CHIP ENG SENG's (CES) Q3 results were within expectations. Gross profit booked from the Prive condominium project in Punggol was very close to my own estimate (about $1m difference).

If my other estimates are as accurate, then CES should look attractive based on fundamentals.

Launched in Dec 2012, Tower Melbourne is now 95% sold. Photo: Company What is positive is that Tower Melbourne is now more than 95% sold.

Launched in Dec 2012, Tower Melbourne is now 95% sold. Photo: Company What is positive is that Tower Melbourne is now more than 95% sold. Based on my estimates, the revenue from this project is above A$300m, with potential gross profit of A$30-60m, depending on assumptions.

With Tower Melbourne sales crossing 95%, perhaps CES’ huge 1,000-unit project at Victoria Street will be launched soon.

Meanwhile, sales at 9 Residences in Yishun are gradually increasing, crossing the 50% mark.

Junction 9 shops are 91% sold, against my earlier estimate from agents of 95%.

Junction 9/9 Residences project is one of the 2 big profit contributors; it can bag more than $125m in gross profit, slightly lower than Alexandra Central’s $140m.

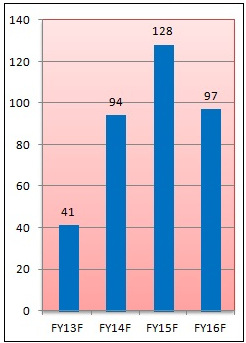

Meanwhile, with TOP dates having gotten clearer, my estimates of CES net profit from property development for 2013-6 are as follows:

2013: $41m, EPS 6.3ct, expected DPS: 3-4ct

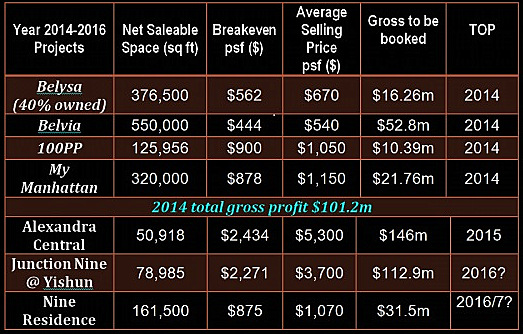

2014: $94m, EPS 14.5ct, DPS: 4-5ct? (main contributors: Belvia, Belysa, 100PP (sold units only), My Manhatten)

2015: $128m, EPS 19.7ct, DPS: 5-6ct? (main contributor: Alexandra Central; almost fully sold; progressive recognition from 9 Residences)

2016: $97m, EPS 15ct, DPS: 5-6ct? (main contributor: Junction 9/9 Residences; assumed fully sold)

Sumer's forecast of CES' property development profits (S'm). Not included: Fulcrum profits (sales only 11%), and Tower Melbourne profits.Beyond 2016: Tower Melbourne (95% sold), Victoria Street (not launched), monetization of hotel, purchase of new sites?

Sumer's forecast of CES' property development profits (S'm). Not included: Fulcrum profits (sales only 11%), and Tower Melbourne profits.Beyond 2016: Tower Melbourne (95% sold), Victoria Street (not launched), monetization of hotel, purchase of new sites?For prudence, the above figures do not take into account Fulcrum profits (sales only 11%, but this is still a very profitable project), construction profits, San Centre revaluation, if any, unsold units at 100PP, and the revaluation surplus of its hotel at Alexandra.

Also, most of the projected profits are already “locked in”, ie, these EPS figures come from achieved sales.

Construction work at Alexandra Central is going at a pretty fast pace, and if the shops are ready by next year, 2014 could be a bumper year for CES earnings, with EPS of above 30ct.

The above figures show that CES is going to book very good profits consistently from now till 2016, with generous dividends to boot.

These, plus my rather good impression of CES’ management and major shareholder, as well as its past record of bidding for land, selling its projects quickly, and dishing out dividends generously, make CES my favourite 2nd liner property stock at the moment

Chip Eng Seng shares closed recently at 71 cents and are up 11.8% in the year-to-date. Chart by FT.comPrevious stories:

Chip Eng Seng shares closed recently at 71 cents and are up 11.8% in the year-to-date. Chart by FT.comPrevious stories: SUMER: "My latest take on my 10 property stocks"

By Q3 2014, CES' s actual 9mth NAV was already 91 cents but NRA full year NAV forecast was only 92.6 cents.

I expect CES full FY14 EPS to hit 38 cents, and full-year NAV to hit ~$1.10, but NRA full year EPS forecast was only 27.5 cents, NAV was only 92.6 cents

Even the Phillip Capital Report is deemed to be conservative as it had not taken into account the following into its RNAV computation

1. THREE land banks in Australia

2. Profits from TM (even if the project is called, rental yield is ~8%)

3. Profits from Fernvale projects

4. Revaluation Gain from CES centre

5. Recurring income is grossly understated...

6. CES also has its HQ at Ubi and some shop houses at Geylang

7. Profits from Fulcrum

8. Monetization of hotel in the near future..

The RNAV of CES is easily more than ~$2

Of course these estimates are extremely crude. Interest cost of debt is not factored in and income may vary for its hotel component. However, it is comforting to know that a substantial portion of its dividend payout is supported by its investment income, thus being able to sustain through property cycles.

Nevertheless, based on pre-sales figures, it looks as if CES is going to repeat its 2009-12 performance come 2014-16, which to me is amazing. So it would appear that 2013’s smallish $40m is now becoming an aberration, and an average net profit of $80m per year could actually be sustainable.

Hi Chan, CES shares are about 35% (not 21%) held by major shareholders and their relatives. Tan Yong Keng is the biggest non-family shareholder with about 7%. Not having tight control has both pluses and minuses. I do not think that just because a stock is held by retail investors it would tumble on the slightest bad news. There are sophisticated retail investors and those who buy on whims. The second group would have exited CES long ago as the stock price had a good run. Those who have kept faith with the company know a sufficient amount of the maths of the company: the constantly high dividend payout, the good ratios like RNAV and PE, and the almost assured high profits over the next 3 years.

Those who go beyond the maths would also have attended CES’ AGMs and felt for themselves how humble and genuine the major shareholders are (the founder personally walk to seated shareholders whom he does not know to shake their hands), and decide to put their money with whom they feel comfortable with. They would also have seen how CES has constantly replenished land at the right price, sell off their projects quickly, and practices “letting go” (Grange Infinite and City Vista) instead of hoarding (which leads to value trap).

Another plus side of shares not being too tightly held is the possibility of a takeover. In fact, CES’ figures appear so attractive that if I were another developer company, instead of bidding for overpriced land, I would rather take over CES, with all its pre-sales and guaranteed profits.

Meanwhile, there are now instruments like CFDs and SBL that allow shorting. So, it does not mean that retail players are only on the buy side of CES. Perhaps there are short positions, and just like any bad news would dampen a share price, good news would push it up by a bigger margin as a result of short-covering. While it is true that bigger floats mean attracting more traders, this also has the benefit of allowing someone who wants to get in big to amass a meaningful quantity, unlike other family-owned small-float developer stocks.

From my observation recently, I do detect attempts to “close the stock low” on several days. Perhaps it’s a work of bears or perhaps it’s just a silly wish, but that’s another story for another day.

Also although revenue for the past 5 years (2008 to 2012) had been rising steadily year-on-year (except 1 yr in 2011)but EPS & Net Profit had been on the downtrend for the past 3 years (2010 to 2012). I am vested and hope to see a reversal of profit next few yrs as projected by Sumer. Thanks so much for the well presented projection by Sumer.

Forecast for property development is based on the more transparent property sales.

The rise in net profits will only begin in 2014 where he is expecting $94m with the main contributors being Belysa, Belvia, 100PP and My Manhattan.