Excerpts from latest analyst reports….

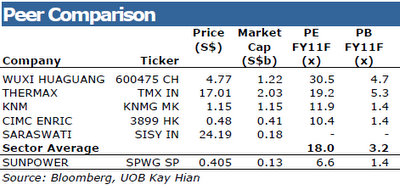

UOB Kay Hian highlights 6.6X PE valuation of SUNPOWER

• We believe that there are numerous opportunities for the business to grow given increasing capex spending by a number of key clients.

• In addition, Sunpower is moving towards higher-end products and solution, while it continues to expand its existing customer base. We believe that a 10-20% EPS growth should be achievable for the group.

• We believe margins should remain stable despite rising raw material costs as Sunpower prices its products based on a cost plus basis. The group purchases raw materials upon securing contracts to lock-in their margins.

• We expect operating cashflow to be healthy going forward as Sunpower typically collects up to 30% down payment in advance for any given project. The remaining sum is collected in phases as the project is being completed.

• Sunpower is trading at a consensus FY11F PE of 6.6x, which is at a 63.4% discount to regional peers.

Story on recent meeting between Sunpower's management and NextInsight readers: SUNPOWER: Orderbook is a record RMB1 billion, up 59%

CIMB maintains 'Neutral' and target price of S$0.37 on AUSGROUP

Analyst: Yeo Zhi Bin

Ausgroup has secured a A$60m earlyworks contract for the Karara magnetite project in Western Australia. The award of this contract precedes a coming main contract which should be worth over A$200m.

Award of the main contract is expected by end-4QFY11. If Ausgroup secures it, its order wins could exceed our A$400m target for FY11. Order book now is A$262m with Ausgroup having added A$250m new jobs YTD. No changes to our earnings estimates or target price of S$0.37, still based on 7.5x CY12 P/E, in line with peer, Hiap Seng.

We maintain Neutral as we await more signs of improvement before turning more positive. We would re-visit the stock upon larger-than-expected orders or a faster-than-expected turnaround in margins.

Recent story: AUSGROUP: Heading towards an inflexion point in 2H of calendar year 2011

DBS Vickers says BioMatrix approval in Japan a catalyst for BIOSENSORS stock

Analyst: Andy Sim

We believe that Japan approvals for BioMatrix should be granted within the next 12 months. This should present a catalyst for the counter in the near term.

We observed historically that, for past coronary stents, the time period from CE mark to Japanese market approval took an average of about three years.

BioMatrix, having obtained its CE Mark in 2008 and also submitting it for approval in Japan, would have crossed the 3-year mark in 2011. This raises the possibility of a near term catalyst for the counter.

Upgrade to BUY, SOTP TP raised to S$1.35.