Excerpts from analyst reports

Credit Suisse downgrades ComfortDelGro and SMRT on profit concerns

Analysts: Leonard Huo, CFA, and Timothy Ross Credit Suisse has downgraded SMRT from 'neutral' to 'underperform' owing to its unclear dividend outlook. NextInsight file photoWe are downgrading both ComfortDelgro and SMRT due to our negative view on profitability for these companies.

Credit Suisse has downgraded SMRT from 'neutral' to 'underperform' owing to its unclear dividend outlook. NextInsight file photoWe are downgrading both ComfortDelgro and SMRT due to our negative view on profitability for these companies.

In an era of heightened political sensitivity, we believe regulatory oversight of public transportation is set to remain high and will cap profitability for the transport operators.

Among the three modes of land transport, we believe the public bus business will be the hardest hit by sustained high fuel costs, wage inflation and inability to pass these on through fare adjustments.

In light of a challenging operating environment, a modest growth outlook and uninspiring valuations, we are downgrading both the stocks under our coverage.

ComfortDelGro: On the basis of modest growth, rich valuation and robust share price performance, we downgrade the stock from Outperform to NEUTRAL. Our target price of S$1.80 is based on a 15x FY13E P/E. A 15x multiple aligns with ComfortDelgro’s ten-year average as well as the broader market.

SMRT: Our target price of S$1.30 is based on a 15x FY14E P/E that is more in line with both the market’s and its own long-run averages.

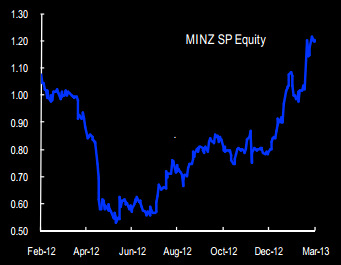

Maybank Kim Eng maintains 'buy' and $1.36 target for China Minzhong

Analyst: Wei Bin

GIC passed the baton to Indofood. Indofood bought the entire GIC’s stake in China Minzhong last Friday through a marriage trade at a price of SGD1.12.

GIC passed the baton to Indofood. Indofood bought the entire GIC’s stake in China Minzhong last Friday through a marriage trade at a price of SGD1.12. This confirms our view of two weeks ago that Indofood will not be satisfied with only 15% control of Minzhong.

We view this transaction positively. Maintain BUY with target price unchanged at SGD1.36, pegged to 5x PER.

29% control may still not be the end. Although Indofood increased its holding to 29%, we think it might still not be the end if Indofood wants to have an absolute control.

Recent story: CHINA MINZHONG, SERIAL SYSTEM: What analysts now say