|

|

Q: How long do you intend to hold your stocks?

Silly Investor: It depends, each has a different buying reason.

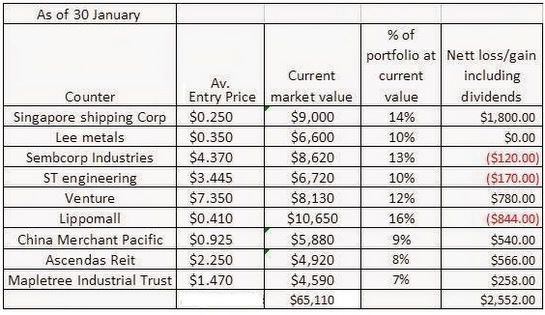

For Singapore Shipping Corp, I will definitely not sell it until I see how they are going to pay out dividends given the increase in income due to higher charter income from their new ship charters. If they increase dividends, I will continue to hold as I see this as a dividend grower.

If they do not, then I MIGHT take profit.

As for Venture, I believe the next 2 years will be clear sky where they can sustain their payout. So if at anytime I gain 3 years worth of dividends, I will take profits PROVIDED the hypothesis about the business remains intact.

Just like Lee Metal, I think if they can sustain 1 cent EPS per quarter, I will just hold.

I feel like "trading" SembCorp Industries. I will hold 1 lot regardless but might go in and out for the other.

Recent story: INVESTOR: "My delusional financial journey so far"