HL TECHNOLOGY Group Ltd (HK: 1087) has followed its November IPO in Hong Kong with stellar full-year 2010 results, with net profit up 75.1% at 155 mln yuan, with the designer and manufacturer of a wide range of cable and signal transmission wire products targeting a near 100% jump in 2011 revenue to 2.2 bln yuan.

Management met with investors and media yesterday in Hong Kong to outline their strategy.

Chairman and CEO Mr. Derek Chi said HL Technology’s comprehensive approach to the entire manufacturing process, from R&D to product launch, gives the firm a decided advantage over the competition.

“HL Technology Group is currently a core supplier to many international first-class electronics firms. Relying on our strong R&D capabilities, our pricing competition, a solid and stable customer base, and a rapidly expanding international sales & marketing network, we are able to demonstrate our one-stop service advantage. We will continue to upgrade our leading position in various industries and expand our market share,” said Mr. Chi.

He told NextInsight that attention to innovation, and protecting the company’s proprietary technology, was a key to HL Technology’s success.

“Our R&D commitment is solid. And given our success, we naturally have to work hard to protect our technology. And as a ‘one-stop’ producer, we have developed technology from product conception to product release, which makes it difficult to replicate our products given the amount of intellectual property that goes into them.

“That being said, we still recognize the need to protect our technology, which we mainly achieve via patents – both in application and already in place,” Mr. Chi said.

HL Technology’s R&D efforts were definitely reaping dividends.

“Our R&D teams in Weihai, Suzhou and Taiwan are working hard to lift the overall technical standards of the Group, raise efficiency, streamline production, improve quality and help introduce new and innovative products. As of December 31, 2010, we had 181 R&D experts who successfully developed products including notebook antennae and low-energy usage halogen-free products which began receiving orders in the fourth quarter.”

On the R&D front, we will continue to boost existing research and development center efforts, continue to improve our R&D capabilities, and in 2011, we will establish in Shenzhen a wireless communications R&D center engaged in wireless communications work to strengthen our competitiveness in the consumer electronics and communications sectors. In addition, we also will establish in Tianjin an automotive wire harness R&D center to consolidate our position in China’s auto sector supply chain,” Mr. Chi said.

He said that companies in the cable and signal transmission business that rested on their past achievements and did not continually innovate did so at their own peril.

“Development of downstream 7-channel high-speed MINI-DP products and support for 3D image conversion and transmission has been considered the world's high-end future development direction for data transfer cable technologies, and we have our R&D teams to thank for this.”

As of end-year 2010, HL Technology’s R&D teams had registered for some 49 patents in the PRC, with another 42 in the application stage, with another three registered in Taiwan and one in application.

“Strong R&D capabilities as well as enviable product development performance won our Group a number of orders designing and developing new products for strategic partners. This relationship allows us to achieve higher profit margins and we can successfully achieve greater market share in the early development of new product launches,” Mr. Chi added.

The most immediate beneficiary was the company’s FY2010 results, its first as a listed enterprise.

The firm saw excellent performance from all its major product categories last year.

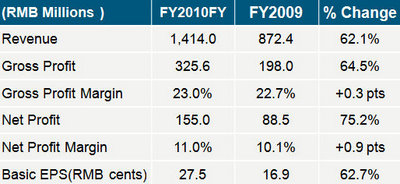

Revenue rose 62.1% year-on-year to 1.414 bln yuan, with HL Technology’s annual sales revenue growth over the past three years averaging 25.5%.

Gross profit margins increased to 23.0% from the 22.7% recorded in 2009, hitting a historic high, while net profit rose over 75% to 155 mln yuan, which helped the company attain a three-year annualized average bottom line growth of 68.6%.

Shareholders returns on investment for the period rose to 24.8%.

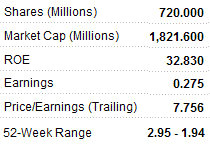

Net profit margins added 0.9 percentage points to reach 11.0%, while basic EPS jumped 62.7% to RMB 27.5 cents.

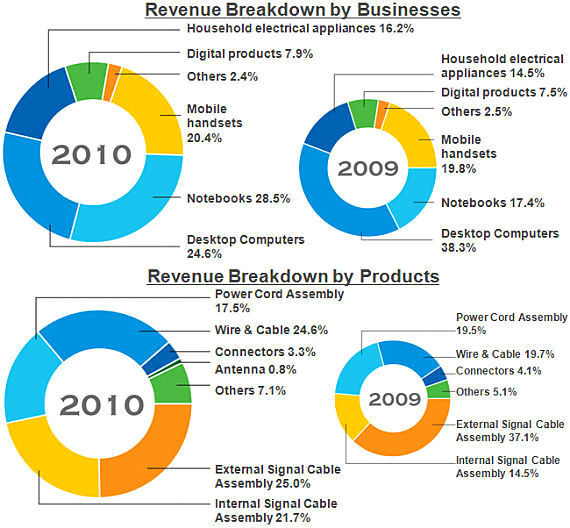

Products mainly applied to the field of consumer electronics were the main revenue contributors.

In 2010, contributions by division were: notebook computers (28.5%), desktop computers (24.6%), handsets (20.4%), household appliances (16.2%), digital products (7.9%), and others (2.4%).

“Compared with 2009, signal cables, connectors and antennae for use in notebooks, mobile phones and household appliances showed a big jump in revenue contribution in 2010,” Mr. Chi said.

The gross profit margin hit a historic high of 23.0% in 2010, up 0.3 percentage points year on year.

“Major reasons for the strong GPM were the continuous efforts at R&D and a series of higher-margin products unveiled such as internal signal cable assemblies and connectors.

“We also had better financial controls which helped more effectively control production costs, an overall improvement in product quality and positive results from enhanced sales and marketing campaigns,” he added.

He said that HL Technology’s antenna products, many of which find their way into our wireless devices such as cell phones and laptops, enjoy impressively high 30% and above margins.

“Therefore, we will be putting more emphasis on these products going forward.”

On the ongoing tragedy in Japan, he said the earthquake and tsunami there did will not adversely impact the company’s forecast for this year, as its Japan-based customer base was not substantial at present.

HL did manage to increase its client base, measured by project-orders, to 177 last year, up from just 100 in 2009.

“In 2010, we have seen even more impressive achievements than in the past, and this helps add considerable value for our shareholders. Sharp fluctuations in copper prices, domestic inflation pressure, and labor cost rises notwithstanding, we continue to see strong growth in large part due to better cost controls.

“This has allowed our profitability to improve and net margins to expand to 11.0% in 2010 from 10.1% a year earlier. And as our most recent results demonstrate, this has significantly benefitted our overall profitability and competitiveness,” he added.