Sino Grandness – Once bitten, twice shy?

Since the start of the year, Sino Grandness (“SFGI”) has underperformed the market. As at 18 Apr 2012, it registered a year-to-date gain of 7.8% vis-à-vis 13.3% and 15.6% by the STI and FTSE Strait Times China index, respectively.

Much of the loss occurred immediately after the 4QFY11 results. What happened? Any noteworthy developments since then?

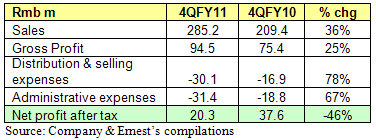

Drop in 4QFY11 net profit caught the market by surprise

Despite a 36% increase in 4QFY11 revenue, SFGI reported a 46% drop in net profit after tax for that period. According to the management, this was mainly attributable to a 78% increase in distribution and selling expenses and 67% increase in administrative expenses.

Management took pains to explain that the expenses are necessary as they had intensified advertising and promotion activities such as new TV commercials on CCTV in 4QFY11 to promote Garden Fresh juices.

Furthermore, higher distribution expenses were incurred due to growing business volume, compounded by the fact that SFGI only has one juice supplier in Fujian Province to support its rapidly growing end markets in different provinces in China. (However, this changed from 2012 onwards – see point 2B).

In addition, more export billing on cost and freight were also incurred. There were also some non – recurring expenses such as the one off convertible bond issue costs of around RMB7.4m (booked under administrative expenses) for its Garden Fresh subsidiary.

Noteworthy developments since its 4QFY11 results release

1. 8 Mar 12: SFGI established strategic tie-up with China National Research Institute of Food & Fermentation Industries

CNIF is the oldest and largest national research institution engaged in the food, bio-engineering R&D work in China. SFGI and CNIF will jointly set up a new R&D center under a five-year agreement to research on loquat juices and establish national standards and specifications for loquat juices. In other words, SFGI would combine its in-house R&D and that of CNIF, so as to further expand the product range and regularly introduce more products into the China market.

For more about CNIF, you can refer to http://www.cnif.cn/

2. 17 Apr 12: SFGI made one announcement but there are several positive developments embedded

2A) Secured additional distributors to expand into new provinces and launched new juices during Chengdu Trade Exhibition

SFGI held a successful Chengdu Trade Exhibition in March. In line with their practice of launching new products every year (icy loquat and loquat pear were introduced in Mar 2011), SFGI launched loquat peach and loquat strawberry at the trade fair this year. Also, SFGI announced that they have secured new distributors to market Garden Fresh juices in existing, as well as in new, provinces in the PRC. The number of new distributors and the provinces which they are serving was not disclosed.

However, based on their aggressive expansion plans to augment their production capacity for their juices (refer to point 2B below), it is likely to be a good number.

Photos: Company

2B) Expanding output capacity at strategic locations in PRC to improve delivery time and cost management

Ever since SFGI embarked on their beverage business in 4Q2010, SFGI had only one external juice supplier based in Fujian Province to support its rapidly growing end markets in different provinces in China. With increasing demand for its Garden Fresh juices, SFGI wanted to better manage its delivery time and costs, thus it started construction and installation of machineries at their internal production facilities in Sichuan Province.

This was opened officially in Mar 2012 and production is expected to be ramped up in the coming months.

Besides their internal production facility, SFGI continued to source for new external suppliers for their Garden Fresh bottled juices. Besides securing the second external supplier in Zhejiang Province in Jan 2012, they also announced that they have secured a third external supplier in Beijing to support potential new markets in northern China. All in, the annualised combined production capacity for Garden Fresh bottled juices is expected to jump from 70,000 tonnes to 280,000 tonnes.

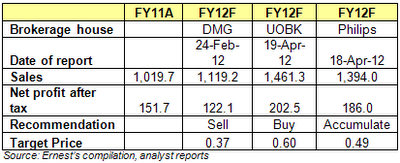

Nevertheless, mixed response from analysts

Notwithstanding the recent developments, SFGI is drawing mixed response from the analysts. Here is my compilation from various analyst reports.

Recent story: LIAN BENG target 71-c, SINO GRANDNESS 70-c, SG property stocks bearish

Visit Ernest Lim's blog http://www.ernestlim15.blogspot.com/