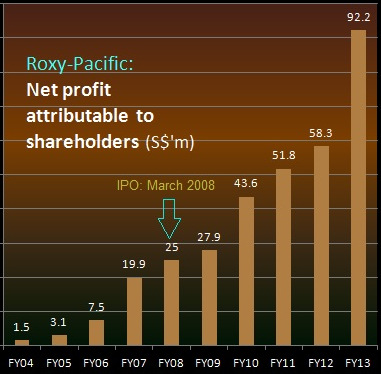

Roxy-Pacific's 9 years of busting its own profit record. (The profit figure for year 2004 is the earliest available in its IPO prospectus).NINTH CONSECUTIVE year of record profit -- that's what Roxy-Pacific Holdings achieved in 2013 when it recorded net profit of S$92.2 million, a 58% increase year-on-year.

Roxy-Pacific's 9 years of busting its own profit record. (The profit figure for year 2004 is the earliest available in its IPO prospectus).NINTH CONSECUTIVE year of record profit -- that's what Roxy-Pacific Holdings achieved in 2013 when it recorded net profit of S$92.2 million, a 58% increase year-on-year.In contrast, 9 years ago, in 2004, it achieved only $1.5 million profit.

Will the music continue this year? The odds look good on the following basis:

1. The big picture is, it has S$922.4 million of revenue to book between 1Q2014 to year 2017 from its pre-sold property development projects.

Roxy-Pacific executive director and CFO Koh Seng Geok speaking with a senior analyst after last Friday's results briefing.

Roxy-Pacific executive director and CFO Koh Seng Geok speaking with a senior analyst after last Friday's results briefing. Photo by Leong Chan TeikOut of this, there will be $141.4 million revenue to book all at one go likely in 4Q of this year after the attainment of T.O.P (temporary occupation permit) of a single commercial project, Centropod@Changi.

In the mean time, there will be residential projects which Roxy will recognise revenue on a progressive basis, according to the stages of completion.

But a key to whether 2014 will be the No.10 record profit year is the timing of the T.O.P. of Centropod@Changi.

If it materialises in 4Q, the aggregate revenue from property development is likely to surpass the $321 million booked in 2013.

2. Over and above this, there is a surprise earnings boost from the recent and very quick sale of 14 floors of a commercial asset in Hong Kong.

Roxy-Pacific and its 70%-JV partner, CLSA Capital Partners, had completed the acquisition of the asset less than a month ago.

The gross profit attributable to Roxy is estimated by analysts to be S$60 million -- which is a significant amount.

3. The HK commercial asset will deliver yet another earnings boost if and when the remaining 7 floors are sold, possibly this year.

All these floors currently make up the Shama Serviced Apartments sited on 8, Russell Street in the Causeway Bay area.

Roxy and its JV partner will do A&A (addition & alteration) works to convert the floors into retail space before handing over to the buyer (whose identity has not been revealed), likely in 2H this year. The profit is likely to be accounted for in 4Q.

|

Roxy-Pacific executive chairman and CEO Teo Hong Lim shed more light on the HK property divestment, and the company's overseas intentions, at last Friday's briefing on the 2013 results:

Currently, another 3 floors -- the highest in the building - are up for sale. Mr Teo said the property has the rare attribute of being of 999-year leasehold and its address (8, Russell St) is a "nice number". Though operating as serviced apartments, it can be converted into retail space which can fetch higher commercial value. Indeed, in 2012, retail space on the ground floor of Russell Street commanded the highest rental psf in the world. Is this a one-off opportunity? Mr Teo said the deal was one of only a few in Hong Kong in the past year that crossed the HK$1.5 billion mark. "It's not easy for Singapore developers to penetrate the Hong Kong market and it's not something that you could search and find."

|

Recent story: ROXY-PACIFIC wins S$60-m profit on quick sale