Excerpts from latest analyst reports...

BOCOM: Initiated coverage on COMTEC SOLAR with a BUY

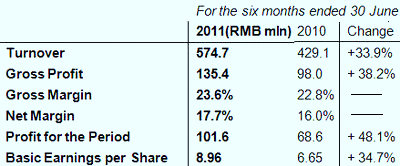

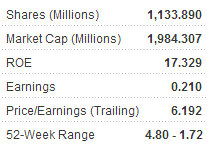

Bocom International said it is initiating coverage of of Comtec Solar (HK: 712) with a BUY recommendation, just after the wafer maker’s first half net profit jumped 48.1% to 101.6 mln yuan.

“The half-year earnings were behind expectations, but we see super mono-crystalline wafers as the next driver,” Bocom said of Comtec’s newly-developed product series.

Bocom’s target price on Comtec is 2.51 hkd, which represents a 25% upside.

Comtec’s January-June revenue increased 33.9% y-o-y to 575 mln yuan while diluted basic EPS was 0.0896 yuan.

Gross margin expanded from 22.8% in 1H10 to 23.6% in the just-finished half.

“The results came below market expectations due to (1) lower-than-expected production shipments (109.4MW); (2) 20% decrease in wafer prices, and (3) expiry of income tax holidays for some capacity which brought its effective tax rate to 25% from 15%,” Bocom said.

Production shipments were lower as Comtec used some of its capacity to produce super mono wafers, with a new 400MW capacity project only commencing production in June.

“We visited the production site of the company in July. The management revealed that it possesses abundant orders and its products could not satisfy market demand. Unlike other solar production companies, Comtec did not observe huge inventory in 1H. In addition, the company had obtained 600MW wafer orders for this year,” Bocom said.

Meanwhile, some of the capacity was used to produce a new type of mono wafer, leading to a lower production shipments in 1H11.

“Production of self-developed super mono wafers with a high conversion efficiency of 23% has begun. ‘Super mono wafers’, also known as monosilicon wafers, are different from the traditional P-type monosilicon wafers because of different additives. Its conversion efficiency could reach 23% and is more stable when compared to the traditional wafers,” Bocom added.

Comtec Solar began to develop the super mono wafers since last September and commenced pilot production in February 2011. It targets to increase the shipments of super mono wafers to no less than 50% of total shipments by 2012.

Comtec’s planned total capacity could reach 1400MW by 2012 upon capital injection from US-based TPG Group.

Income tax rate expected to fall The 400MW project at Jiangsu Haian has commenced production since June and total capacity of Comtec has reached 600MW. It plans to expand its capacity to 1000MW by the end of this year, but it changed to expand its capacity to 1400MW by mid-2012.

“New plants are expected to enjoy income tax holidays, which could reduce the overall tax rate level,” Bocom said.

"Comtec Solar is a leading mono wafer producer. It will expand its capacity proactively in 2011 and 2012 given the national supportive PV policy. We are bullish on the growth prospect and product competitiveness of the company.”

See also: COMTEC SOLAR: HK-Listco's 1H Profit Soars 48.1% On Vibrant Wafer Sales

BOCOM: Still BUY on DATANG, interim earnings in-line

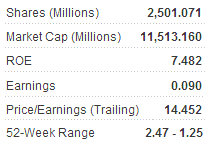

Bocom International said it is maintaining its BUY call on China Datang Corp Renewable Power (HK: 1798) after the wind farm and hydroelectric power plant operator’s in-line results.

The brokerage has a 2.99 hkd target price on Datang, representing a whopping 83.4% upside.

“Datang’s interim earnings were in-line with our previous forecast that 2011 earnings will double,” Bocom said.

January-June revenue soared 78.2% to 1.859 bln yuan in 1H11 while net profit attributable to shareholders jumped 105.2% y-o-y to 416 mln. Diluted basic EPS was RMB0.058.

Yearly target of 1500MW achievable The company’s installed wind power capacity amounted to 4142MW as of the end of 1H11, meaning that Datang has completed installation of 114MW in 1H11.

“While the construction work of the wind farms usually begins at the beginning of the year, the wind farm could only operate in the second half of the year after it passes a 3-month trial period.

“We believe Datang could achieve its yearly installation target of 1500MW in 2011. Similarly, Longyuan Power only completed a 49MW of installation in 1H10 but it managed to achieve its yearly installation target of 2000MW last year.”

Bocom said PRC government policy was very pro-renewable energy.

“Mainland China will build eight major 10GW wind power bases during the 12th Five Year Plan period with new wind power installed capacity of around 70GW. Despite a fair market valuation, we are bullish on its growth prospect given three-year average installed capacity growth of 28.4%,” Bocom added.

See also: RENEWABLE ENERGY ASIA, DRY BULK SHIPPING, BERLIAN LAJU: What Analysts Now Say...