- Thank you received: 0

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

SGX Penny Stocks

- kelly.pheyphey

- Topic Author

- New Member

-

Less

More

8 years 5 months ago #24044

by kelly.pheyphey

SGX Penny Stocks was created by kelly.pheyphey

Asia-Pacific Strategic Investments is attempted a rights cum warrants issue to raise net continues of up to $22.4 million to support the organization's new venture into land improvement. Oei Hong Leong, the Indonesian extremely rich person head honcho, has likewise gone into a sub-guaranteeing concurrence with UOB KayHian who has embraced to endorse up to 7.8 billion rights shares. The counter last exchanged at 0.4 penny.

Keppel DC REIT reported Wednesday that it has obtained its second colocation server farm in Dublin, Ireland for a sum of 66.0 million euros ($101.3 million). Units in Keppel DC REIT last shut a large portion of a penny brings down at $1.295 on Tuesday.

Sapphire Corporation declared Tuesday that it has secured an RMB 276 million ($57 million) rail designing contract for the second period of the Beijing Metro's Changping Line. Offers in Sapphire Corp shut a large portion of a penny higher at 29.5 pennies on Tuesday.

A consortium including Heeton Holdings, KSH Holdings and Ryobi Kiso Holdings is getting Dry Bar, an exciting scene in Manchester City, with a view to redeveloping the property into a boutique inn. Offers in Heeton, KSH, and Ryobi Kiso shut down at 47 pennies, 74 pennies and 18 pennies on Tuesday.

United Engineers (UE) on Tuesday declared the arrangement of Zhong Sheng Jian and Pua Seck Guan as its new executives. Zhong, the administrator, and CEO of Yanlord Land Group has been named as a non-free and official executive of UE. Offers in United Engineers shut level at $2.72 on Tuesday.

Global Share Markets.... Read More

Keppel DC REIT reported Wednesday that it has obtained its second colocation server farm in Dublin, Ireland for a sum of 66.0 million euros ($101.3 million). Units in Keppel DC REIT last shut a large portion of a penny brings down at $1.295 on Tuesday.

Sapphire Corporation declared Tuesday that it has secured an RMB 276 million ($57 million) rail designing contract for the second period of the Beijing Metro's Changping Line. Offers in Sapphire Corp shut a large portion of a penny higher at 29.5 pennies on Tuesday.

A consortium including Heeton Holdings, KSH Holdings and Ryobi Kiso Holdings is getting Dry Bar, an exciting scene in Manchester City, with a view to redeveloping the property into a boutique inn. Offers in Heeton, KSH, and Ryobi Kiso shut down at 47 pennies, 74 pennies and 18 pennies on Tuesday.

United Engineers (UE) on Tuesday declared the arrangement of Zhong Sheng Jian and Pua Seck Guan as its new executives. Zhong, the administrator, and CEO of Yanlord Land Group has been named as a non-free and official executive of UE. Offers in United Engineers shut level at $2.72 on Tuesday.

Global Share Markets.... Read More

Please Log in to join the conversation.

5 years 6 months ago #25467

by Val

Replied by Val on topic SGX Penny Stocks

By Mystic Dax

ISOTeam - Watchlist and perhaps an ideal time to enter due to Wuthelam holding last Friday deal to raise stakes to almost 60% worth $15.6billion, becoming the majority shareholder.

<FYI, the Wuthelam group (Nippon Paint Singapore)is also a substantial shareholder of ISOTeam with slightly over 5% shareholdings>

www.channelnewsasia.com/news/business/si...billion-sgd-13041014

(Currently, trading at $0.138)

Stock Analysis

ISOTeam

(Below details extracted from POEMS)

- Current Price : $0.141

- NAV : Approx. $0.20

- Business Summary: A/A upgrading, maintenance related, M&E services, coating & painting works, bike sharing (new venture)

- Placed out new shares to Japan?s Taisei Oncho at $0.24 this year (At least 62,000,000 new shares this year to, raising more than $13.6 million so far)

- Average Dividend : 2 to 3%

- Gearing ration/ Debt to Equity : 22.10%

- Recently Secured new contracts worth $32.5million in June (good sign amidst COVID19 situation)

- Prior to above award, they have already secured order book of $106 mil in FY2020

- Company did 3 share buybacks this year at (200,000 shares @ $0.19x, 200 shares @ $0.155, 100,000 shares @ $0.12x)

- over the past several years, they have done plenty of company share buy blacks at much higher prices of over $0.58 too.

- they are In installation of solar powered related business sector too

- Have Nippon Paint Singapore as substantial shareholder

(Their past placement was as high as $0.50 or even more)

- Exclusive applicator of Nippon Paint in for various government segment (I.e JTC, HDB, Town Councils etc)

Note:

1) At current prices, ISOteam looks to be trading cheaply at a massive discount, especially when compared to Taisei Oncho buying in at $0.24

2) Japanese companies tend to go by the book and with their investment into ISOteam, it shows they see potential and more importantly, they have seen the books and have surely conducted strict due dilligence in covered all aspects of business. This is actually quite assuring to any new retail investors who decides to invest in ISOteam.

3) Their business are mainly in maintenance/upgrading and bulk of their work is with the government (HDB/Town council) which helps as they would definitely paid end of the day. In addition, we can expect them to secure more contracts as many housing development are aging.

Summary:

Pros:

1) The sector that ISOteam is in are considered quite recession proof. However, the recent COVID19 situation has indeed put strain in their business as they are very dependent on foreign workers to carry out their works

(If unable to work due to various reasons like dormitory shutdown, BCA requirement, it affects their ability to claim the contract sum) Nevertheless, it seems that government have taken better control in this area and we believe that most projects and work will resume eventually.

2) Investment from Japan company Taisei Oncho and company doing share buybacks a amidst COVID19 shows belief in ISOteam business capability to recover in time.

3) Nevertheless, price has been sliding down from most recent high of $0.189 (18th June 2020) and a better entry trigger would be once new bottom is found and price reverse back up strongly (look for bullish signal).

This will be for a longer term investment play to be safe.

4) Target price : Easily $0.20 when market situation gets better and when news report shows construction sector going back to normalcy, along with most foreign workers going back to workforce. (Which currently SG government is working on now)

5) Now that ISOTeam substantial shareholder Wuthelam Holdings have become the majority shareholder of Nippon paint, this might be a good catalyst for the stock since they are vested, they can provide better rates which may help ISOTeam improve their margins and give them an added edge over the competitors. In addition, it shows that they are optimistic that the coating and painting industry would be improved.

ISOTeam - Watchlist and perhaps an ideal time to enter due to Wuthelam holding last Friday deal to raise stakes to almost 60% worth $15.6billion, becoming the majority shareholder.

<FYI, the Wuthelam group (Nippon Paint Singapore)is also a substantial shareholder of ISOTeam with slightly over 5% shareholdings>

www.channelnewsasia.com/news/business/si...billion-sgd-13041014

(Currently, trading at $0.138)

Stock Analysis

ISOTeam

(Below details extracted from POEMS)

- Current Price : $0.141

- NAV : Approx. $0.20

- Business Summary: A/A upgrading, maintenance related, M&E services, coating & painting works, bike sharing (new venture)

- Placed out new shares to Japan?s Taisei Oncho at $0.24 this year (At least 62,000,000 new shares this year to, raising more than $13.6 million so far)

- Average Dividend : 2 to 3%

- Gearing ration/ Debt to Equity : 22.10%

- Recently Secured new contracts worth $32.5million in June (good sign amidst COVID19 situation)

- Prior to above award, they have already secured order book of $106 mil in FY2020

- Company did 3 share buybacks this year at (200,000 shares @ $0.19x, 200 shares @ $0.155, 100,000 shares @ $0.12x)

- over the past several years, they have done plenty of company share buy blacks at much higher prices of over $0.58 too.

- they are In installation of solar powered related business sector too

- Have Nippon Paint Singapore as substantial shareholder

(Their past placement was as high as $0.50 or even more)

- Exclusive applicator of Nippon Paint in for various government segment (I.e JTC, HDB, Town Councils etc)

Note:

1) At current prices, ISOteam looks to be trading cheaply at a massive discount, especially when compared to Taisei Oncho buying in at $0.24

2) Japanese companies tend to go by the book and with their investment into ISOteam, it shows they see potential and more importantly, they have seen the books and have surely conducted strict due dilligence in covered all aspects of business. This is actually quite assuring to any new retail investors who decides to invest in ISOteam.

3) Their business are mainly in maintenance/upgrading and bulk of their work is with the government (HDB/Town council) which helps as they would definitely paid end of the day. In addition, we can expect them to secure more contracts as many housing development are aging.

Summary:

Pros:

1) The sector that ISOteam is in are considered quite recession proof. However, the recent COVID19 situation has indeed put strain in their business as they are very dependent on foreign workers to carry out their works

(If unable to work due to various reasons like dormitory shutdown, BCA requirement, it affects their ability to claim the contract sum) Nevertheless, it seems that government have taken better control in this area and we believe that most projects and work will resume eventually.

2) Investment from Japan company Taisei Oncho and company doing share buybacks a amidst COVID19 shows belief in ISOteam business capability to recover in time.

3) Nevertheless, price has been sliding down from most recent high of $0.189 (18th June 2020) and a better entry trigger would be once new bottom is found and price reverse back up strongly (look for bullish signal).

This will be for a longer term investment play to be safe.

4) Target price : Easily $0.20 when market situation gets better and when news report shows construction sector going back to normalcy, along with most foreign workers going back to workforce. (Which currently SG government is working on now)

5) Now that ISOTeam substantial shareholder Wuthelam Holdings have become the majority shareholder of Nippon paint, this might be a good catalyst for the stock since they are vested, they can provide better rates which may help ISOTeam improve their margins and give them an added edge over the competitors. In addition, it shows that they are optimistic that the coating and painting industry would be improved.

Please Log in to join the conversation.

3 years 11 months ago - 3 years 11 months ago #25947

by Joom

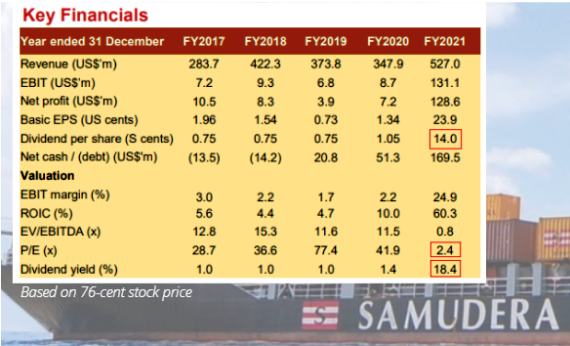

source: nextinsight.net/story-archive-mainmenu-6...es-are-still-buoyant

Good article, says freight rates continue to be high.

I conclude -- the stock can trade at 2X higher valuation, say PE 4. So it can be $1.50-$1.60.

at that level, dividend yield still lofty at ard 10% yield. Do i make sense?

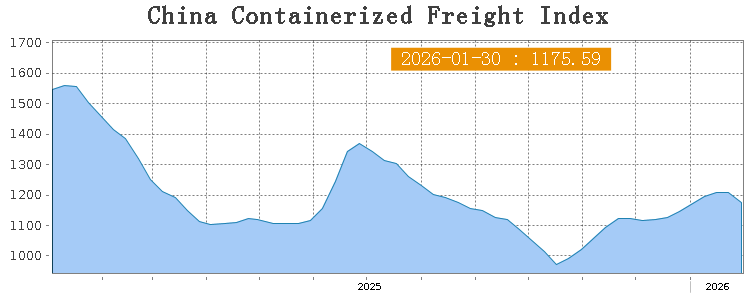

Put another way, Samudera can't continue to be at PE 2 if market sees that the freight index is still as high as last year.

http://www.sse.net.cn/index/indexImg?name=ccfi&type=english

Replied by Joom on topic SGX Penny Stocks

source: nextinsight.net/story-archive-mainmenu-6...es-are-still-buoyant

Good article, says freight rates continue to be high.

I conclude -- the stock can trade at 2X higher valuation, say PE 4. So it can be $1.50-$1.60.

at that level, dividend yield still lofty at ard 10% yield. Do i make sense?

Put another way, Samudera can't continue to be at PE 2 if market sees that the freight index is still as high as last year.

http://www.sse.net.cn/index/indexImg?name=ccfi&type=english

Last edit: 3 years 11 months ago by Joom.

Please Log in to join the conversation.

3 years 11 months ago #25951

by Joes

Replied by Joes on topic SGX Penny Stocks

Aside frm Samudera, check out Uni-Asia.

Confidence booster on Mar 16, executive director and CEO Kenji Fukuyado acquired 50,000 shares S$55,993.

equates to S$1.12 per share.

His preceding acquisition was back on Dec 2, 2020 with 50,000 acquired at an average price of 63.3 cents per share.

Confidence booster on Mar 16, executive director and CEO Kenji Fukuyado acquired 50,000 shares S$55,993.

equates to S$1.12 per share.

His preceding acquisition was back on Dec 2, 2020 with 50,000 acquired at an average price of 63.3 cents per share.

Please Log in to join the conversation.

3 years 9 months ago #25982

by Joom

Replied by Joom on topic SGX Penny Stocks

Strong upmove continues for Jiutian Chemical Group Limited (C8R SP):

KGI --- Raise TP to S$0.245 and expect to see another record year in FY22

KGI --- Raise TP to S$0.245 and expect to see another record year in FY22

Please Log in to join the conversation.

3 years 1 week ago #26024

by Joes

From: www.heartlandboy.com/new-milestone-income-dividend-stocks/

comment:

Geo Energy -- very high dividend yield and stock price (while lower today) has held up well.

PE only 2X, so downside is limited

Replied by Joes on topic SGX Penny Stocks

From: www.heartlandboy.com/new-milestone-income-dividend-stocks/

comment:

Geo Energy -- very high dividend yield and stock price (while lower today) has held up well.

PE only 2X, so downside is limited

Please Log in to join the conversation.

Time to create page: 0.236 seconds