XMH Holdings: The company, which is Mitsubishi’s No.1 distributor for marine diesel engines, is flush with cash: It held net cash of S$39.1 million as at 31 Oct 2011.

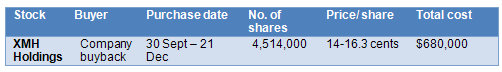

With this war chest, the company has regularly bought back its shares since Sept 30. The total acquired is 4.5 million shares for a total of about $680,000.

That’s, of course, not making any dent in its cash hoard and XMH has ways to go in its buyback.

XMH’s cash hoard was boosted by its Jan 2011 IPO net proceeds of $18.9 million when it sold shares at 25 cents apiece.

About $10 million is earmarked for the development or acquisition of premises for general warehousing and work areas and the establishment of an assembly line for the group’s in-house brand of power generating sets.

Another $7 million is for expansion opportunities.

The business, however, is feeling the heat from the global economic uncertainty.

The Group expects its revenue trend to head down. In 1H2012 ended Oct 31, revenue was down 36% to $21.8 million while net profit tumbled 45% to $2.99 million.

It said it, however, expects to remain profitable for the financial year ending 30 April 2012.

While a majority of XMH's clients are shipyards and vessel owners buying marine diesel engines, XMH also sells power generators to hotel and building owners.

About 90 per cent of XMH's 2010 turnover came from its distribution of diesel engines and power-generating sets, while 9.6 per cent came from after-sales services and trading.

Recent story: XMH: 1- cent dividend, or 5% yield

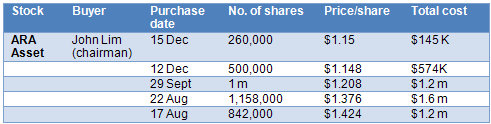

ARA Asset Management: In the last five months, its group CEO has shelled out about $4.7 million buying shares of the company he co-founded.

The buying spree in that 5-month period, as the stock price of ARA declined, also happens to be his only bout of buying in 2011.

As a result, John Lim now owns 5.79 million shares in his own name and has a deemed interest in another 281 million shares, or a 36.6% stake in ARA.

Except for 1 m shares, all the 281 million shares are held under an investment vehicle wholly owned by him.

ARA is a leading Asian real estate fund manager focused on the management of public-listed real estate investment trusts (REITs) and private real estate funds.

DBS Vickers recently described ARA as "Asia’s finest asset manager with a high cashflow generating business model and little earnings downside."

John Lim's purchases signal a positive outlook for ARA’s business, which recently reported a 44% increase in net profit to S$54.9 million for the nine months ended 30 September.

Total assets under management stood at S$19.3 billion as at 30 September 2011, 31% higher year-on-year.

ARA said it is on track for another year of record profits.

It is yet to be seen if ARA would raise its final dividend. Its trailing dividend yield is about 4% based on a recent stock price of $1.17.

Recent stories:

ARA ASSET: Resilient earnings, super-high profit margins, steady dividends

DBS VICKERS: What to buy, what to exit from