Excerpts from analysts' reports

Analyst: Andrea Isabel Co, CFA

|

Constant-flow business accounts for 80% of group revenue while S$300m orderbook provides visibility. We see a leaner and refocused CSE post-divestment of its healthcare unit and decamping from unprofitable Middle East projects. The stock offers the highest yields of 3.6-4.2% in the sector. Fragmented shareholdings make it an attractive takeover target. Initiate coverage with BUY. Target price: S$0.88. • Initiate with BUY and a street-high target price of S$0.88. In this report, we outline the key investment highlights for CSE Global (CSE) as part of our mid-cap strategy. |

Lim Boon Kheng was appointed group MD/CEO in Nov 2013. He joined CSE in 1999 as group financial controller. He holds 7.095 million shares of CSE.

Lim Boon Kheng was appointed group MD/CEO in Nov 2013. He joined CSE in 1999 as group financial controller. He holds 7.095 million shares of CSE. NextInsight file photoAbout 40% are maintenance and upgrading contracts which provide a base level of business that CSE has to sustain. The other 40% are brownfield and small greenfield projects.

Greenfield customers translate to brownfield customers 80% of the time as they require new add-ons or expansion of existing facilities. These constant flow of activities provide stability in an otherwise volatile and long-drawn O&G sector.

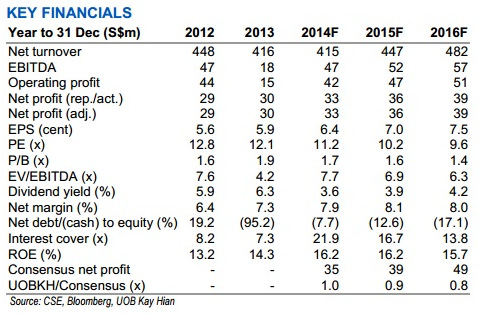

With maintenance and enhancement revenue estimated at S$150m-200m p.a., we think revenue for this year will meet last year’s over S$400m.

With more higher-margin projects and lower financing costs, we project a net profit growth of 8.5% in 2014. Management is now looking to secure contracts for 2015 recognition.

It sees a lot of maintenance work needed in the North Sea. CSE has a dedicated team in the Gulf of Mexico and a few projects are being negotiated in Australia. The US offshore market will still be a significant contributor.

Recent story: CSE GLOBAL -- buy, target 73 cents, says AmFraser initiation report

Full UOB Kay Hian report here.