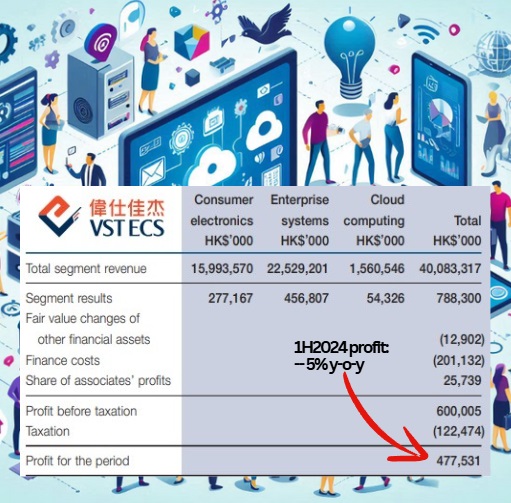

• The IT distribution business is a very competitive business but what if you can scale across multiple countries and you hold distributorship agreements with multiple global principals? VSTECS Holdings (market cap: HK$6.6 billion), listed in HK since 2002, is such a company, counting a long list of big names as principals: Huawei, HP, Amazon, Apple, AMD, Starlink, Dell, Lenovo, IBM, etc. • It is not to be confused with VSTECS Berhad, listed on Bursa Malaysia, which is an associate company of VSTECS Holdings (Singapore), which is a wholly-owned subsidiary of VSTECS Holdings (0856.HK). This means that the Malaysian company is indirectly controlled by the Hong Kong company through its Singapore subsidiary. • Aside from thriving on global partnerships, VSTECS Holdings is riding on favourable large trends: » rising adoption of AI, » refresh cycles for consumer electronics, and » increasing cloud services.  • VSTECS benefits from distributing AI-related hardware and software, which are essential for enterprises looking to scale their AI capabilities. • VSTECS is in the midst of refresh cycles for electronic gadgets such as mobile phones and PCs. • The company also distributes cloud services from major providers like Microsoft Azure and Alibaba Cloud. While the trends have started, they have yet to significantly lift VSTECS' earnings (1H2024 profit was -5% y-o-y), which is why year to date, the stock is up only 5.9%. For more, see UOB Kay Hian's report below... |

UOB Kay Hian report

Analysts: Kate Luang & Gigi Cheuk

|

VESTECS Holdings (856 HK/BUY/HK$4.53/Target: HK$5.47) |

• VSTECS is Starlink’s preferred partner when it entered Asia. It began to distribute Starlink’s standard kits in Malaysia and Indonesia in early-24 and has received positive feedback on its market entry in the Philippines and Thailand.

| VSTECS HOLDINGS | |

| Share price: HK4.65 | Target: HK$5.47 |

We believe VSTECS is poised for opportunities from the uptake of Starlink in other SEA countries, thanks to its first-mover advantage and established distribution network.

• Cloud computing revenue grew at a three-year CAGR of 22.4% in 2021-23 as VSTECS extended its cloud services to multi-cloud management platforms, computing power scheduling and AI management.

We forecast VSTECS’ cloud computing segment registering a three-year CAGR of 14.0% in 2024-26 as AI advancement continues to drive increasing demand for computing power and cloud services.

| • Catalyst: Key consumer electronic product upgrades driving replacement demand and cooperation with leading cloud services providers. • Valuation: Initiate coverage with BUY and a target price of HK$5.47, based on 7.3x 2025F PE, pegged to its historical mean in 2019-24. The company is now trading at 6.1x one-year forward PE, which is 0.5SD below its historical mean in 2019-24. |

Full report here.