PROPERTY STOCKS have, in general, performed well this year, so far. This is despite the regular negative headline news on slow property sales and falling prices and rents -- and reminders of an impending glut in housing in 2015-17 when many projects are completed.

PROPERTY STOCKS have, in general, performed well this year, so far. This is despite the regular negative headline news on slow property sales and falling prices and rents -- and reminders of an impending glut in housing in 2015-17 when many projects are completed.I think this is due to the following reasons:

1. Most property stock bears would have exited by now. In other words, negative news has already been discounted, and has mostly little impact on property stocks.

However, to be prudent, we should be prepared for even more nasty surprises, and be on guard for that.

2. Privatisation and insider buying are providing cash flows (for those who sell out) into other property stocks.

Recently, offers were made for Superbowl and SingLand, and insider buying are seen for counters like Ho Bee, Chip Eng Seng, etc.

Shareholders who exit fully or partially from these stocks may plough their proceeds back to other property counters, as their belief in the stocks’ undervaluation is reinforced by privatization and insider buying.

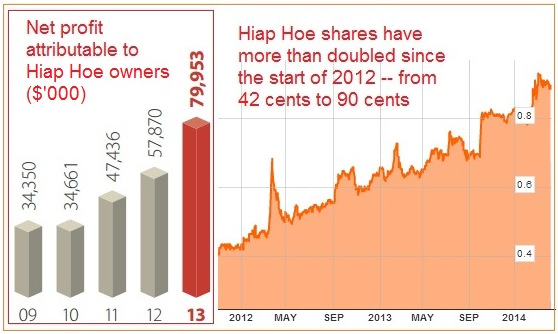

Hence, one can see shareholders of Superbowl switching to buying Hiap Hoe shares, leading to the latter’s uptrend. In Hiap Hoe’s latest annual report, Geraldine Tan and Oliver Siah, wife and son of Francis Siah, have entered the top 20 shareholders’ list.

Francis’ personal stake could be hidden in some nominee bank’s account. This is an obvious switch from SuperBowl to Hiap Hoe. (For more on Francis Siah, see: SUPERBOWL: New substantial shareholder emerges, has remarkable history)

3. Property stock charts are showing strength, and this may lead some players to perk up and take a second look at them.

Where there is money to be made, attention will follow. Among stocks that have made 52-week highs or are nearly doing so are Oxley, Aspial, Ho Bee, Hiap Hoe, Lian Beng, etc.

Even those that were trending down are rebounding smartly: Wheelock, UE, Tuan Sing, etc. Even the heavy weights have found strength recently.

4. Analysts are paying slightly more attention to property stocks, despite the general tendency to call for “underweight” for the sector. For example, CIMB today issued a report on the prop companies that could be privatized next.

The analyst lists the following counters as most likely candidates: Ho Bee, Wheelock and Wing Tai. The report cites huge undervaluation as a main reason for privatization. Unfortunately, the analyst had no time to look at smaller cap property counters, but this is where we can do our own homework and profit from that research void.

For the above reasons, I continue to like and own property stocks.

While not as exciting as the dramatic rise and fall of speculative or earnings-related counters, these stocks have provided good dividends and capital gains while giving me the security of high net asset value.

Some, like Oxley, Hiap Hoe and Superbowl, have provided rather good capital gains over the past 6 months.

As a quick summary, I continue to like ...  Teo Hong Lim, executive chairman, Roxy-Pacific. NextInsight file photo Teo Hong Lim, executive chairman, Roxy-Pacific. NextInsight file photo

> Oxley for the boss’ ability to provide the excitement of rapid growth, |

Previous articles: