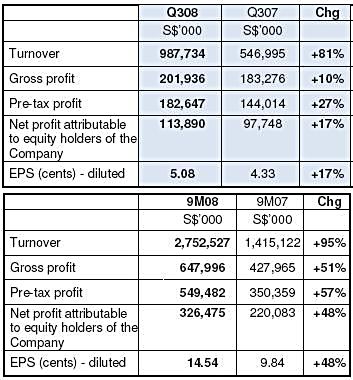

LOOKING BEYOND all the nice numbers in COSCO'S latest results (right), investors are more intent on knowing about potential cancellation of orders, delays in ship delivery, credit financing difficulties etc.

Is the situation really that bad? I did a summary of the research reports that I received from my broker to try and reach a fair assessment of the business.

Results in line with expectations?

Most of the analysts concurred that the 3Q results were in line with their expectations.

Nomura, JP Morgan, UBS, Phillip and Citi were comfortable with the results, although they noted higher contribution from forex gains (S$7.7m) and scrap metals (S$39m).

While the revenue growth was impressive, higher steel costs resulted in a big drop in overall gross margin from 33.5% in 3Q07 to 20.4% in 3Q08.

Gross margin for 9M08 was 23.5%, which is already down 6.7%. Deutsche and Morgan Stanley were among the few who commented that the 3Q results were weaker than expected.

Major concerns going forward

Among the brokers, Deutsche remains the most bearish on COSCO. Its analyst highlighted that COSCO faced risks on 2 fronts. On the shipping front, COSCO has 12 vessels, of which two are up for renewal in 4Q08 while the current contracts for six vessels will expire in 1H09.

With the Baltic Dry Index (BDI) currently at a low of 925 (which is down 91% y-o-y), the renewal of the charter for these vessels is at risk. The report also stated that the COSCO management is considering putting 2 vessels on spot charter even though they acknowledged that no shipper can be profitable at these levels.

On the ship building front, COSCO is experiencing delays for nine bulk carriers, which were supposed to be delivered in 2008 at its Zhoushan shipyard. Lack of experience was cited as a key reason for the delay.

Deutsche takes the view that further delays are possible as these 9 vessels are added to the 40 that were scheduled to be delivered in 2009. The analyst pointed out that delays beyond 180 days may lead to customers canceling orders.

Citigroup also brought up concerns on dry bulk ship cancellations due to sharp decline in BDI and credit crunch. Hence, the risks of potential write-downs exist and could continue to depress the valuations of the Company.

Phillip Securities also highlighted a concern that COSCO’s young offshore segment may face slower order momentum given the drop in crude oil prices in recent times. Although the analyst does not expect cancellation of orders, she is of the view that the risk remains.

A couple of houses also emphasized the slower order momentum in 2008. A weaker demand environment for dry bulk ships, and a lower BDI rate andoil prices could result in potentially lower new orders for ships and rigs, raising concerns for the end of the cycle. JP Morgan, for instance, is reducing its order book assumption further from S$1.5B/S$1B/S$1B for FY08/FY09/FY10 to no more new orders for FY08 and S$500 million for FY09 and FY10 each.

Morgan Stanley brought up an interesting point about the taxation rate of the Group - something which was not well highlighted in the other research reports. The tax rate in 3Q08 was 13%, 300 basis points higher than in 2Q08. The analysts expect the tax rate to remain high and rise toward 18% over the next two years.

Good things going for COSCO

For a start, nearly everybody agrees that the sharp drop in steel prices is likely to benefit COSCO. Steel prices have declined by more than 10% from the peak in June 2008. This could drive margins higher in 2H09 as COSCO recognizes revenue for higher-priced vessels and lower input costs. However, margins could remain weak in 1H09 as the Company locked in steel price for that period in 1H08.

COSCO also announced that it had secured three bulk carrier shipbuilding contracts worth S$220.2mn and an offshore contract to construct two windmill turbine installation vessels. It also received a few conversion and floating dock construction projects that are positive for the stock in an environment where yards are seeing cancellations.

COSCO(S)’s current order book of S$12 billion provides earnings visibility of more than two years. In addition, Sevan Marine has secured construction financing of up to US$1 billion (70% of construction cost) to build two deepwater rigs. COSCO is currently building the hull of these two rigs. With the financing secured, COSCO and Sevan could announce the signing of the contract.

Morgan Stanley thinks that the total project size to be US$500 million for the two semi submersibles. During the briefing, COSCO management confirmed it had not received any order cancellations from its customers. Most investors believe there is a chance of some cancellations. The company has secured US$2.9 billion of initial deposits from customers, which could provide more stability to its backlog vis-a-vis its peers. Analysts from JP Morgan are expecting COSCO to continue to benefit from foreign exchange gains as the USD strengthens against the SGD.

Changes to analyst estimates

Analysts took this opportunity to cut their earnings’ estimates and target prices, as reflected in the compilation below: | House | Recommendation | Target Price (Previously) | Target Price (Now) |

| Citi | Hold | S$1.50 | S$0.85 |

| Deutsche | Sell | S$0.50 | S$0.47 |

| JP Morgan | Overweight | S$2.50 | S$1.50 |

| Morgan Stanley | Equal-Weight | S$0.75 | S$0.75 |

| Nomura | Reduce | S$0.72 | S$0.72 |

| Phillip | Hold | S$3.44 | S$0.66 |

| UBS | Buy | S$0.77 | S$0.77 |

You are welcomed to post a comment or question at our forum.