Excerpts from latest analyst reports....

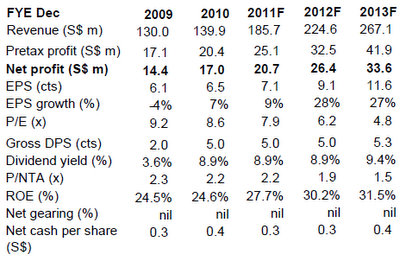

CIMB says OKP offers 'excellent value", target price 98 cents

Analyst: Gary Ng

Excellence is now an understatement describing OKP, as another strong quarterly profit power drives its figure further north.

Earnings momentum is red hot. We believe the appetite for more projects will materialize in months ahead, providing short to mid-term catalysts.

We see superior dividend yield of above 9% shifting this stock to another universe, where the hybrid of blazing earnings growth and defensive characteristic truly exists. Perhaps, the best word to describe OKP to investors is, BUY.

Valuation and recommendation: Maintained BUY, target price S$0.98.

We like OKP for its high projects visibility in the public sector, and its strong potential overseas expansion story.

OKP is a prime candidate to government infrastructural spending and the stock offers excellent value trading at 6.3x CY12 P/E against its 3-year core earnings CAGR forecast of 23%.

Recent story: SUNPOWER, UTD ENVIROTECH, OKP, BANKS: What analysts now say....

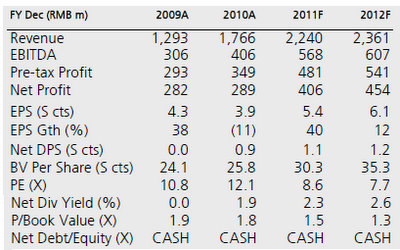

DBS Vickers says SOUND GLOBAL, which has won a RMB480m contract, is a 'buy'

Analyst: Tan Ai Teng

Sound Global has won a RMB480m contract to build wastewater treatment plants with total daily treatment capacity of 13,000 tons in five rural towns in Jiangyan City, Jiangsu Province including ancillary facilities for wastewater pipe networks, and the BT of the water supply pipe networks.

The concession period of this project is 25 years. Construction will take 14 months and the project is expected to commence operation by late Dec 2012.

SGL currently trades at 8x FY12 PE. We believe our 12% EPS growth for FY12 is conservative and see room for earnings upside if the company executes its expanding orderbook faster than expected.

Maintain Buy with unchanged TP of S$0.81 based on historical average of 14.5x PE on FY11/12 blended earnings.

DMG says "Expect STI volatility, with downward bias in the short term"

Analysts: Leng Seng Choon, CFA, and Singapore team

Following our recent changes in STI component stocks’ target prices, our 12-month STI target has been revised to 3240. This gives an upside of 19% from the current STI level of 2712.

Although the current STI level gives a weighted FY12 P/E of 14.2x (using DMG earnings estimates, where available), lower than the 20-year historical average of 19x, we do not find it attractive, as we believe therein lies earnings downside risk as developments unfold, particularly from Europe.

Whilst we may witness periods of volatile share price movements (in both directions), we believe the STI trend is likely to be downwards over the next few months before recovering.

BUY defensive stocks. Our top BUYs are corporate whose earnings are less cyclical and whose dividend yields are likely to be sustained at a relatively high level. Key BUYs include ComfortDelgro (S$1.33\BUY\TP:S$1.70), Frasers Centrepoint Trust (S$1.47\BUY\TP:S$1.79), M1 (S$2.48\BUY\TP:S$2.85) and Olam (S$2.33\BUY\TP:S$2.98).