The report's buy calls: China Hongxing, Li Heng and Sino Environment.

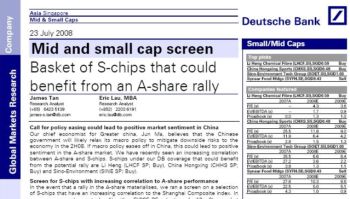

DEUTSCHE BANK’s Greater China chief economist, Jun Ma, believes that the Chinese government will likely relax macro policies in the coming months to mitigate downside risks to the country's economic growth.

According to the bank’s report on 23 July, the measures may include:

* relaxation of monetary policy;

* slowdown in the pace of RMB appreciation;

* VAT rebate increase for the export sector; and

* broadening of financing options for developers, SMEs and exporters

Deutsche Bank’s report said the moves could lead to positive market sentiment in China and Hong Kong, and should be particularly positive for the banking and property sectors. The move to reduce the probability of significant economic slowdown in China could help put a stop to the deterioration of corporate earnings.

Investors and fund managers from Singapore and China visited Fibrechem recently on a trip organised by Financial PR. Photo by David Leoy

Recent media reports highlighted that the Chinese government could increase general export tax rebates from 11% to 13% and rebates on exported clothing from 11% to 15% in a bid to support the Chinese textile and garment industry.

Chemical fibre and synthetic fibre plays that could ride on potential fiscal policy changes and a potential A-share rally are Li Heng, China Sky, Fibrechem Technologies and Sino Techfibre.

In Deutche Bank's screen selection, analysts James Tan and Eric Lau looked at companies with:

1) a FY08E PE valuation of <12x;

2) a market capitalization of more than US$200 million and less than US$2.0 billion; and

3) a daily trading liquidity of more than US$1.0 million.

| Rating | Price $ | Mkt cap (US$m) | Yield (%) | P/B | PE FY07 | PE FY08 | PE FY09 | ROE (%) | |

| China Hongxing | Buy | 0.515 | 969 | 2.1 | 1.5 | 25.5 | 11.8 | 9.0 | 15.2 |

| Li Heng | Buy | 0.615 | 774 | 4.3 | 1.3 | 4.6 | 4.3 | 3.6 | 40.1 |

| FerroChina | NR | 1.25 | 740 | 0.8 | 0.8 | 7.3 | 5.3 | 4.1 | 10.7 |

| China Sky | NR | 0.81 | 476 | 2.3 | 1.1 | 4.8 | 4.4 | 3.2 | 27.7 |

| Synear Foods | Sell | 0.465 | 474 | 2.1 | 1.0 | 8.2 | 10.3 | 8.6 | 10.1 |

| Fibrechem Technologies | NR | 0.635 | 425 | 2.5 | 1.3 | 5.9 | 5.3 | 3.7 | 36.3 |

| Sino Techfibre | NR | 0.56 | 386 | 2.1 | 1.5 | 5.3 | 5.3 | 3.9 | 32.1 |

| China Milk | NR | 0.69 | 378 | 1.4 | 1.4 | 5.3 | 4.9 | 4.4 | 30.3 |

| Celestial Nutrifoods | NR | 0.785 | 370 | 2.5 | 1.3 | 5.5 | 5.7 | 5.6 | 26.6 |

| Pine Agritech | NR | 0.155 | 344 | 3.6 | 1.3 | 6.5 | 6.9 | 7.7 | 28.6 |

| Sino Environment | Buy | 1.14 | 292 | 0.0 | 1.3 | 8.1 | 6.6 | 6.4 | 22.4 |

| China Sports | NR | 0.405 | 202 | 2.2 | 2.1 | 9.9 | 6.7 | 5.0 | 46.6 |

Source: Deutsche Bank, Bloomberg consensus, prices updated as of 23 July 2008

From a statistical standpoint, Deutsche Bank believes that the basket of stocks above which have met its screen criteria are stocks which have been oversold and could see value start to emerge.

”This basket of stocks could benefit in the event of a rally in the A-share market or if China moves to relax its policy through specific policy measures.”

Deutsche Bank's report had something to say about its 3 buy calls:

Li Heng:

We believe that Li Heng’s current share price reflects overly pessimistic concerns of lowerglobal demand for textiles amidst rising oil prices and inflationary cost pressures.

Our price target for Li Heng is S$1.40 based on our DCF valuation (13.3% WACC, 1.0% terminal growth rate). This implies a forward PE multiple of 11.1x and 8.7x FY08-09E PE, respectively. Risks include higher raw material costs and the effect of a global economic slowdown on textile demand.

China Hongxing:

We continue to like China Hongxing’s business model as a proxy for China’s sporting boom. The company occupies the mass market sporting segment in China where it is one of the fastest growing companies. We maintain our Buy rating on the company with a DCF based target price of S$0.85.

For our DCF calculation, we assume a beta of 1.1, an equity risk premium of 5.3% and a risk free rateof 4.9% to derive our WACC of 10.7% and terminal growth rate of 2.5%, in line with our assumptions for other China brands. Key risks: increased competition in the sportswear segment, a macro consumer slowdown and inflationary pressures.

Sino Environment:

We believe that further progress in the VOC, dust elimination and desulphurization businesses would drive a re-rating of the stock. Trading at a significant discount to global peers, the stock was oversold, in our opinion, given its healthy order backlog and forecast 28% EPS CAGR between 2007 and 2010E.

We are keeping our Buy recommendation on the company and our 12-month target price at S$1.87 (based on 12x 2008E PER). Major risks include: 1) its short track record in the desulphurization market and its lack of a Grade-A license; 2) a delay in the start of construction for environmental projects; and 3) potentially weak execution of its business expansion strategy.

Recent stories:

FIBRECHEM gives premium fabrics suppliers a run for their money

LI HENG: Visit to leading Chinese nylon producer