Watch the above video (1 min 32 seconds) for glimpses of Mencast's FY2012 results briefing and of analysts and fund managers visiting Mencast's new waterfront facility in Penjuru Road. Glenndle Sim, executive chairman & CEO, Mencast Holdings. He and the extended Sim family collectively own about 43% of the company. NextInsight file photoMENCAST HOLDINGS hosted a group of analysts and fund managers on Tuesday (Mar 12) on a visit to its brand new facility in Penjuru Road -- that's the tip of south-west Singapore.

Glenndle Sim, executive chairman & CEO, Mencast Holdings. He and the extended Sim family collectively own about 43% of the company. NextInsight file photoMENCAST HOLDINGS hosted a group of analysts and fund managers on Tuesday (Mar 12) on a visit to its brand new facility in Penjuru Road -- that's the tip of south-west Singapore.

There, Mencast has clinched the last parcels of waterfront land, which will be the company's launch pad for bigger business.

The 35,466 sq m of built-up area accounts for the majority of the increase in built-up area of Mencast's facilities -- from 7,000 sq m in 2007 to 48,378 sq m last year.

The larger space reflects the big dreams and the sizzling progress of the company since its IPO in 2008.

A few indicators: Assets have gone up 8.6x, while revenue 4.4x and market cap, 3.4x.

Mencast today has a market cap of about S$141 million. It has added S$100 million since IPO.

There is a 'big hairy audacious goal' championed by its energetic and driven executive chairman-cum-CEO Glenndle Sim. Mencast would strive to become a $1 billion company by 2020, he said.

And its earnings target is more than S$50 million by then, compared to the S$13.3 million it earned last year. Jojo Alviedo joined Mencast in Oct 2012 as CFO. Prior to that he was Corporate Advisory Principal at Nexia TS Public Accounting Corporation, Singapore.

Jojo Alviedo joined Mencast in Oct 2012 as CFO. Prior to that he was Corporate Advisory Principal at Nexia TS Public Accounting Corporation, Singapore.

Photo by Leong Chan Teik

How to get to $1 billion

To understand Mencast's roadmap to $1 billion, one has to understand its business transformation over recent years.

Mencast used to be mainly a sterngear manufacturer which also repaired and maintained sterngear.

It made five M&A deals in pursuit of its vision of becoming a MRO -- maintenance, repair and overhaul -- player in the oil & gas and marine industries.

By no means would those be the last M&A deals: Mencast has identified M&A as one of the ways it will continue to grow by.

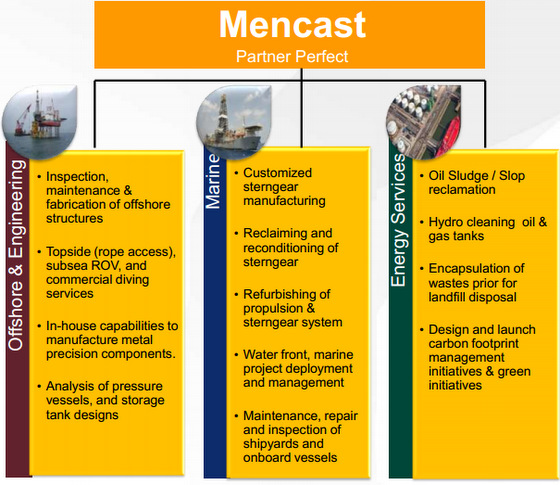

The following visual depicts the 3 business segments and the range of services of Mencast currently:

These are not unrelated business segments: on the contrary, their services can be cross-sold to the same customer in an industry rich in opportunities.

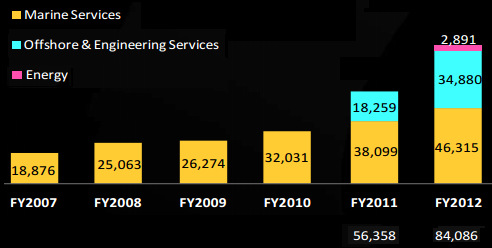

The chart below shows the contribution of new business segments to Mencast's revenue in 2011 and 2012.

Revenue growth (in S$'000) of Mencast through the years, and the contribution from new business segments in 2011 and 2012, resulting in total revenue of $56,358,000 and $84,086,000, respectively.

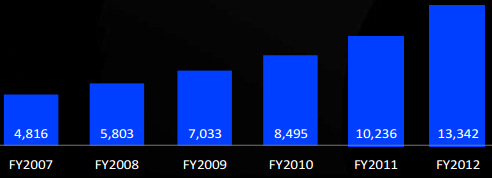

Revenue growth (in S$'000) of Mencast through the years, and the contribution from new business segments in 2011 and 2012, resulting in total revenue of $56,358,000 and $84,086,000, respectively.  Net profit (in S$'000) of Mencast

Net profit (in S$'000) of Mencast

Getting loans from banks to grow used to be a big challenge, so Mencast turned to the more expensive route -- issuing new shares which translated into relatively high weighted average cost of capital.

Among investors who liked the business fundamentals and growth plan of the company were Temasek Holdings fund, the SME Co-Investment Fund Limited Partnership, which bought 7 million new shares, or a 3.7% stake, for S$3.7 million. (See our earlier story.)

Given the track record it has achieved and its bigger business size, Mencast is confident of raising bank borrowings for any M&A needs in future.

The stock traded recently at 62 cents, or slightly above its RNAV of 54 cents, which comprises 40 cents book value and a revaluation surplus of 14 cents on its properties.

Mencast said if it had excess liquidity, it would be prepared to buy at a premium to RNAV, the premium currently being set at 'a modest' 10%.

Mencast's Powerpoint materials for its FY2012 results briefing can be accessed at the SGX website.

For more on Mencast, read:

MENCAST: Transformed, and taking off in oil & gas industry

MENCAST: Transforming into MRO player for higher profitability