- Posts: 770

- Thank you received: 23

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Severely Undervalued Stocks

4 years 8 months ago #25780

by pine

Replied by pine on topic Severely Undervalued Stocks

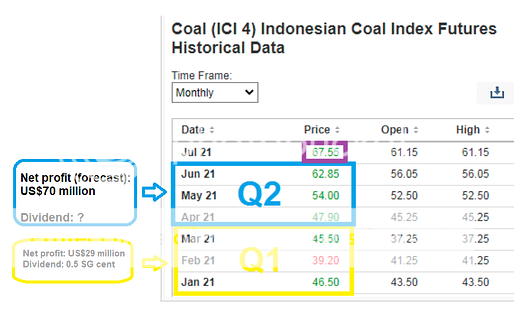

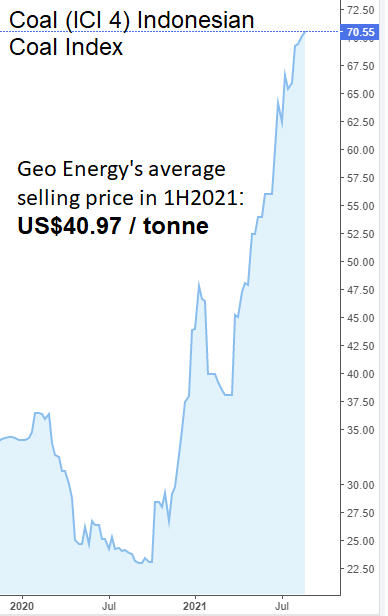

Coal prices continue to be very strong! Geo Energy and Golden Energy will huat ! Not just growth but awesome growth in 1H2021 results.

The following user(s) said Thank You: josephyeo

Please Log in to join the conversation.

4 years 8 months ago #25790

by pine

Replied by pine on topic Severely Undervalued Stocks

Gas Shortage Pushes Coal Prices To 10-Year HighBy Irina Slav - Jun 25, 2021, 9:30 AM CDT

Tight natural gas supply and a rebound in electricity consumption have combined to push thermal coal prices to the highest in a decade, the Wall Street Journal reports, adding that insufficient rainfall in China has contributed to the trend.

Citing data compiled by Argus, the WSJ's Joe Wallace wrote that the price of export coal from Newscastle, Australia -- most of which goes to Asia -- has gained 56 percent over the last year. European prices have also risen, adding 64 percent since the start of the year.

Coal supply is also experiencing a growing tightness because of low investment in new production, partially the result of a drive towards lower use of the dirtiest fossil fuel and a boost in renewable electricity generation capacity additions.

However, the latest price trends suggest that this capacity still falls short of meeting the demand for electricity in most key markets.

According to the WSJ report, coal prices are likely to remain higher over the next few months due to the situation with fundamentals.

Supply is shrinking and it's probably shrinking faster than demand, Tom Price, head of commodities strategy at Liberum, told the WSJ's Wallace. "Everyone had turned their backs on these [thermal-coal mining] assets. Those companies that have clung on to them have made a small fortune on them in just the past few months."

In China, the situation is quite critical. A shortage of coal last month prompted the introduction of power rationing in parts of the country, Argus reported earlier this month, adding that more rationing is likely as supply continues to be tight, not least because of a ban on Australian imports amid a political row between the two countries.

Meanwhile, other suppliers are reaping the benefits of the unofficial ban, free to raise prices for delivery of the fuel to the world&rsquo s largest consumer.

By Irina Slav for Oilprice.com

Tight natural gas supply and a rebound in electricity consumption have combined to push thermal coal prices to the highest in a decade, the Wall Street Journal reports, adding that insufficient rainfall in China has contributed to the trend.

Citing data compiled by Argus, the WSJ's Joe Wallace wrote that the price of export coal from Newscastle, Australia -- most of which goes to Asia -- has gained 56 percent over the last year. European prices have also risen, adding 64 percent since the start of the year.

Coal supply is also experiencing a growing tightness because of low investment in new production, partially the result of a drive towards lower use of the dirtiest fossil fuel and a boost in renewable electricity generation capacity additions.

However, the latest price trends suggest that this capacity still falls short of meeting the demand for electricity in most key markets.

According to the WSJ report, coal prices are likely to remain higher over the next few months due to the situation with fundamentals.

Supply is shrinking and it's probably shrinking faster than demand, Tom Price, head of commodities strategy at Liberum, told the WSJ's Wallace. "Everyone had turned their backs on these [thermal-coal mining] assets. Those companies that have clung on to them have made a small fortune on them in just the past few months."

In China, the situation is quite critical. A shortage of coal last month prompted the introduction of power rationing in parts of the country, Argus reported earlier this month, adding that more rationing is likely as supply continues to be tight, not least because of a ban on Australian imports amid a political row between the two countries.

Meanwhile, other suppliers are reaping the benefits of the unofficial ban, free to raise prices for delivery of the fuel to the world&rsquo s largest consumer.

By Irina Slav for Oilprice.com

Please Log in to join the conversation.

4 years 7 months ago #25812

by pine

Replied by pine on topic Severely Undervalued Stocks

Coal prices are even higher in July 2021 and likewise the August 2021 futures.

Around US$60 per tonne. More than double their cash cost of production.

Geo Energy & Golden Energy will huat big - time!

Around US$60 per tonne. More than double their cash cost of production.

Geo Energy & Golden Energy will huat big - time!

Please Log in to join the conversation.

4 years 6 months ago #25846

by Joom

Replied by Joom on topic Severely Undervalued Stocks

regarding Geo Energy, admittedly the 2Q profit was much lower than expected. I looked thru press rls, and Geo may have explained it on page 3:

"The Group had early repaid its prepayment facility with Macquarie Bank for the offtake of its TBR coal. With the early repayment, we will secure a higher average selling price in the coming months."

links.sgx.com/FileOpen/Geo_1H2021%20Medi...cement&FileID=678197

Geo kena squeezed by this favour from Macquarie. But going forward, it will be market price.

"The Group had early repaid its prepayment facility with Macquarie Bank for the offtake of its TBR coal. With the early repayment, we will secure a higher average selling price in the coming months."

links.sgx.com/FileOpen/Geo_1H2021%20Medi...cement&FileID=678197

Geo kena squeezed by this favour from Macquarie. But going forward, it will be market price.

Please Log in to join the conversation.

4 years 6 months ago #25862

by Joom

Replied by Joom on topic Severely Undervalued Stocks

Please Log in to join the conversation.

Time to create page: 0.241 seconds