She owns 5.1% (direct & deemed interest) of DMX, and is its third largest shareholder after KDDI Corp and Venture Corp. NextInsight file photo.

CLOUD COMPUTING will be the next growth driver of the IT industry, according to DMX CEO Jismyl Teo, at DMX’s 2Q2012 results briefing.

She said DMX, the leading integrated network infrastructure and digital media solutions provider, has been preparing itself to become a cloud infrastructure enabler.

Global expenditure in cloud computing is forecasted to grow about 19.8% to US$109 billion this year, compared to a muted 3% for global IT spending, according to Gartner.

DMX will also continue to differentiate itself in the IT market through its expertise in security solutions and services, an area where IT spending will still be allocated, while capitalizing on its regional presence to provide one-stop solutions and services to multinational corporations across Asia.

The company posted a 13.2% year-on-year increase in 2Q2012 revenue to US$91.1 million and a 13.7% rise in net profit attributable to shareholders to US$4.7 million.

Infrastructure Enabling

Leading DMX's growth was its Internet-related Infrastructure Enabling division, which grew 17.1% to US$52.1 million and contributed 57.2% of group sales.

Digital Media

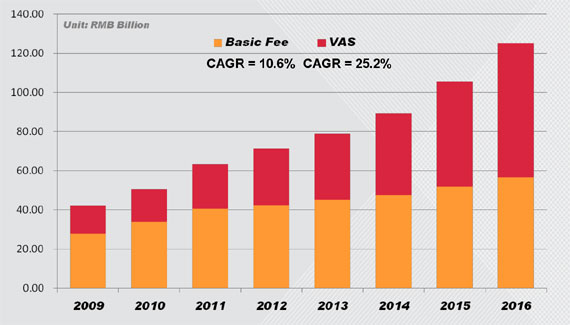

Its TV-related Digital Media division grew 6.7% to reach US$37.7 million and contributed 41.4% of overall sales. This comprised of Digital Media Solutions, which grew 12.7% while the Multimedia Software segment declined 14.1%.

"One customer, Jiangsu Cable TV, increased its revenue from value-added services by 10% after it implemented DMX's Vision CEP and Vision TA platform for 30% of their customers," said CEO Jismyl Teo.

New Media

The Group’s New Media division, which focuses on providing content and applications to telecom, cable and mobile operators, grew 85.7% to US$1.3 million for 2Q12.

The group's outstanding order book as at 30 June 2012 was US$75.8 million.

Other improvements in 2Q2012

- Revenue from China grew 19.0% to reach US$63.2 million, and contributed 69.4% to group sales.

- Gross margins expanded by 0.83 percentage points to 22.85% as a result of more high-end equipment sales and service projects.

- Collection of accounts receivables improved, resulting in cash position increasing by US$2.9 million to US$25.9 million

“We will focus on growing bottom line through the creation of differentiated software, services and applications for more recurring, higher-margin revenue streams,” said Ms Teo.

Related story: TECHNICS, ANWELL, DMX: What Analysts Say Now...