ONE OF the most enterprising and wealthiest Malay businessmen in Singapore is Mr Mohd Salleh Marican, 58, who has a net worth of around $125 million just based on his stake in listed companies.

The bulk of that is his own and his family’s combined 70% holding (worth around $90 m) in Second Chance Properties, of which he is CEO.

His shareholding entitles him to a fat dividend every year as Second Chance (market capitalization: $126 million based on stock price of 38.5 cents recently) has been declaring near-fabulous dividends in recent years.

For the current year ending June 30, it has declared a 3-cent tax-exempt dividend, which equates to a yield of 7.8%.For the next financial year, Second Chance is set to pay out 3.5 cents (tax-exempt), or a yield of 9.1%.

The company has stated its dividend intentions in advance and has, so far, delivered the goods. "Barring any changes in circumstances, the directors intend to continue increasing the dividend payout in future years," according to its press release.

| FY05 | FY06 | FY07 | |

Revenue |

$39.1m | $42.5m | $48.2m |

| Net profit | $10.0m | $10.5m | $18.4m |

| Dividend | 2 ct | 2.4 ct | 2.7 ct |

In a recent meeting with NextInsight, an analyst and a financial industry professional, Mr Mohd Salleh shared insights into his business which looks headed for another good year.

To start with, Second Chance has not only its office but its gold retail business operating out of Tanjong Katong Complex. Some years ago, the government announced that the complex, which is sited near the Paya Lebar MRT station, is earmarked for redevelopment.

To prepare for its relocation, possibly in 2012, Second Chance started buying shop units in City Plaza, which is just across the road. Recognising that other Tanjong Katong Complex tenants might relocate there, Second Chance accumulated more shop units in City Plaza.

It now owns 16 freehold shop units there valued at $34 million.

Future demand for City Plaza space could swell now that it has been announced that Malay Village nearby would also be redeveloped in 2011.

“There are 150 tenants in Tanjong Katong Complex and 40-50 in Malay Village. They depend on Malay customers and they have to be here in the Geylang area. Where can they go? Joo Chiat Complex is full,” reasoned Mr Mohd Salleh.

That’s why he thinks City Plaza will be in big demand, especially during the four to five years it takes for new developments to come up, he added.

After that, City Plaza’s rentals (now at $10-12 psf, compared to the $40-plus psf rates at suburban centers such as Tampines Square and Parkway Parade) will continue to be buoyed by the higher rates that new developments will charge.

“If the new shopping center charges $40 per sq foot, the rental at City Plaza of course won’t be $40 but at just $20, it will be double what the rate is now.”

Becoming a landlord

In April 1999, Second Chance had started buying shop units in Housing Board estates when the property market was in a slump. It had $5.4 million raised from its IPO in 1997, and cashflow from its apparel and gold businesses. Significantly, it borrowed as much as it could from the banks.

Its move into the property arena stemmed from it being an apparel retailer and its experience of being a tenant, said Mr Mohd Salleh.

”We knew which properties to buy. We had the confidence.”

He explained that in addition, tenants with a captive pool of customers have a high tolerance for rental increases. Reasons: they would find it more expensive to relocate and fit-out a new shop, and they would be uncertain of building up a new pool of clients.

Being a landlord of retail space was attractive to Second Chance because, unlike residential properties, retail outlets are renovated or spruced up at the cost of the tenants, not the landlord.

As of the last FY annual report, Second Chance owned 18 units shop units in HDB estates such as Clementi and Toa Pyaoh. It also owns nine units in places such as Far East Plaza and Peninsula Plaza. In all, its investment and self-occupied properties were valued at $97 million last year.

Second Chance has been able to increase rental rates on its shops when leases were renewed. On the whole, its net rental income (after property tax) is $7.6 million, or close to 10% yield based on the original purchase prices of its properties, said Mr Mohd Salleh.

Second Chance has been paring down its debt sharply, and its gearing now is a very low 0.32%.

Stock investor

Second Chance holds about $17.6 million in equities, after having sold $7.8 million in the first nine months of the current FY ending June 30 ’08.

Most of that is in Reits such as Suntec, Allco and MacArthur.

“Prices of physical properties have not corrected a lot but property counters have come down. Why buy a physical property when you can buy a Reit at 30-40% below NTA and providing a yield of as high as 10%?”

The market has de-rated them as some may be facing difficulties in accessing credit to make acquisitions but “this is not going to be the case all the time,” said Mr Mohd Salleh.

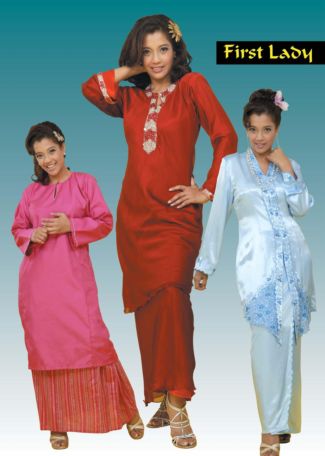

Photo: annual report

Gold & apparel businesses

As gold prices climb, sales of gold by Second Chance drops. But profit margins go up because the inventory was bought at lower costs, explained Mr Mohd Salleh.

The company does not take a position on where gold prices might be headed. “We don’t gamble. We buy the quantities we sold last week.”

Second Chance has a single gold retailing outlet and it operates at Tanjong Katong Complex, generating $22.5 million in sales in FY07 and $3.8 million pre-tax profit – a relatively stable business.

”Our competitive advantage is that we have the widest range of gold jewellery for Malay taste.”

Second Chance reckons it has about 40% of the Malay market.

It, however, does not plan to open another store in another part of Singapore, since “it will cannibalise part of our existing sales and it won’t make this kind of profit. It’s not worth it.”

In addition, gold is a capital-intensive business. Even for a small shop, Second Chance would need a few million dollars in cash, said Mr Mohd Salleh, adding that with that money he would rather buy properties for rental income.

What about the company’s focus on expanding its apparel business?

“That is a business that doesn’t need much capital to expand. It doesn’t cost much to start up, and if the business is good, you get back your money in two or three years. You can use the money to open more shops.”

All the company’s 29 First Lady apparel shops, which are located all over Malaysia, are profitable.

Of all its businesses, the apparel business is the most challenging as fashion and customer taste are ever changing. Property rental is, in comparison, stable with leases locked in for a long duration. Gold retailing, too, is stable.

Daughter’s resignation

Finally, when asked about the recent resignation of his daughter, Radiah, as an executive director of Second Chance, Mr Mohd Salleh said she was hoping to start a family. So there, nothing for investors to be unduly concerned about.