ARA Asset Management is a billion-dollar company listed on the Singapore Exchange. Especially in turbulent market conditions such as currently, stocks like ARA get noticed by investors searching for businesses that are resilient and offer decent dividend yields.

NextInsight met up with ARA’s management as well as attended a presentation by its Group CEO recently to come to grips with its business model – it’s unique and powerful. To begin with, its strategic partner is Cheung Kong Group of Hong Kong whose boss is, of course, Li Ka Shing. Having the region's largest real estate developer as a substantial shareholder gives it access to a critical mass of real estate assets. Other barriers to entry include its track record, which is what regulators look at, the network and know how in real estate...

1. What is ARA’s business?

Founded in 2002 as a joint venture between ARA Group's CEO, John Lim, and the Cheung Kong group, ARA has grown to become one of the largest real estate fund managers in Asia. It deals only with physical real estate, not equity.

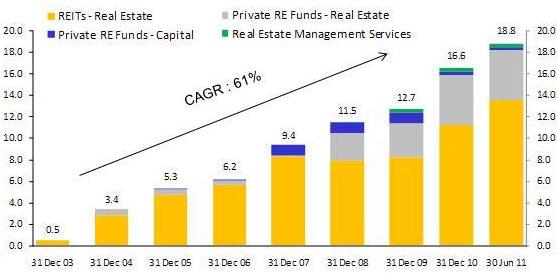

The assets under management amount to S$18.8 billion as at end-June this year. It takes pride being an Asian manager focusing on Asian assets and attracting global capital.

ARA manages 6 REITs - Fortune (SGX and HK-listed), SUNTEC and Cache Logistics Trust (SGX-listed), Prosperity and Hui Xian (HK-listed), and AmFirst (KLSE-listed).

Its portfolio of assets spans every sector -- office, retail, industrial/office and logistics - as well as private real estate funds investing in real estate in Asia.

There are also supporting services that it also owns (more on this later).

2. How does ARA generate revenue?

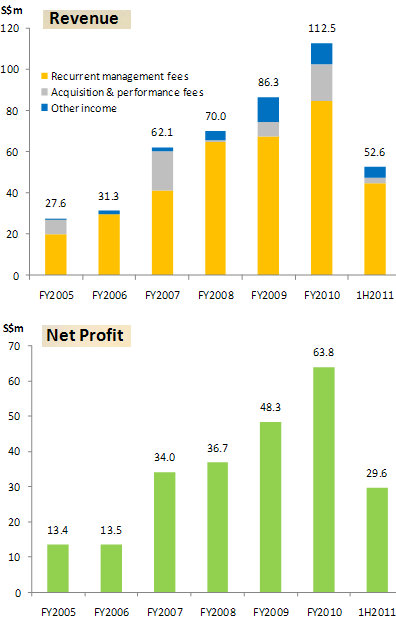

ARA is well diversified with 5 revenue streams – REIT management fees, private real estate fund management fees, real estate management fees, acquisition and performance fees as well as distribution and other income.

REIT management

A REIT manager’s income increases with the number of buildings held under the REIT. REIT managers’ base fees are a percentage of gross property value (assets under management) and net property income.

For example, ARA collects 0.3% of Fortune REIT’s gross property value and 3% of its net property income. Fees may be marginally higher or lower from REIT to REIT.

According to John Lim, the CEO, about US$500 million in assets under management for a REIT manager is the break-even point.

Beyond that, the margins of the REIT manager grow rapidly because of economies of scale and operating leverage.

REIT management fees accounted for 51.4% of ARA’s 1H2011 revenues.

Private real estate fund management

Other than REIT management fees, ARA derives significant management fees from its private real estate funds, which has attracted top-notch American pension funds such as Calpers.

While REITS hold stable mature real estate with over 90% of its space leased out, private real estate funds typically invest in newly completed properties, properties under development, turnaround properties and distressed real estate.

ARA derives management fees for these funds based either on investors’ committed capital or gross property value. Such fees accounted for 21.8% of ARA’s 1H2011 revenues.

Real estate management services

At this point, it is useful to bear in mind that ARA derived 73.2% of its 1H revenue from managing REITS and private funds. ARA has two other business segments that provide supporting services to its core businesses.

One of these is real estate management services such as property management and convention and exhibition services. This segment belongs to the more traditional realm where, for example, it handles the human resources necessary for building maintenance and space leasing.

This is obviously a less scalable business but it complements the core business units of the group. Its real estate management service segment employs about 500 even though the segment contributed only 11.7% to 1H2011 revenues.

Corporate finance advisory

ARA Financial Pte Ltd is the Group’s in-house corporate finance advisory arm that provides advisory services on asset acquisitions to the REITs managed by the Group and advises the Group on the establishment of REITs, partnerships and joint ventures as well as mergers and acquisitions.

3. Is this a unique business model?

Yes. It is the only one of its kind on the Singapore Exchange - in fact, the whole of Asia. It is highly scalable, resulting in greater profits as it expands its assets under management. And its net profit margin is very attractive.

4. What kind of profit margins does such a business generate?

The Group’s 1H2011 net profit margins were 56.3%. It has consistently exceeded its internal net profit margin target of 50% since listing in 2007. It is one of a very few listed companies anywhere that can enjoy such lucrative margins.

5. What else is attractive about investing in ARA?

Resilient earnings model

ARA is one of the region’s largest real estate fund managers with a very well diversified portfolio of physical buildings.

In 1H2011, 85% of its revenue are from recurring income derived from REIT, private real estate fund and real estate management fees.

This is augmented by performance fees. For example in Aug, it announced the divestment of the interests of the private investors in the ARA Harmony Fund.

The ARA Harmony Fund is a private real estate fund established by ARA in September 2009 to acquire the Suntec Singapore International Convention & Exhibition Centre and had achieved an IRR of 64.8%.

For such an instance of fantastic performance, ARA is receiving a whopping one-off income of over S$10 million in 3Q2011 of performance fees for crossing its hurdle rate.

Its unique business model gives investors, who are less risk-averse, the desirables such as resilient fee-based income model and consistent dividends even in uncertain economic times. As John Lim said: "We are not like equity fund managers. We don't have redemption issues."

Even in an economic downturn, it can increase its AUM by setting up a property fund for distressed assets. And ARA has proven to be innovative, having launched the Hui Xian REIT in Hong Kong in April this year, the world's first offshore RMB-denominated equity offering.

Rapid growth

Its AUM has grown by a CAGR of 61% since incorporation in 2002, rising to S$18.8 billion as of Jun 2011.

REIT management is a highly scalable business as the same manager can manage all the physical assets in the REIT portfolio.

For example, FORTUNE REIT does not need to hire another manager when a new mall is added to its portfolio of malls.

Strong balance sheet

Its balance sheet is as clean as can be. It is debt-free, and has cash of S$40.0 million.

Consistent Dividends

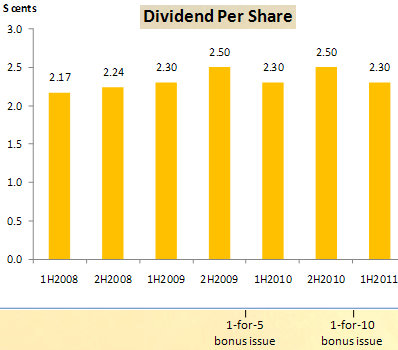

ARA paid out dividends of 4.8 cents a share per annum in FY09 and FY10. On top of that, it had a 1-for-5 bonus issue and a 1-for-10 bonus issue in those years, which effectively raised the dividend payout by 32%. Based on its recent stock price of S$1.345, it dividend yield is 3.6%.

Powerful strategic partner

The Cheung Kong Group of companies, with its worldwide presence of over a quarter of a million employees, combined market cap of HK$865 billion (as at Jun) and shareholding interest in ARA as well as the REITS means ARA has a very powerful strategic partner.

6. What are the roles of its other business segments?

The role of the REIT manager is to obtain financing for acquisition, capital management of the trust, engage in asset enhancement activities such as increasing traffic and source for new real estate assets that the trust may acquire.

Unlike the REIT manager or the real estate fund manager, a real estate manager handles the human resources necessary for building maintenance and space leasing.

With its corporate finance advisory arm, the entire supply chain of the real estate management business is taken in-house.

7. What is the culture of ARA?

What makes things happen in ARA, in the words of Fortune REIT CEO Anthony Ang: “John Lim is a very creative person. He is very focused and persistent. When he gives you a task, he doesn’t forget and constantly reminds you about it. When he sees an opportunity, he goes for it.”

ARA’s personnel are from 16 to 17 nationalities. Over the past 5 years, ARA has experienced an influx of senior people from leading organizations like Merrill Lynch, GIC, DBS, Ascendas and Mapletree.

It prides itself on its corporate culture, which is neatly summarized by the acronym REIT - Respect, Excellence, Integrity, Teamwork:

RESPECT - Treat our colleagues and business partners with consideration and respect at all times.

EXCELLENCE – Excel not just in financial performance, but in every aspect. We do not cut corners and always put our customers first.

INTEGRITY – Integrity is a commitment to honor the trust placed on us. We abide by a strong code of ethics and uphold the highest standards of professional conduct.

TEAMWORK – We constantly support each other and build an environment that values the team player, while working creatively, and performing to our best potential.

Recent story: Buying During Market Panic: ARA ASSET, SERIAL SYSTEM, SAMKO TIMBER

Anyhow, I just saw the latest Jaguar XF and I love it.... but will I pay $265k for it? Likewise, do I want to pay $1.18 for ARA today? Looks cheap now, if you see that ARA was trading @ $1.75 only 4 months ago. Since ARA fundamentals didnt deteriorate since May, (in fact ARA is better today versus May with a $10m kitty coming) ... so was ARA overvalued then, or its undervalued today? Or neither?

Let's look at a common valuation method for asset managers. AUM/Mkt cap... the higher the cheaper.

Ok here goes.

1. ARA is 18.8/0.906 = 20.75X

So who to compare?

ARA took a 15% stake in a Aussie peer (http://www.ara-asia.com/Document_Library/newsLetter/22-Jul-1008-07-54_APN-Placement-220710.pdf) in July 2010. So lets look at APN Property Group.

2. APN's AUM/Mkt cap is 2.253/0.026 = 86.65X

So now we know why John bought into APN... anyway, his entry price is 22cts. Its now doing 16cts.

3. Using ARA's 20.75X matrix, let us also look at CMA. Why CMA? Coz, its got an ARA-business embedded within. (most people don't realise this)

CMA's AUM for their fee-income biz is abt $25bn. So at ARA's valuation, their fee-income business is worth $1.2bn. CMA mkt cap is $4.6bn today but it has got lots of real estates inside there whereas ARA's NAV is their shares in REITs + tables + chairs. Once again, going through CMA's valuation would be a new long winded topic altogether.