Translated by Andrew Vanburen from a Chinese language blog piece in Sinafinance by Vicky Wang

TO UNDERSTAND a rising market – and more importantly to profit from it – investors need to take a step back and do more than ooh and aah at the soaring benchmark index.

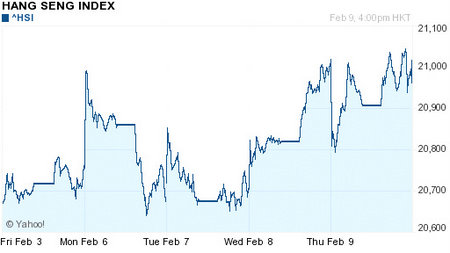

In short, those hoping to capitalize on this mini-bull run need to focus on more than just Hong Kong’s headline-making Hang Seng.

As I see it, there have been at least two drivers at play over the past month or so.

First has been the return of the tycoons.

Much of the upward activity in share prices, especially among index counters and growth-theme plays, has been fueled by the super rich.

The other driver these days, equally formidable, has been the surging interest in the privatization theme.

Specifically, the growing number of investors willing to take their chances on these rather elusive and shape-shifting targets.

Admittedly, there is no fund in the local market specifically tailored to go after privatization counters, and if there was, the recent upswing in the market might look more like a tidal wave..

This is mainly due to the fact that entities undergoing this complex, time-consuming and legalistically arcane transformation often frighten away even the most seasoned lot of investors who all want targets they can better wrap their minds around and put into a box of some size or shape.

Breaking up is hard to do, so the saying goes. And companies are no different.

Case in point, just look how long it's taking PCCW to redefine itself, organizationally and existentially.

Firms undergoing privatization of some sort are undergoing reorganization, partition, unit restructuring, asset reallocation and management reshuffling and reassignment – all of which spell instability and thus is anathema to the garden variety investor in today’s topsy-turvy marketplace.

And lest we forget, the process of privatization produces more than its fair share of low-hanging fruit with spinoffs and M&A activity often creating scenarios wherein a large entity can be virtually unrecognizable from one day to the next.

Therefore, it should now be clear why no funds are in a position to be dedicated to the privatization theme, and simply put – sometimes not even those behind the scenes in the process can offer any clear guidance on what bits and pieces, or complete entities, will be the best bets when all the hammering and drilling noises have subsided.

In addition, even if you somehow are privy to the goings on behind the scenes during privatization campaigns and have more than an inkling on what will be the final investment vehicle to emerge, most wouldn’t dare set up a dedicated fund with a banner chasing such slippery subjects.

Therefore, I would urge investors to be extremely wary of jumping on board a fast-moving vehicle without first understanding where it's headed, how many seats it has, and most importantly -- if the seat belts on the conveyance are in proper working order and good repair.

Otherwise you might never know where you'll end up.

And unfortunately for passengers onboard this vehicle, tickets are non-refundable.

That having been said, those along for the ride who've done their homework will often feel they've gotten their money's worth -- and then some.

Read more:

Hong Kong Developers On PRC Bargain Hunting Spree

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us