MSCI Index adds GOLDPOLY NEW ENERGY

The prestigious and widely referenced MSCI Index has added Goldpoly New Energy (HK: 686) to its constituent list for the MSCI Global Small Cap Index.

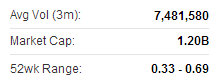

Goldpoly's recent Hong Kong share performance. Source: Yahoo Finance

Goldpoly's recent Hong Kong share performance. Source: Yahoo Finance

MSCI indices are widely used as the benchmark indices by which the performance of global equity portfolios are measured.

Listcos making the Index typically exhibit signs of high growth potential.

Goldpoly recently issued 50 million usd in convertible bonds to finance possible acquisitions of solar power plants when opportunities arise.

Goldpoly New Energy Hldgs Ltd is engaged in the investment, development and operation of solar power stations in the PRC, and has a polysilicon solar cell factory in Quanzhou, Fujian Province, PRC. The Company is listed on the main board in Hong Kong (stock code: 686). On 10 June 2013, the Company completed the acquisition of China Merchants New Energy Hldgs Ltd, a company focused on the investment, development and operation of solar power stations. Following the acquisition, China Merchants New Energy Hldgs Ltd became a wholly-owned subsidiary of the Company. The Company turned a new page of development since then, and commenced to fully integrate the solar power stations business to create a leading global operations platform for photovoltaic power stations.

Comtec Chairman Mr. John Zhang (left) speaking to investors earlier this year in Hong Kong. NextInsight file photoCOMTEC, SOLARGIGA buoyed by policy support

Comtec Chairman Mr. John Zhang (left) speaking to investors earlier this year in Hong Kong. NextInsight file photoCOMTEC, SOLARGIGA buoyed by policy support

Comtec Solar Systems Group Ltd (HK: 712) and Solargiga Energy (HK: 757) received very good recent news on the policy front.

China’s solar-friendly government announced it was targeting the country’s photovoltaic plays to raise installed capacity by 20% next year to 12 GW.

Specifically, next year’s target is for distributed solar and solar power plants to share installed capacity of 8 GW and 4 GW, respectively.

Comtec’s shares rose nearly 10% over a five-day stretch, buoyed by the policy support, while Solargiga’s shares added 7% over the same period.

Furthermore, the relatively prosperous eastern Chinese province of Shandong announced it would provide additional subsidies to Chinese solar power plays in the region. Comtec recently 1.71 hkdThe country’s top economic planning body, the National Development and Reform Commission (NDRC) in Shandong, said the province will give an additional RMB0.2/kWh subsidy to the benchmark on-grid power price of RMB1/kWh.

Comtec recently 1.71 hkdThe country’s top economic planning body, the National Development and Reform Commission (NDRC) in Shandong, said the province will give an additional RMB0.2/kWh subsidy to the benchmark on-grid power price of RMB1/kWh.

Comtec Chairman Mr. John Zhang said: “We are confident to capture enormous opportunities in the upcoming era of clean and economical power of solar energy, to drive continued and healthy growth of Comtec in the future.”

Comtec was not only looking to boost capacity at home but was also aiming to expand offshore output.

The Shanghai-based firm is planning to expand production capacity in Malaysia which would enable Comtec to lower production costs and to increase the scale of operation. Solargiga recently 0.38 hkdConstruction of the Malaysia facility is on schedule and management expects to complete it by the end of 2013, eventually to accommodate around 300 MW production capacity.

Solargiga recently 0.38 hkdConstruction of the Malaysia facility is on schedule and management expects to complete it by the end of 2013, eventually to accommodate around 300 MW production capacity.

Fellow Hong Kong-listed solar power play Solargiga is also on the move, having obtained financial assistance earlier this month for a 500MW multicrystalline ingot and wafer manufacturing line construction project.

Founded in 1999 and tapped into the solar wafer industry in 2004, Comtec Solar is a leading high quality monocrystalline solar ingot and wafer manufacturer in the PRC and one of the pioneer manufacturers in the PRC able to massively produce Super Mono Wafers which achieve an average conversion rate of approximately 23%. With its production bases in Shanghai and Jiangsu, Comtec Solar focuses on the design, development, manufacture and marketing of high-quality solar wafers and has accumulated strong industry experience in the manufacture of semiconductor ingots and wafers.

Solargiga’s annual monocrystalline silicon solar ingot production capacity is 1.2GW; monocrystalline silicon solar wafer capacity is 900MW, while capacity for solar cells and modules is approximately 300MW and approximately 175MW, respectively. The Group operates its major production facilities for ingots, wafers, cells and modules in Jinzhou, Liaoning Province, with another solar ingot plant in Xining, Qinghai Province. Through capitalizing on its vertically-integrated business model, Solargiga aims to become a one-stop solutions provider for solar power plants in the industry.

See also:

GOLDPOLY Wins 'Buy' Call

Solar Sector Scenario: GOLDPOLY, COMTEC

SOLARGIGA Eyes 500MW Project