LI JIALIN, Chairman and CEO of VST Holdings Ltd (HK: 856), puts it very succinctly.

For a growing number of us, IT devices have already become the fourth necessity of life, alongside food, clothing and shelter.

And that is very good news for the Hong Kong-listed firm – Asia’s top supplier of products like smartphones and laptops.

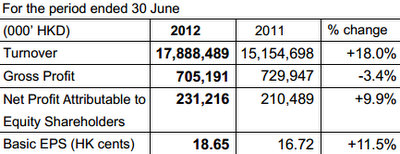

VST Holdings saw its first half revenue jump an impressive 18.0% year-on-year to just under 18 billion hkd, producing a bottom line increase of nearly 10% to 231 million hkd.

This all helped the Hong Kong-based firm boost its earnings per share to 18.65 hkd compared to 16.72 in the first half of 2011.

Revenue from VST’s distribution of Information & Communications Technology (ICT) products business remained the top earner by far, increasing by a whopping 24.3% year-on-year to reach 14.96 billion hkd in the January-June period, and constituting nearly 84% of total revenues.

“The Group has shown very strong growth in the first half. This is mainly due to growth in the distribution segment because of the strong demand for hard disks and media tablets,” said VST Chairman and CEO Li Jialin.

Speaking in Hong Kong to investors and reporters, he said that the PRC market continued to be VST’s growth engine.

“Geographically, the Mainland China market has shown growth with an increase of around 22.5% in terms of turnover versus year-earlier levels, while Southeast Asia markets have shown a growth of approximately 5.2%.”

Although VST is rapidly aiming to boost awareness of its name, the brands it distributes need no introduction, and read as a Who’s Who among the global ICT giants.

“We have continuously aimed to widen our product range in order to provide more choices to our customers.

“Our extensive and diversified products lines now include vendors such as HP, Apple, Seagate, AMD, Intel, Western Digital, Lenovo, Dell, IBM, Acer, Microsoft, Oracle, Cisco and Asus to name a few,” Mr. Li added.

But VST was aware that strong demand growth for its distributed products was not a given.

Like any other consumer products sector play, sales were impacted for better or for worse by consumer sentiment and the relative strength of the economy.

“The continued uncertainties arising from the Eurozone debt crisis, weaker economic recovery in the US, slower growth in China and intense competition in the IT industry will continue to have an impact on the performance of the Group,” Mr. Li said.

However, he was confident that “demand for consumer electronics, in particular mobile devices, will continue to grow.”

“The Group is working with many leading vendors in a bid to establish itself in the mobile devices segment. Despite the hard disks market going through a period of consolidation and the effect caused by the flooding in Thailand last year, the Group has seen significant growth in this area because of our long term partnership with Seagate and Western Digital,” Mr. Li said.

He added that many of VST distributorship relationships operate on a regional level.

“In turn, this has strengthened the Group’s economies of scale especially in China and Southeast Asia. At the same time, the Group remains cautious about global signs related to the Eurozone debt crisis and the US slowdown and intends to manage future growth strategies accordingly.”

Investors all took these assessments, remedies and forecasts in stride.

But what got everyone’s attention was Mr. Li’s overview of the ICT sector as a whole, and where he saw it headed speaking as someone with intimate, first-hand knowledge of such things.

As all of you well know, and as I can clearly see with a quick look around the room at all the smartphones and tablets, IT gadgets have in fact already become life necessities for many of us,” the Chairman said.

This comment caused a roomful of investors to look up from their Apple tablets or away from their iPhones long enough to take in more of what the head of the firm quite possibly supplying them the products in question in the first place had to say about the industry.

“Our distributed products for many are becoming as indispensible as food clothing and shelter. This, needless to say, is a huge part of our growth story,” Mr. Li said.

And if this weren’t incentive enough to attract more investor attention to the Hong Kong-listed firm which boasts over 25,000 active channel partners with 53 offices in six countries – China, Thailand, Malaysia, Singapore, Indonesia and the Philippines – he said there was another strong factor driving steady growth.

“As we represent a wide range of IT firms, many of them competitors, it doesn’t really affect us one way or another if one sees falling market share at the expense of another in the countries in which we do business.

“After all, when HP gobbles up business in China from Lenovo, or vice-versa, we are unfazed because both firms are our clients. As long as the entire sector sees increased sales, we prosper,” Mr. Li said.

On the sidelines of the results briefing, NextInsight was able to ask Mr. William Ong, VST Holdings’ CFO, a few more detailed questions.

Mr. Ong began by saying VST was pleased by the first half results, but they were still within its range of expectations.

He said VST had a very efficient business model on the IT products side which allowed the firm to benefit from individual clients twice in some cases, allowing VST to enjoy not only a “win-win” relationship with customers, but oftentimes a “double win” to boot.

“Take Lenovo for example, who has recently become our top revenue contributor in China on the distribution side.

“We sell them hard disks which they install in their laptops. Then we distribute their completed notebooks to the mass consumer market.”

He said that as CFO of an ICT distribution business, ensuring healthy cash flow and establishing steady and reliable credit facilities were some of his most important tasks.

“We were caught a bit by surprise by the strong hard disk business from Seagate as the first half drew to a close. Much of that was restocking from post-flood Thailand by PC makers looking to get back to earlier production figures.”

He said he had to scramble to find facilities of some 90 mln usd in just two weeks in June – a figure he seldom had to raise in several months of “normal” operations.

But thanks to VST’s strong credit history, cash flow situation and growth trajectory, lenders came through in the clutch, which Mr. Ong said made his job “much easier.”

“We need a big pocket to succeed in this industry. That’s why it’s so critical to nurture strong relationships with a variety of lenders.

“Of course they base their decisions in part on our credit history. But more important for them is our business plan. And because we keep our lenders in the loop at all times, both sides move forward with confidence.”

See also:

VST: Making ‘IT’ Happen In PRC; Shares Soar 26%

VST Holdings: IPads, China Market Propel 1H Sales