Dukang Distillers CEO Zhou Tao chatting with shareholders after the AGM at Marina Mandarin Hotel. Photo by Leong Chan Teik

Dukang Distillers CEO Zhou Tao chatting with shareholders after the AGM at Marina Mandarin Hotel. Photo by Leong Chan Teik

At Dukang's AGM, some shareholders suggested that the company should pay dividends since it was highly profitable. Photo by Ngo Yit Sung.

At Dukang's AGM, some shareholders suggested that the company should pay dividends since it was highly profitable. Photo by Ngo Yit Sung.

Venue: Marina Mandarin Hotel

Time & date: 2.30 pm, Tuesday, 30 Oct 2012

Photo by Ngo Yit Sung.

AT ITS AGM, Dukang Distillers CEO Zhou Tao and other members of the management explained why the baijiu distiller has never paid dividends despite being profitable since listing in 2008.

Mr Zhou believes it is in the long-term interest of shareholders if the company uses its retained earnings for expansion so as to ride the industry's rapid growth.

Formerly known as Trump Dragon Distillers, the company had lagged behind the baijiu’s industry until it acquired another baijiu player carrying the ancient Dukang brand name.

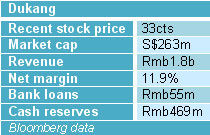

After the M&A was completed in May 2010, the company was renamed Dukang and its revenues surged to Rmb 1.8 billion for FY2012 with a CAGR of 53% over FY2011 to FY2012.

Net profit also multiplied at an astounding rate to Rmb 218 million (CAGR 195%) over the same period.

This exceeds even China’s rapid growth in baijiu sales of 30% a year over the past 5 years.

The Chinese market for baijiu was Rmb 374.7 billion in 2011. Outside China, in comparison, the heavy liquor is relatively unappreciated, and the market is only about Rmb 500 million.

Buoyed by the optimistic outlook for baijiu demand, Dukang decided to embark on an aggressive expansion strategy to increase its market penetration outside its current stronghold in Henan province.

On 26 November 2011, it signed a letter of intent with South Korean’s largest beverage player, Lotte Chilsung Beverage, for the later to distribute the Luoyang Dukang brand of baijiu products in hotels, supermarkets and departmental stores in South Korea.

It has also been advertising on national TV and intends to step up its distribution efforts outside Henan this December.

To meet the demand as a result of its marketing efforts, it is ramping up production capacity by 40%. By mid 2013, it will have another 700 fermentation pools that will add 3,000 tons of grain alcohol production to its annual capacity.

Below is a summary of the questions raised by shareholders the replies provided by Mr Zhou, non-independent and non-executive director Calvin Tan, and Financial Controller Raymond Ho.

Photo by Ngo Yit Sung.

Q: Will you consider paying dividends since you are profitable?

A: It had been important for us in the past two years to conserve cash for expansion. We are at the stage of aggressive capacity expansion and it is costly to build fermentation pools.

The cost of raw materials for baijiu production has been rising and they have to be paid for upfront. We need ample stores of grain alcohol feedstock to meet new demand as we expand our distribution network in provinces outside Henan.

Marketing and promotional expenditures are also expected to be higher as we are at the stage of making Dukang a national brand.

It was after much consideration that the board of directors decided not to distribute dividends for the current year.

We will consider distributing dividends and buying back shares when we have achieved these immediate goals and have surpluses that do not need to be ploughed back into our operations.

Q: How do floods and typhoons affect your inventories and cost of production?

A: The cost of raw materials is always on the rise. This is a worldwide situation. Speculative demand is pushing up commodity prices but hoarding feedstock is not a solution for us.

We try to stabilize cost of production through constant negotiation with suppliers and by buying one to two months ahead of our production requirements.

Q: Which part of your accounts receivables are overdue?

A: We have no overdue receivables. For the Dukang brand, we sell on cash terms. Our Siwu brand has credit terms of 30 to 60 days.

Q: FY2012 profit before tax was Rmb 300 million. What is the profit segment breakdown by geography between Henan, domestic sales outside Henan and overseas?

About 30% to 40% of our sales come from outside Henan such as Tianjin, Hunan, Shandong, Guangdong, Hebei, Northeastern China and Inner Mongolia. About 60% is from Henan.

Our best-selling product has a concentration of 52% alcohol. To be the best brand, we need a strong distribution network throughout China's key cities.

Q: What do your intangible assets of Rmb 40 million comprise of?

Mr Ho: Our brand value is much higher than Rmb 40 million, but this amount is based on the book value when we acquired Luoyang Dukang.

Mr Zhou: I would not sell the company even for Rmb 400 million.

Q: Why does the company have short-term borrowings when it has so much cash?

In Singapore, banks give loans based on reputation, credit standing, operations and sales projections. However, in China, we have to maintain good relations with banks by maintaining short-term loans at reasonable interest rates. In fact, we do not need bank borrowings.

Q: Please explain the jump in Inventories value from RMB279.2 mil in FY2011 to RMB404.9 mil in FY2012.

More than half of our inventories consist of grain alcohol, the rest is packaging material and grains. The bottleneck to support sales in the baijiu industry is the sufficiency of well-aged grain alcohol supply as aged grain alcohol is vital to produce high quality premium baijiu which can fetch a higher margin.

When we acquired Luoyang Dukang, more than half of its fermentation pools were idle. The 45% jump in inventories value is due to our effort in revitalizing the idle pools to boost grain alcohol production for ageing in anticipation of sales growth in near future.

Q: The new fermentation pools would not boost the bottom line in the near term. Is there any avenue to acquire old fermentation pools?

We are able to cultivate the fermentation soil for the new pools so that the quality of the grain alcohol produced by the new pools will not differ much from the older pools. This is the result of our in-house R&D to transfer microbes from older pools to newer ones.

On the other hand, we are also looking into acquiring old fermentation pools from the villagers near our Ruyang plant as most of the households used to make baijiu for own consumption back in the 1950s.

Nonetheless, based on the annual grain alcohol production capacity of 7,610 tonnes, our consistent improvement in fermentation technique to yield more grain alcohol per pool and the aggressive stock up of grain alcohol, we have no problem in supporting our target sales for the next three to five years.

Q: Do Mr Gao Feng and Mr Zhou Tao have share options as part of their remuneration package?

No, they do not. We have not activated our employee share option scheme.

Q: Will your audit fees increase when you appoint BDO Singapore to act jointly with BDO Hong Kong?

The joint appointment is in compliance with SGX listing rules. BDO has assured us there will be no audit fee increment.

Q: Will you sell Dukang baijiu in Singapore?

We are talking to liquor distributors in Singapore. We hope Dukang baijiu will be distributed in Singapore in the near future.

Click on the visual below for more pictures of the AGM.

Related story: DUKANG: Steps Up Advertising To Create National Brand