THE WORLD'S No.1 distributor of Mitsubishi marine diesel engines, Singapore-listed XMH Holdings, assured investors yesterday that it is business as usual despite disruptions to Japan’s manufacturing sector following the recent natural disasters. XMH derives more than 70% of its revenue from Mitsubishi engines.

The management of XMH met about 15 analysts, fund managers and traders yesterday to discuss the results for 3Q ended Jan 2011.

In its results announcement on Mar 17, XMH had, however, expressed concern about the knock-on effects of the earthquake and tsunami on its business.

It said it would likely experience delays in the supply of engines and/or power generating sets from Mitsubishi Heavy Industries due to disruptions in infrastructure, power supply and transport systems in various parts of Japan.

So far, it has been business as usual --- Mitsubishi's factories are located near Yokohama and Nagoya, and therefore suffered no damage.

XMH, which listed its shares on the Singapore Exchange in January this year, has achieved the distinction of being Mitsubishi’s largest worldwide distributor for marine diesel engines for the last 6 consecutive years.

It is also one of the top two marine diesel engine distributors in Indonesia.

The company has 50 years of operating history and counts shipyards and vessel owners, which construct or own smaller vessels like tugs and barges, as its main customers.

Other than marine diesel engines, it also distributes industrial diesel engines used in hotels and buildings, and water and oil pumps.

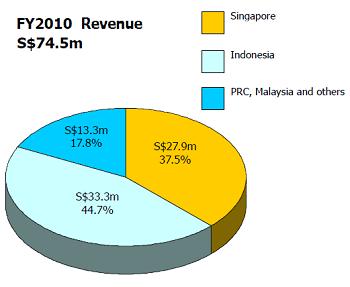

Revenues for its first three quarters ended 31 Jan 2011 were S$53.4 million, up 12.9% year on year. The gross margin was 27.9% while net margin was 22.4%.

Operating profit was S$12.2 million, up 18% year on year after excluding IPO expenses of $1.4 million.

XMH said its order book stood at S$64.8 million as at 17 Mar, most of which would be fulfilled in the next financial year which starts in May 2011.

An outstanding feature of its financial performance is that its 9-month operating cashflow was S$12.7 million, helping to boost its cash and cash equivalents to $53 million.

In its IPO, XMH raised net proceeds of S$18.85 million. It intends to use S$10 million to construct an assembly line for its in-house brand of power-generating sets, and expand warehousing and work areas. S$7 million will be for M&A while the balance is for working capital.

Below is a summary of questions raised at the meeting and replies by CEO Elvin Tan, executive director Sam Chua and financial controller Johnson Yap.

Q: Investors are not generally positive on distributors. What is your competitive edge?

Local distributors normally only carry one brand and distribute in only one country. We are unique in the relatively large number of products (over 4,000) and brands (8) we carry, and our distributorship rights are worldwide. This allows us to offer one-stop solutions for MNC clients. Our size also enables us to bargain for better credit terms and pricing from suppliers.

Q: Who did you list as competitors in your prospectus?

Marine diesel engine brands that compete against Mitsubishi are: Caterpillar, Cummins and Yanmar.

Q: In the event that you cannot procure engines from Japan, do you have substitutes?

During boom times or during natural disasters, we do face tightness in supply. In such situations, Mitsubishi will look for alternative component suppliers.

We are also carrying the Doosan brand from Korea, that is similar to Mitsubishi.

Q: Why did you list when your cash flow is so strong -- the IPO proceeds were less than operating cash generated over 2 years?

We want to raise our profile --- to attract more talent, get more principals and widen our product range.

Q: Who are your top 5 customers?

We listed Pacific Ocean, Hoe Ee, Sarmar, Palma Progress Shipyard and Otto Marine in our IPO prospectus. ASL Marine and Marco Polo are also customers, but not among the top 5.

Photo by Leong Chan Teik

Q: Who decides on the engine brand?

All parties – the ship owner, end user, shipyard, as well as the naval architect.

Q: Are your distributorships for a limited period or indefinite?

Most are auto-renewed.

Q: How will Singapore’s increase in foreign workers levy impact you?

We have less than 10 foreign workers -- so the impact is small.

Q: What is your biggest risk?

A shipping downturn, but we survived the global financial crisis. We are also highly dependent on Mitsubishi. We have been Mitsubishi’s no.1 distributor for 6 years. They have never changed any dealer.

Photo by Leong Chan Teik

We are their exclusive distributor for Indonesia, Singapore and Maldives. We have a good standing with them due to our track record penetrating these 3 markets from zero to become one of their leading distributors. We created new applications and new markets, such as offshore vessels.

In recognition, they gave us non-exclusive distributorships for China, India and Vietnam last year.

Q: What are you doing now that the market for small to medium offshore support vessels is shrinking?

There is now a vessel supply glut, so we are focusing on Indonesia, where there is demand for tugs and barges due to demand for transportation of coal and crude palm oil.