DeTeam Co-Chairman and Executive Director Godfrey Mak

DeTeam Co-Chairman and Executive Director Godfrey MakPhoto: Benny Yu, Aries ConsultingCOAL UPGRADER AND MINER DeTeam Co Ltd (HK: 65) sees at least four factors playing in its favor, including strong government support for cleaner burning coal in China which relies on the commodity for around 70% of its electricity generation needs.

China’s new leadership has reemphasized its commitment to cutting pollution and using cleaner forms of energy, both of which represent very good news for DeTeam which specializes in upgrading raw coal into purer, less-polluting varieties.

DeTeam Co-Chairman and Executive Director Godfrey Mak said that having both mining and upgrading facilities near to each other in the coal rich provinces of Inner Mongolia and Jilin brought tremendous advantages to the Hong Kong-listed energy play.

“Local governments in Inner Mongolia especially are very welcoming toward our business because we help boost local GDPs and employ many workers. Also, we fit into the national leadership’s plan of using less resources more efficiently and in a more environmentally sustainable way,” he said.

DeTeam Co-Chairman and Executive Director Godfrey Mak (left) at the firm's coal upgrading plant along with Ma Hong Song, General Manager of Beijing Guochuan. Photo: DeTeamMr. Mak added that having operations in China’s northern coal belt also offered significant logistical advantages as a major component of coal upgrading is removing water, thus making the product significantly lighter and much less expensive to transport to industries and power plants by rail.

DeTeam Co-Chairman and Executive Director Godfrey Mak (left) at the firm's coal upgrading plant along with Ma Hong Song, General Manager of Beijing Guochuan. Photo: DeTeamMr. Mak added that having operations in China’s northern coal belt also offered significant logistical advantages as a major component of coal upgrading is removing water, thus making the product significantly lighter and much less expensive to transport to industries and power plants by rail.And the ongoing legislative gathering in Beijing during which China’s new president and premier officially took office has been a forum of strong support for clean coal.

“Beijing has been strongly encouraging more use of high kilo-calorie coal which is less polluting and far more efficient. As our average burning temperature for our thermal coal is 5,000 kCal, it is increasingly in demand.”

He added that China’s coal mining and power generating sectors are highly fragmented, with hundreds upon hundreds of small miners and independent power producers (IPPs) competing for business.

“With the stricter emissions guidelines for power plants in place, we are seeing more coal miners come to us seeking to upgrade their raw coal to make it compliable. Also, we are getting more orders from utility plants who are increasingly mandated to use higher-grade thermal coal.

DeTeam benefits from the price premium of upgraded thermal coal over high-polluting brown coal of up to 300% Source: DeTeam

DeTeam benefits from the price premium of upgraded thermal coal over high-polluting brown coal of up to 300% Source: DeTeam“So we are seeing more demand for our goods and services from both upstream and downstream sectors,” Mr. Mak said.

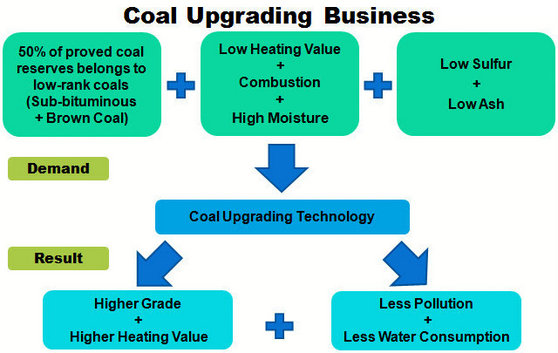

With a major business presence in Northeast China, DeTeam is engaged in both coal mining and coal upgrading business -- a key aspect in Clean Coal Technology (CCT).

Mr. Mak said that being equipped with mature technology and practical experience in the Jilin Province-based city of Changchun and across Inner Mongolia, DeTeam has managed to rapidly gain substantial trust from both local governments and major state-owned enterprises (SOEs).

“Solid partnerships with local governments and major SOEs integrates our business model, from policies to project financing, and from long-term low-rank coal supply to off-take agreements,” he said.

“Solid partnerships with local governments and major SOEs integrates our business model, from policies to project financing, and from long-term low-rank coal supply to off-take agreements,” he said.He added that DeTeam's ownership of proprietary technology raised the entry barrier to potential competitors.

He said well-established ties with governments and SOEs were crucial to DeTeam’s success because China’s power producers, coal miners and rail transport operators – despite all being quite fragmented and hyper-competitive – were still dominated by large SOEs.

Mr. Mak said that DeTeam’s focus on upgrading of coal meant its products were not only in greater demand by consumers required to cut down on pollutants, but also provided DeTeam with handsome profits.

“Coal upgrading is an emerging green energy business in China.

“With an abundance of low-rank (brown) coal in China -- mainly in Eastern Inner Mongolia and Yunnan Province -- and prevailing wide price spreads between low-rank coal and thermal coal (up to 300% difference), the coal upgrading business is a lucrative business likely to enjoy significant growth.”

See also:

TECH TALLY: ‘Outperform’ For COMTEC, LENOVO; BYD ‘Neutral’

CHINA SOLAR SECTOR Emerging From Shadows?

ANWELL: Completes US$25 M Solar Power Plant In Thailand

COMTEC SOLAR: Doubles Shipments, But Swings To Loss