Photo: Anwell

Anwell secures S$18 million solar contract

Anwell Technologies is making good headway into Thailand’s solar power industry.

It recently secured its second engineering, procurement and commissioning (EPC) contract to build a solar power plant in Thailand.

The contract is worth 445 million Baht (S$17.7 million). Anwell receives a cash deposit of 125 million Baht (S$5.0 million) upon the signing of the deal and progress payments thereafter.

In relation to its latest EPC deal, Anwell sold its power producer assets to the investor of the solar farm as follows:

> Its entire stake in Lopburi Solar Co., Ltd., which owns a power purchase agreement to sell electricity to the Provincial Electricity Authority of Thailand.

> Land for developing the solar farm

The assets were disposed at 25 million Baht (S$1 million) in cash, about four times the combined book value of 5.9 million Baht (S$230,000).

Related story: ANWELL: Booming Thai Solar Power Demand To Continue To Drive Revenue

DBS Vickers says Jaya Holdings is a "recovery play with potential dividend kicker"

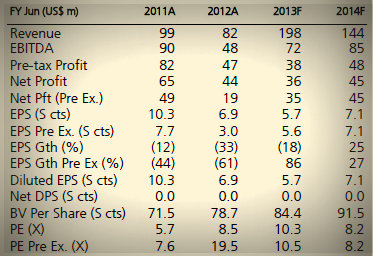

In reinstating coverage of Jaya Holdins, once a market darling in the ship-building sector, DBS Vickers says it is projecting robust earnings recovery from FY12’s trough.

"We believe Jaya’s earnings troughed in FY12 as the group transitioned to its new business model.

"Despite fewer expected vessel sales/disposals, we project FY12-14F EPS CAGR of 54%, driven primarily by the Offshore Support division on a larger fleet, improved day rates, and better margins.

"There is upside potential to our numbers as we have not assumed new vessel orders."

DBS Vickers analyst Jeremy Thia, CFA, has a target price of S$0.85 for the stock, calling it a "recovery play with potential dividend kicker."

With a clearer focus and less volatile earnings, he believes Jaya now offers a more attractive investment opportunity.

"We see a potential re-rating of the stock towards its book value on a strong 86% recovery in FY13 earnings. The potential award of high-value newbuild orders and resumption of dividend payments following the refinancing of its scheme debt are likely catalysts.

"We re-instate coverage on Jaya with BUY and TP of S$0.85, pegged to 1.0x FY13 P/BV."

Recent story: JAYA HOLDINGS: Strong 1Q results, more good news to come?

OSK: STX OSV $1.22 Takeover Price Too Low

The $1.22 takeover offer price for STX OSV is somewhat low given its relatively strong balance sheet, said OSK analyst Jason Saw in a report.

STX OSV has net cash of S$0.35 per share and the offer values the stock at 7x FY13F P/E.

The $1.22 offer price is at 13% discount to its last closing price and a 17.5% discount to the weighted average price of the last three months.

This depressed sale price could be primarily driven by the desperation of the STX Group to sell its assets to pare down debts. The STX Group is also looking to sell its shipping unit, STX Pan Ocean.

He believes the general offer is unlikely to succeed for the following reasons:

(1) The offer price is at substantial discount to the current price ($1.40)

(2) Offerer Fincantieri might not get the acceptance level to take the company private.

“Assuming Fincantieri did not manage to get full acceptance to its general offer and the stock stays listed, we believe the change in major shareholder could remove the overhang on the stock and lead to a re-rating of the stock.

"We maintain BUY with a target price of S$2.05 based on 12x FY13F P/E.”