BOCOM: INTERNET sector kept at ‘outperform’

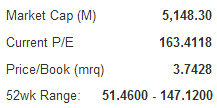

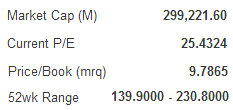

BOCOM International said it is maintaining its ‘outperform’ recommendation on China’s over 500 million-strong online user Internet sector, with Tencent Holdings Ltd (HK: 700) and Sina.com Inc (NASDAQ: SINA) – parent of China’s top microblogger Sina Weibo -- as its top picks.

“Sina is the top portal attributable to Sina Weibo’s strong performance.

"We saw a growing trend on Sina’s daily visitors and pageview market share with unique daily visitors to Sina growing fast from 155 mln to 160 mln month-on-month in September, while other portals were flat,” Bocom said.

Sina Weibo controls the lion’s share of China’s massive and rapidly-growing microblogging market.

Sina Weibo’s market share and daily visitors reached 68% and 56 mln, respectively, as of September 2.

“Sina Weibo will continue to grow as an SNS (social networking service) platform with more applications/services in the near future. Sina will benefit from Sina Weibo’s growth on an upgraded version and government support.” Bocom added.

Meanwhile, Tencent Weibo’s unique visitors also grew fast, up 3 mln to 30 mln per day in September, attributable to Tencent’s strong promotion activities and QQ user importation.

For the traditional SNS sector, Tencent Pengyou’s unique user base has surpassed Kaixin001 since March and has grown to match Renren with 19 mln user as of September 2.

“Users stayed on Kaixin001 (9mins/day) longer than Pengyou (5mins/day), but the gap has narrowed since early 2011.

"If Tencent’s investment in Kaixin001 takes place, we view the combination of Pengyou and Kaixin001 as a major competitor of Sina Weibo,” Bocom said.

See also: Current Bear Market A 'Playground' For Institutional Investors

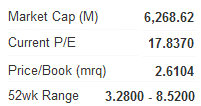

BOCOM: ‘Outperform’ call on HEALTHCARE SECTOR maintained

BOCOM International said it is maintaining its ‘outperform’ recommendation on China’s healthcare sector.

However, it cautioned that centralized procurement of high-value medical consumables in Beijing may trigger short-term risks of price cuts in cardiac stents, a major revenue driver for a number of listed firms.

“Beijing has recently conducted a centralized bidding and purchasing process for medical consumables, including cardiac stents and bone surgery apparatus,” Bocom said.

The brokerage noted that affected products of Hong Kong-listed companies, including MicroPort Scientific Corp (HK: 853) Shandong Weigao Group Medical Polymer Company Ltd (HK: 1066) and Trauson Holdings Co (HK: 325), are involved.

“We think the centralized bidding process will inevitably lead to falling prices in related medical consumables. Short-term risks may arise if the magnitude of the fall exceeds market expectations.

"Investors are advised to adopt a wait-and-see attitude towards these companies,” Bocom added.

See also: Counting The Costs Of Living In SHENZHEN