PAX Global executives explain the electronic payment system play's growth strategy to investors in Hong Kong. Photo: Aries Consulting

PAX Global executives explain the electronic payment system play's growth strategy to investors in Hong Kong. Photo: Aries Consulting

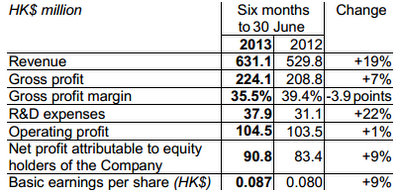

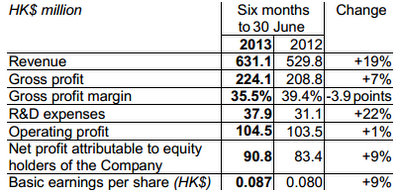

PAX GLOBAL Technology Ltd (HK: 327), China’s top Electronic Funds Transfer Point of Sale (EFT-POS) play, saw its first-half PRC sales rise 37%, helping boost the bottom line by 9% to 90.8 million hkd.

In the January-June period, revenue rose 19% year-on-year to 631.1 million hkd, with sales in the PRC alone surging 37% to 429.4 million.

That gave PAX Global’s home market of China a 68% contribution to first half revenue, still significant despite having been as high as 86% five years ago.

PAX Global Group Financial Controller Chris Lee (left), alongside Chairman Tiger Nie and CEO Jack Lu.

PAX Global Group Financial Controller Chris Lee (left), alongside Chairman Tiger Nie and CEO Jack Lu.

Photo: Aries ConsultingThis is in line with the high-tech firm’s desire to boost foreign sales.

“The expanding business reach of third-party operators in the finance industry created new market demand for PAX Global’s products.

“While the China business also registered satisfactory growth, PAX Global’s plan for a ’Global Presence’ has entered into a new growth phase. Overseas market sales will make a significant contribution to the Group’s current and future business development,” said PAX Global Chairman Tiger Nie, speaking at an Aries Consulting-organized investor gathering in Hong Kong on Friday.

First half net profit rose 9% year-on-year to 90.8 million hkd, while basic earnings per share stood at 0.087 hkd, representing a yearly increase of 9%.

“During the reporting period, we achieved encouraging results, and sales volume of China POS terminals jumped rapidly.

“Emerging third-party operators in China’s payment industry presented opportunities for a breakthrough in PAX Global’s China business,” Mr. Nie added.

PAX Global's H1 China revenue surged 37%.First half orders from third-party payment operators grew substantially by 88% and became the key revenue growth driver.

PAX Global's H1 China revenue surged 37%.First half orders from third-party payment operators grew substantially by 88% and became the key revenue growth driver.

“To become a leading global player, we need to keep boosting market share and move up the ranks,” the Chairman said.

As a high-tech firm in a constantly evolving industry, reinvesting profits into technical upgrades was critical to PAX Global’s success.

The company invested 37.9 million hkd into R&D, up 22% year-on-year.

As at end-June 2013, the Group had cash and short-term bank deposits of 1.24 billion hkd, with no borrowings outstanding.

Mr. Jack Lu was appointed PAX Global’s CEO in May of this year. Photo: Andrew VanburenMr. Jack Lu, who was appointed PAX Global’s CEO in May this year, said Mainland China remains the firm’s key market for now.

Mr. Jack Lu was appointed PAX Global’s CEO in May of this year. Photo: Andrew VanburenMr. Jack Lu, who was appointed PAX Global’s CEO in May this year, said Mainland China remains the firm’s key market for now.

“We are doing a good job in the PRC market now, and we also launched a full-scale global marketing push in 2012,” he said.

PAX Global ‘Going Global'

While Mainland China represented over two-thirds of revenue for the first half, PAX Global was increasingly living up to its name as a “Global” firm by making its mark overseas.

In the first six months, the Asia Pacific, Latin America, former member states of the Soviet Union and Hong Kong all reported sales revenue growth.

A major success came in Hong Kong where PAX was chosen as the exclusive EFT-POS terminal provider for supermarket chains Wellcome and for Maxim’s restaurants.

“We did fantastic in Hong Kong and China, and we now have an over 40% market share in Hong Kong. We also saw fantastic achievement in Latin America,” said PAX Global Group Financial Controller Chris Lee.

Another bright spot was the Central Asian country of Uzbekistan, where PAX Global’s market share stood at an unassailable level of over 90%.

"Overseas markets will make a significant contribution to the Group’s current and future business development,” said PAX Global Chairman Tiger Nie. Photo: Andrew VanburenDuring the period, PAX Global formed business alliances with new partners including Bank Mandiri in Indonesia, Banrisul in Brazil and the Egyptian Bureau for Engineering.

"Overseas markets will make a significant contribution to the Group’s current and future business development,” said PAX Global Chairman Tiger Nie. Photo: Andrew VanburenDuring the period, PAX Global formed business alliances with new partners including Bank Mandiri in Indonesia, Banrisul in Brazil and the Egyptian Bureau for Engineering.

PAX Global also obtained the completion of Class A certifications on the PAX S90 and the SP20 products from Heartland Payment Systems (NYSE: HPY), the fifth largest payment processor provider in America.

Nearly all PAX Global EFT-POS terminals have passed internationally-recognized certifications including EMV, and the Group’s core products are compatible with Near Field Communication (“NFC”) technology.

With higher technology standards than its PRC peers, the Group has effectively expanded its business reach around the globe.

According to the latest Nilson Report, PAX Global’s global ranking in EFT-POS terminal shipments climbed three spots to No.4 in 2011, compared with No.7 in 2010.

Looking forward, PAX Global will place emphasis on third-party payment operators while continuing to explore new overseas markets.

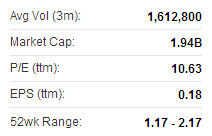

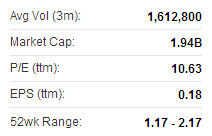

PAX recently 1.87 hkdThird-party payment operators, for example Alipay and ChinaPNR, through business contracts with leading banking corporations, provide transaction platforms through various online and physical payment means for their customers.

PAX recently 1.87 hkdThird-party payment operators, for example Alipay and ChinaPNR, through business contracts with leading banking corporations, provide transaction platforms through various online and physical payment means for their customers.

“Third-party payments are an evolving new business trend of the payment industry in China,” Mr. Nie added.

PAX Global Technology Ltd is an electronic funds transfer point-of-sale (EFT-POS) terminal solutions and services provider. PAX Global was listed on Hong Kong’s main board on 20 December 2010. The Group currently collaborates with over 35 partners worldwide on EFT-POS solutions. Its EFT-POS products are sold to more than 70 overseas countries and regions including the US, Singapore, Taiwan, Japan, South Korea, New Zealand, EMEA and Central Asia.

See also:

PAX Wins Order From Top Indonesia Bank

PAX Global executives explain the electronic payment system play's growth strategy to investors in Hong Kong. Photo: Aries Consulting

PAX Global executives explain the electronic payment system play's growth strategy to investors in Hong Kong. Photo: Aries Consulting PAX Global Group Financial Controller Chris Lee (left), alongside Chairman Tiger Nie and CEO Jack Lu.

PAX Global Group Financial Controller Chris Lee (left), alongside Chairman Tiger Nie and CEO Jack Lu.  PAX Global's H1 China revenue surged 37%.First half orders from third-party payment operators grew substantially by 88% and became the key revenue growth driver.

PAX Global's H1 China revenue surged 37%.First half orders from third-party payment operators grew substantially by 88% and became the key revenue growth driver. Mr. Jack Lu was appointed PAX Global’s CEO in May of this year. Photo: Andrew VanburenMr. Jack Lu, who was appointed PAX Global’s CEO in May this year, said Mainland China remains the firm’s key market for now.

Mr. Jack Lu was appointed PAX Global’s CEO in May of this year. Photo: Andrew VanburenMr. Jack Lu, who was appointed PAX Global’s CEO in May this year, said Mainland China remains the firm’s key market for now. "Overseas markets will make a significant contribution to the Group’s current and future business development,” said PAX Global Chairman Tiger Nie. Photo: Andrew VanburenDuring the period, PAX Global formed business alliances with new partners including Bank Mandiri in Indonesia, Banrisul in Brazil and the Egyptian Bureau for Engineering.

"Overseas markets will make a significant contribution to the Group’s current and future business development,” said PAX Global Chairman Tiger Nie. Photo: Andrew VanburenDuring the period, PAX Global formed business alliances with new partners including Bank Mandiri in Indonesia, Banrisul in Brazil and the Egyptian Bureau for Engineering. PAX recently 1.87 hkdThird-party payment operators, for example Alipay and ChinaPNR, through business contracts with leading banking corporations, provide transaction platforms through various online and physical payment means for their customers.

PAX recently 1.87 hkdThird-party payment operators, for example Alipay and ChinaPNR, through business contracts with leading banking corporations, provide transaction platforms through various online and physical payment means for their customers. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Amazing....