Excerpts from DBS Vickers' report.....

Analysts: Tan Ai Teng, Ling Lee Keng, Singapore Research Team

Trading at a larger discount to large caps but broad market weakness to limit SMC (small and mid caps) upside. SMC’s discount to large caps has widened to 25% currently from 18-20% early this year. SMCs now trade at an average of <10x FY11/12F PE on 15% growth.

Although valuations are attractive, we believe broad market weakness – we see STI downside risk to 2500 - would cap advances in SMCs near term. We believe interest would be limited to defensive stocks like REITs or company-specific counters with visible growth.

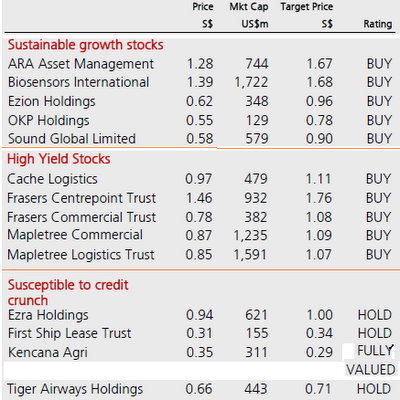

Exit stocks with high gearing; accumulate stocks with high yields and sustainable growth drivers. As the continuing Eurozone debt crisis raises the specter of a liquidity crunch, we would stay away from companies with weak earnings outlook and high gearing: Ezra, Kencana Agri, Tiger Airways and First Ship Lease.

Beat the current low interest rate environment with high yield REITs: FCT, FCOT, MCT, MLT and Cache Logistics. Outperform current period of sub-par growth with companies offering visible and sustainable earnings growth over the next twelve months: ARA, Biosensors, Ezion Holdings, OKP and Sound Global.

ARA (S$1.28, BUY, TP: S$1.67): In our view, ARA is Asia’s finest asset manager with a high cashflow generating business model and little earnings downside since its fee income is based on a % of property value and % of net property income, which has proven to be resilient in previous crisis.

Following a set of strong 3Q11results which beat expectations, near term catalysts for the stock includes the formation of a new fund - Asia Dragon fund II aiming to raise US$1bn by 1Q12 - and a potential new REIT listing in 2012, with potential AUM of over S$2bn, which would add 10% to current AUM.

Fees from these potential assets under management are poised to bolster fees growth in 2012 and 2013.

Our target price of 18x FY12 AUM earnings for ARA is pegged to the higher end of global asset manager peers (PE ranging from 10x-18x), justified by its superior ROE, strong earnings visibility and multi earnings growth drivers over the next two years in our view.

OKP (S$0.55, BUY, TP S$0.78): With its S$250m order backlog representing a record bookto-bill ratio of almost 2.0x, we are positive on OKP’s growth prospects and its ability to sustain dividend payments.

OKP currently has close to S$95m net cash on its books, which includes proceeds from placements and warrant conversions, and can be used to pay higher dividends to shareholders, or explore investment opportunities in related businesses like property development to boost ROEs.

We are of the view that major shareholder China Sonangol’s interest in the Singapore property market will create business opportunities for OKP in building construction contracts as well as potential investment avenues.

Recent stories:

ARA ASSET: Resilient earnings, super-high profit margins, steady dividends

Market strategy, OKP offers 'excellent value', SOUND GLOBAL is a 'buy'