MAYBANK KIM ENG posted an 'Overweight' rating on the offshore and marine sector in its 16 July report, where it predicted a stable earnings outlook for Singapore rigbuilders Keppel Corp and SembCorp Marine, but possible downside risks for the Chinese shipbuilders, Cosco and Yangzijiang Shipbuilding.

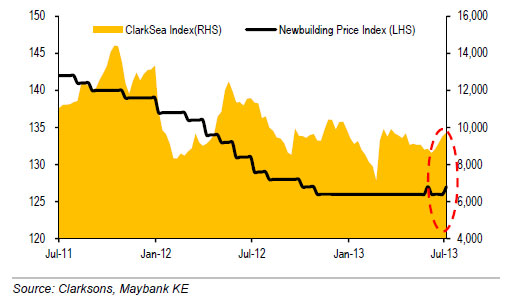

“Clarkson’s newbuilding price index shows first signs of uptick after threading the bottom for more than 8 months. A rise in price could actually trigger shipowners to start placing orders before prices increase further.

“While these are positive signs that may indicate that the shipbuilding sector could be at the start of the road to recovery, we believe that it only applies to selective product segments for now," wrote analyst Yeak Chee Keong, CFA.

"The new demand trend is for mega, fuel-efficient and environmentally friendly ships (Triple-E) and also LNG vessels.

"Shipyards with technological capabilities and execution track records, such as Korean shipyards will are likely to get more orders.

"In our view, the return of such orders to the Korean yards could also ease the hunger to compete in other offshore vessel categories. This would relieve the competition with Singapore rigbuilders."

Keppel Corp (Buy, target price SGD12.10)

On Thu, Keppel Corp posted a 1H2013 net profit of S$677 million, 47% lower year-on-year.

It also announced an interim dividend of 20.8 cents per share, comprising of 10 cents in cash and a dividend in-specie of Keppel REIT units equivalent to 10.8 cents per share.

As at 30 June, it had order books of S$13.1 billion. Year-to-date, it has secured S$3.5 billion worth of orders and delivered 13 out of 22 rigs on its schedule for this year.

The Maybank Kim Eng analyst does not think that competition would drive down newbuild rig prices and thereby leading to a downward margin trend for Keppel Corp.

In his report, he said, ”We also view management’s guidance of 10-12% long-term operating margins as too conservative at least for the next 3 years.

”We think that market is still skeptical, which leaves room for stock price upside on better-than-expected margins.

“Maintain Buy with SOTP-based target price reduced to SGD12.10 (from SGD12.50) as we adjust SOTP components and increased risk-free rates (3%) used in DCF valuations.” Normalized price change comparison between Keppel, Sembcorp Marine, Cosco and Yangzijiang shows outperformance by Keppel. Bloomberg data

Normalized price change comparison between Keppel, Sembcorp Marine, Cosco and Yangzijiang shows outperformance by Keppel. Bloomberg data

Sembcorp Marine (Buy, target price SGD5.20)

The analyst is forecasting stable operating margins from Sembcorp Marine of 12% to 13% when it announces its 2Q2013 results on 1 Aug.

”Its first Sete Brazil drillship is now progressively recognized but concerns on Brazil yard operations may once again be raised given Norwegian shipbuilder Vard’s recent issues in Brazil.

“The mitigating factors are:

(1) Local content proportion is not 100% unlike Vard (55-65% for SembCorp Marine)

(2) SembCorp Marine will not likely need to outsource to third-party Brazilian yards as what Vard did

(3) Its new yard is in a less crowded area (Espirito Santo) where there is ready access to labor unlike in Rio de Janeiro.

“Our view: Market concerns on Brazil margins are overly pessimistic. We expect marginal margin expansion despite the risks, as opposed to margin decline as expected by consensus.

“Maintain Buy with SOTP-based TP reduced marginally to SGD5.20 (from SGD5.40) for higher risk-free rate assumptions (3%) and lower valuations on Cosco.”

Cosco Corp (Sell, target price SGD0.65)

The analyst is expecting Cosco to face more downside margin pressure.

”Rongsheng’s downfall puts a negative pall on the Chinese shipbuilding sector, which makes re-rating of the stock unlikely in the near term. Instead, we see possible further stock price downside given the potential of a sector de-rating.

“The company has secured a slew of new contracts recently, bringing YTD contracts secure to an estimated USD743 million (excl. potential exercise of options for about USD260 million more), but execution remains a big uncertainty.

“Our expectation is for USD1.8 billion of new orders this year against management’s target of USD2.0 billion.

“We lower our target price to SGD0.65 (from SGD0.73) as we now peg our valuations to a 1.1x P/B (from 1.3x P/B), which is 1 std dev below mean, given the downside risks. Maintain Sell.”

Yangzijiang Shipbuilding (Hold, target price SGD0.93) About 90% of Yangzijiang's revenue is from shipbuilding, but it is diversifying into offshore engineering and other businesses. Company photo

About 90% of Yangzijiang's revenue is from shipbuilding, but it is diversifying into offshore engineering and other businesses. Company photo

As Yangzijiang enters its most trying times between 2H13 to 1H14 when its shipbuilding orderbook gets depleted, it has maintained its rationality in the shipbuilding business, refusing to take any orders that are loss making.

“Instead of using aggressive pricing to secure jobs, it instead sought to counter the downturn through the micro-financing business and investments in held-to-maturity assets. This did not go down entirely well with many investors but has kept the company afloat.

“YZJ has one of the strongest balance sheets and has good track record for execution.

”It recently secured a batch of new orders worth USD414 million, bringing YTD order wins to about USD1.01 billion. It still has 51 options worth USD2.64b outstanding.

”Valuations are already at a low among the Chinese shipbuilders, and we do not see much downside from here even if the sector de-rates. However sector weakness will mean that the stock price would continue to be range bound.

“Maintain Hold and SOTP-based target price of SGD0.93. Implied P/B is 1.0x.”

Yangzijiang is expected to announce its results on 7 Aug.

Related story: YANGZIJIANG: Shipbuilding Downturn, Yes, But We Will Prevail With New Income Streams