Good Visibility: "Sunny will focus on promoting handset lens sets and camera modules with high resolution, with an aim of maintaining its strength in the domestic market and entering into the supply chain of international leading handset manufacturers,” said Sunny Optical. Photos: CompanyCLSA: SUNNY OPTICAL Initiated with ‘Buy’ Call

Good Visibility: "Sunny will focus on promoting handset lens sets and camera modules with high resolution, with an aim of maintaining its strength in the domestic market and entering into the supply chain of international leading handset manufacturers,” said Sunny Optical. Photos: CompanyCLSA: SUNNY OPTICAL Initiated with ‘Buy’ Call

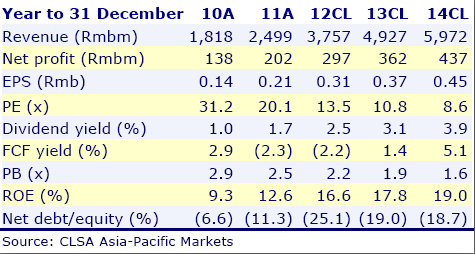

Sunny Optical (HK: 2382), the largest handset camera module supplier for Chinese smartphone OEMs, gets a “Buy” call initiation from CLSA, with a target price of 6.21 hkd (recently 5.06).

“The company is a great proxy for explosive growth of Chinese branded smartphones and poised to benefit from the on-going upgrade of camera resolution, which will drive ASP expansion and margin upside.

“Valuation is still reasonable after the recent stock price rally,” CLSA said.

Proxy for Chinese smartphone growth

More than 60% of Sunny Optical’s revenue is handset related, including lens and camera modules, and supplies to almost all the local Chinese smartphone makers.

Three main product lines include: camera lenses (34% of 1H12 revenue), camera modules (61%), and optical instruments (5%).

“The fast migration to higher resolution cameras in Chinese smartphones benefits camera module makers as higher resolution means higher ASP and margins,” CLSA said.

First half camera module sales doubled y-o-y of which 60% were driven by ASP increases due to fast resolution migration to 5Mpx and another 30% from volume growth.

“Moreover, contrary to popular belief, the gross margin of Sunny’s handset camera modules has been on an upward trend since 2009,” the French research house said.

Continued fast growth driven by handset camera modules

The continued fast growth of Chinese smartphones and migration to higher resolution cameras will remain the key growth driver for Sunny Optical, CLSA said.

“Other lens businesses such as vehicle camera lenses can generate meaningful revenue contribution and margin accretion after 2014.

“We expect Sunny’s handset camera module sales to almost double from 2012 to 2114, with GM at least maintained in the current range due to resolution migration.”

CLSA said it is initiating with a “Buy” given Sunny’s No.1 position in the China handset camera space, superior R&D capability over its Chinese peers, 3% dividend yield, 22% EPS growth and 18% ROE.

“The stock deserves to trade at least on par with its regional peers despite its smaller market cap. We view the company as one of the few high quality small-cap stocks worth owning among the emerging Chinese handset supply chain.”

See also:

WATTS UP? Hong Kong Electronics Rundown

Sunwah Kingsway: Staying ‘Buy’ on SUNNY OPTICAL

Sunwah Kingsway Research said it is reiterating its “Buy” recommendation on handset camera module maker Sunny Optical (HK: 2382) with a target price of 5.59 hkd (recently: 5.06).

“We are confident that Sunny Optical will be able to meet our net profit forecast of RMB328m for 2012. The optical expert recently shipped 9.5m units of handset camera modules, which increased 35% YoY and 9.7% MoM,” Sunway said.

Behind the Scenes: Sunny Optical's lens sets are installed in a wide range of consumer electronics. Photos: (from left) Samsung, Panasonic, Carl Zeiss

Behind the Scenes: Sunny Optical's lens sets are installed in a wide range of consumer electronics. Photos: (from left) Samsung, Panasonic, Carl Zeiss

The research house said the company’s shipments of camera modules have been achieving new monthly records in recent months.

“Furthermore, we have no reason to believe the popularity of smartphones in China will slow down in the near term, as the country added 9.5m of 3G subscribers in Oct 2012 alone.

“We believe this will continue to drive strong demand for Sunny Optical’s products.”

In addition, the company’s smart TV video modules have commenced mass production while the shipment of other optoelectronic products increased 152% MoM.

The counter is currently trading at 10.8x 2013 PE compared to 15.1x 2013 PE for its comparable peer Largan Precision.

See also:

ELECTRONICS ‘Outperform’

VST Enjoys Consensus ‘Outperform’ Call

The consensus expectations amongst three brokerages covering IT products distributor VST Holdings (HK: 856) stands at “Outperform,” with a median target price of 2.65 hkd (recently 1.64).

This “Outperform” recommendation has been the consensus outlook since investment community sentiment began worsening just over one year ago.

Currently, there is one “Buy,” one “Outperform,” and one “Hold” on VST Holdings.

In addition, the four analysts providing 12-month target prices have a high range of 3.35 hkd and a low of 1.53.

The median estimate represents a 63.6% upside from recent levels.

See also:

VST, BLUEFOCUS & Their Top Client LENOVO All ‘Buys’

VST CHAIRMAN: ‘IT Gadgets Already Life Necessity’

VST: Making ‘IT’ Happen In PRC; Shares Soar 26%