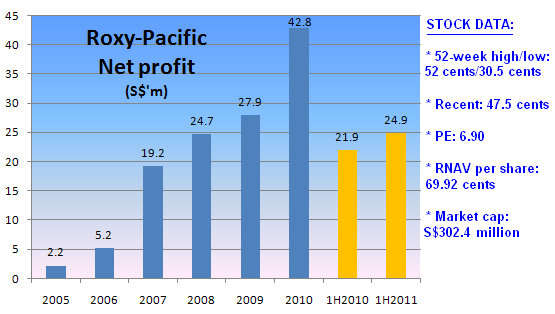

ROXY-PACIFIC Holdings has reported a 14% increase in net profit to $24.9 million for the first half of 2011, boosted by a $9.6-m fair value gain (vs $4.3 m in 1H2010) on its investment properties.

However, revenue declined 16% to $97.1 million, mainly because of a 23% fall in revenue contribution from property development, its mainstay, to $71.8 million.

Roxy recognises revenue according to the stages of construction of its projects.

The next one or two quarters may continue to see a decline, though not substantial, in property development revenue, said Mr Teo Hong Lim, its chairman, at a briefing for analysts and the media yesterday.

A pick-up will be enjoyed after the construction of two major projects begins, which is likely to be around 4Q of this year and January next year.

The two projects are 18 Spottiswoode and Space@Kovan, respectively, which in aggregate will contribute $387 million in revenue until their construction is completed.

The $387 million represents a significant 73% of the $531.1 million of progress billings of 12 property projects that Roxy will book between the current 3Q until 2014.

7 new projects to be launched at year-end and 1Q12

In addition to the $531.1 million, Roxy will enjoy another major revenue stream after its current landbank of 7 properties are launched for sale in six to nine months.

In response to a question, Mr Teo gave an update on the redevelopment plans and possible launch timing for the 7 sites:

1. Marina House (70, Shenton Way): Its existing lease will soon be topped up to 99 years. A showflat is under construction and the project could be launched for sale by year-end.

This project will have 40% residential-60% commercial space.

The Roxy consortium recently had put up the existing building for re-sale but didn’t receive any concrete offer.

2. Singapura Theatre (55, Changi Road): Roxy's original plan to sell 100% of the space as retail shops (strata title sales) was turned down by the URA, which instead allowed only 40%.

Roxy’s amended plan for the remaining 60% to be residential units has been approved recently. Project launch would likely be at year-end.

3. Everitt Building (116, Changi Road): This is to be an A&A (addition & alteration) project with shops on the ground floor, and offices of 400-500 sq ft for SMEs on the upper floors.

Sale will start after Singapura Theatre and New Changi Hotel projects have been launched. The Everitt Building is currently income-generating so there is no rush to redevelop it.

4. New Changi Hotel (80, Changi Road): Roxy has received in-principle approval for the freehold site to be rezoned into commercial.

It plans to redevelop it to have 40% retail, 60% office space for strata title sales. Likely year-end launch.

5. 103, 105 Lorong N Telok Kurau: Roxy has just completed the purchase of this site. It can be launched for sale in 6 months.

6. MacKenzie Mansion (131, MacKenzie Road): Launch by 1Q next year.

7. 12, 14, 16, 18, 20, 24 Hillview Terrace: Launch will be end of this year at the earliest.

Other highlights of the Q&A session yesterday:

Q Will Roxy be offering shoe–box units?

Mr Teo: We will offer compact-sized units. The government is now trying to control the minimum size and if we have to offer 400 sq ft units, it doesn’t make sense to do 1-bedroom units. We probably will go up to 500 sq ft and offer two bedrooms. This will attract buyers looking for value.

Q Can you provide an update on Nottinghill Suites?

Mr Teo: It is about 20% sold since its launch in July 2011. Average pricing is $1,600 psf. Frankly, we feel the speed of the sale is not as expected.

Q You are converting meeting rooms in your Grand Mercure Roxy hotel into hotel rooms. How many will be involved?

Mr Koh Seng Geok: We will create 15 more hotel rooms. Currently we have 558. Valuation at the start of the year was $560,000 per room.

We are going to spend close to $4 million for the new rooms plus a refurbished poolside and a new restaurant, so it’s money well spent.

While property development's revenue contribution declined 23% in 1H2011, Roxy-Pacific's hotel across the road from Parkway Parade shopping mall contributed 11% more in revenue amounting to $23.7 million.

Grand Mercure Roxy Hotel enjoyed a strong room occupancy rate of 93.0% and an average room rate of $186.0.

Another revenue boost came from its property investment segment which added 5% more revenue, mainly from higher rental on the renewal of leases for some shop units at Roxy Square.

Roxy's property investment segment comprises 88 retail shops at The Roxy Square Shopping Centre and Kovan Centre.

More information on Roxy's 1H2011 financial performance can be accessed at www.sgx.com

Recent story: PORTEK, COMBINE WILL, ROXY PACIFIC: Latest happenings....