mr Wang, why he chose to compete in an industry dominated by local and foreign big boys. According to CCID Consulting, Nokia, Motorola, Samsung and Sony Ericsson still dominate the mobile phone market in the world’s fastest growing economy and account for more than 70% of all mobile phones sold there during the first half of this year.

During the first six months, around 295 million mobile phones were produced in China, and the figure is expected to exceed half a billion till the year’s end. Mr Wang replied with a laugh that this was exactly the reason he moved into this market. He has a corporate vision to become a leading mobile handset solutions provider with the brand name “OBEE” that offers services ranging from product definition, solutions design to production support, and to develop Z-OBEE's brandname handsets.

With this in mind, he has set out a number of strategies and future plans. Firstly, the group has plans to enhance its product development capabilities consistently and increase the size of its R&D team.

Secondly, he also intends to enlarge the product mix, enhance the efficiency of existing production facilities and penetrate overseas markets by setting up sales offices or forming strategic alliances. A Hong Kong marketing team was set up in early 2008 to penetrate the South Asia market.

Thirdly, Z-OBEE will develop a flagship brandname for the sales and marketing of its proprietary handsets.

Trading 65% Below NAV

At its last done price of 5.5 cents, Z-OBEE’s market capitalization was S$27.4 million, which is about 35% of its NAV (15 Singapore cents). It is trading at 2x FY2008 (March YE) earnings.

| US$’ million | 2007 | 2008 | 1Q2009 |

| Revenue | 46.3 | 119.6 | 37.6 |

| Operating expenses | -2.0 | -5.8 | -1.3 |

| EBITDA | 8.7 | 11.5 | 3.1 |

| Profit before taxation | 9.3 | 10.9 | |

| Net Profit | 8.8 | 10.1 | 1.9 |

| Number of shares (’million) | 409.6 | 497.6 | 497.6 |

| NAV | 12.7 | 51.6 | 53.9 |

| Current Liabilities | 3.7 | 16.8 | 29.8 |

| Non-current Liabilities | 3.6 | 2.9 | 2.6 |

| Cash and cash equivalents | 4.4 | 19.1 | 10.8 |

| Financial Ratios | |||

| Debtors turnover (days) | 30.7 | 73.4 | -- |

| Stock turnover (days) | 21.1 | 22.8 | -- |

| Creditor turnover (days) | 3.7 | 23.6 | -- |

The management guided that there will be minimal capex in 2009/2010. While there are some other developments going on con-currently, the use of additional capex is kept at a minimum. Small cap stocks tend to have high beta in volatile markets. But if there is one small cap which looks like it can withstand this market winter, it is Z-OBEE, which may well turn out to be a winner.