WHAT SORT of performance this year would you expect of a company like Mencast Holdings after it has delivered consistent revenue and profit growth and a high profit margin, even through the global financial crisis?

Your answer could well be ‘more of the same’ – and you could be right.

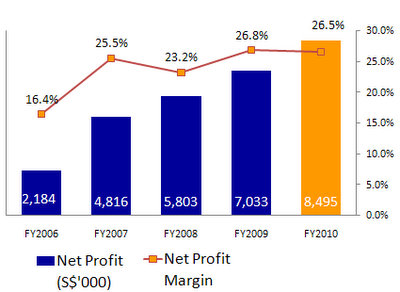

Mencast, which reported a record $8.5 million net profit for 2010, is a unique business listed on the Singapore Exchange: It manufactures sterngear for vessels, and repairs worn out or damaged stearngear.

In this field, unlike others, Glenndle Sim, its chairman and CEO on Monday (Mar 7), there has been no significant new competitors in the last decade.

The sterngear services industry has a high barrier to entry for various reasons, including the specialized skills required and the fact that certification requirements for sea-worthiness are required for work done before the relevant mandatory insurance policy on the ship can be purchased.

Mencast has been around some 30 years, during which it has established itself and enjoyed strong growth particularly in recent years – and a robust net profit margin of between 23% and 26.5% in the last three years.

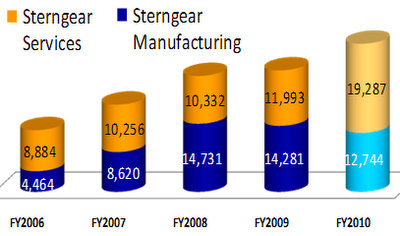

Between 2006 and last year, Mencast achieved a compounded annual growth rate of 19% and 31% for its revenue and net profit, respectively.

And the management of Mencast in a briefing for analysts and fund managers on Monday (Mar 7) said it is putting in place three drivers that will ensure yet further growth, mainly:

1) Capacity expansion: Mencast is on track to increase its manufacturing capacity progressively from 10,000 sq m to 40,000 sq m from the second half of this year to 1H2013.

Its new Penjuru Road facility is a waterfront facility, and is its prized asset as the location will facilitate the transfer of sterngear to and from vessels.

Mencast is the preferred manufacturer of Becker for sterngear and heavy rudder assemblies, in part because of Becker’s trust in Mencast’s ability to protect Becker’s intellectual property, according to Mr Sim.

Through Becker, Mencast will be able to access new customers in Korea, Japan and China for its manufactured products.

3) Mergers & acquisitions, joint ventures and alliances: Mencast is actively looking at M&As, JVs and alliances to boost its earnings, following a successful 100% acquisition of Recon Propeller in mid-2009.

Recon Propeller contributed significantly to the revenue last year, enabling Mencast to offset lower revenue from its manufacturing business (as a result of slower shipbuilding activities). The Group's revenue rose 21.9% year-on-year to $32 million.

Shares of Mencast (market cap: S$66 million) closed at 38.5 cents recently for a trailing PE of 7.1. On a 1.1 cent final dividend (proposed), its yield is 2.85%.

Well-known investor Gay Chee Cheong is the biggest buyer among 9 investors who took up a placement of shares of Mencast last year.

Mr Gay took up 8 m shares at 35 cents apiece for a total of $2.8 m. Between 2001 and 2006, he was the CEO of 2G Capital, a private investment company that he co-founded.

Recent stories:

MENCAST on course for high growth

MENCAST: Gay Chee Cheong among 9 buying new shares