Excerpts from analyst reports...

Goldman NEUTRAL on YANGZIJIANG SHIPBUILDING

Goldman Sachs is initiating coverage on Mainland China’s shipyard sector with an attractive stance.

“We believe it has the potential to become one of the global leaders in the shipbuilding/offshore and marine (O&M) industry over the long term, given its low-cost advantage, increasing labor expertise, strong domestic demand, and policy support. We also believe it can double its profits over the next 4-8 years.”

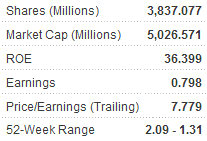

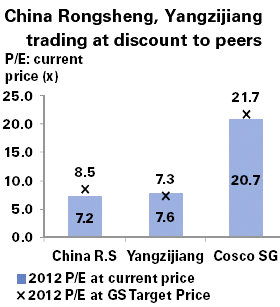

To this end, it is initiating coverage of Yangzijiang Shipbuilding (Holdings) Ltd (SGX: YZJ) with a NEUTRAL call and a 12-month Director’s Cut-based target price of 1.4 sgd.

“Yangzijiang is a well-regarded private shipbuilder with the best margin track record among the three yards (Cosco, China Rongsheng, Yangzijiang). It currently owns three yards and is also building a fourth yard.”

Goldman Sachs added that Yangzijiang’s main focus is on own-design vessels, and dry bulkers and containerships.

“The company plans to diversify into O&M, but has had limited meaningful opportunities so far. Yangzijiang is already in a net cash position at end 2010.”

See also: YANGZIJIANG, STAMFORD TYRES, SARIN: What Analysts Now Say...

Goldman BUY on HK-listed shipbuilder CHINA RONGSHENG

Goldman Sachs says China’s shipbuilding sector could potentially see outstanding profit growth over the next few years for several reasons.

The brokerage said the sector has room to expand market share further in commercial shipbuilding as Chinese shipyards still have lower revenue market share than Korean peers.

“We believe Chinese shipyards could secure higher O&M market share as key success factors for this sector are largely similar to commercial shipbuilding; and diversification into related industries -- higher vertical integration along with more revenue streams.”

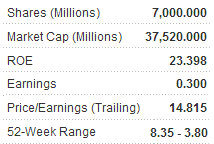

To this end, Goldman Sachs said it is initiating coverage of China Rongsheng Heavy Industries Group Holdings Ltd (HK: 1101) with a BUY and 12-month Director’s Cut-based target price of 6.1 hkd.

“China Rongsheng is a relatively new entrant in the market (first order in 2006) but already has the largest order backlog among the three yards (Cosco, China Rongsheng, Yangzijiang). CRS has a strong and highly-regarded management team.”

Goldman Sachs added that CRS has historically focused on dry bulkers and tankers, but is now diversifying into containerships and O&M, and potentially into LNG carriers.

“We think 2011E net debt to equity of 39% is high, but we expect it to decline through 2013E as CRS grows its earnings/cash flows.”

See also: PRC BANKS, PORTS, CITY TELECOM: What Analysts Now Say...