At $1.145, Yangzijiang's stock price is up more than 10% since the beginning of this month.

At $1.145, Yangzijiang's stock price is up more than 10% since the beginning of this month.

Bloomberg data

Excerpts from analysts' reports…

DBS Vickers’ target for Yangzijiang is S$1.55 post VLOC deal

Analyst: Ho Pei Hwa

Building bigger ships

In June 2011, on the back of its solid track record in medium-sized containerships and bulk carriers, Yangzijiang Shipbuilding shattered Korean yards’ monopoly in mega containerships when it clinched an order for seven 10k TEU containerships.

The order came from a top tier shipowner, Seaspan at decent prices and payment terms. In less than three years, the first unit was delivered on time and on budget, as was for the subsequent three units as well.

Yangzijiang’s execution capability impressed and set the stage for Yangzijiang to undertake larger, higher value-add vessels.

The recent contracts for four Very Large Ore Carriers (VLOCs) further underlines Yangzijiang’s growing presence in the very large / mega ships segment, which currently makes up 25% of its orderbook by units and 40% by value.

Applauding the move to divest non-core

CFO Liu Hua (left) and executive chairman Ren Yuanlin. NextInsight file photoChairman & CEO Mr Ren Yuanlin took the opportunity to reaffirm Yangzijiang’s vision of staying focused on shipbuilding related businesses and, for the first time, disclosing publicly that the company would eventually divest its non-core businesses.

We believe the process would be gradual over the next 2-3 years for the following reasons.

1) Half of current Held-to-Maturity (HTM) investments fall under non-current assets, which will be largely collected in two years;

2) The property development project at the old yard site is expected to be completed by 1H16.

There should not be a material impact to FY14-15 bottom-line as the potential “loss of income” could be offset by deposit interest and write-back of Rmb600-700m worth of bad-debt provisions. Instead, the strategic shift serves as a sentiment and confidence booster amid jitters of shadow banking and property bubbles.

Reiterate BUY; Sum-of-the-parts based target price unchanged at S$1.55.

Recent story: YANGZIJIANG'S First VLOC Order, GEO ENERGY In Coal Concession Deal

JP Morgan target for top sector pick SIA is $13

Analyst: Corrine Png

Singapore Airlines is one of our top sector picks. We expect the pricing environment to improve as industry demand-supply comes into balance from late 2014.

SIA’s valuations look attractive to us at 0.9x P/B, close to its historical trough valuation. We think this is unwarranted as we expect SIA's earnings to recover as industry demand-supply growth gradually improves.

Net cash still amounts to 29% of market cap. If SIA paid out one-third of this, the yield would be 10%.

Alternatively, it could partially divest its stake in SIA Engineering via a dividend in specie to help facilitate more third-party MRO work. Reducing its stake to 51% would imply a 12% yield.

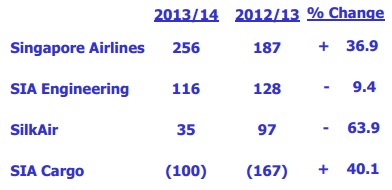

Contribution to Group Operating Profit (S$m) Company data

Contribution to Group Operating Profit (S$m) Company data

Valuation

Our Jun-15 price target of S$13 is based on 1.1x P/BV, in line with SIA's historical average valuation over the past 10 years. We think this is well supported by our estimate of SIA’s “liquidation” value of about S$13.30 per share.

Stay "Overweight" – SIA is one of our top sector picks.

Risks to Rating and Price Target

Key downside risks: deterioration in the macro environment, rising fuel prices, worse-than-expected competition from low-cost carriers and Middle Eastern carriers, value-destroying M&A, and a weaker Singapore dollar.