"The outlook has improved so much over the past 6 months, we can now tender only for projects with good margins," said CEO John Sheridan. File photo by Sim Kih

"The outlook has improved so much over the past 6 months, we can now tender only for projects with good margins," said CEO John Sheridan. File photo by Sim Kih

IT IS BOOMTIME in Western Australia and Ausgroup is riding on this.

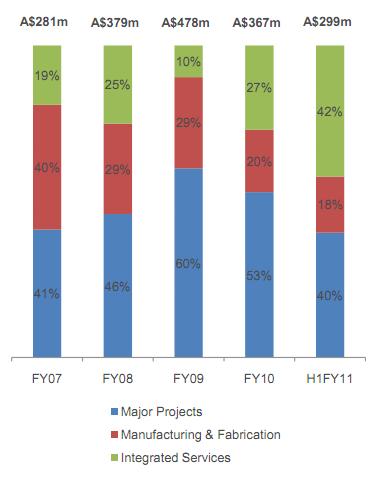

Ausgroup grew revenues a whopping 87.2% for the 6 months ended Dec 2010 (1H2011) to reach A$298.8 million.

The outlook is bright, with more than A$300 billion in major resource projects in Western Australia over the next 10 years, according to the company’s internal estimates.

However, the boom in Western Australia is being challenged by a shortage of skilled labor.

Potential business contracts for Ausgroup, which has strong exposure to iron ore, oil and gas, LNG and other mineral commodity sectors in Western Australian, amount to some A$67 billion.

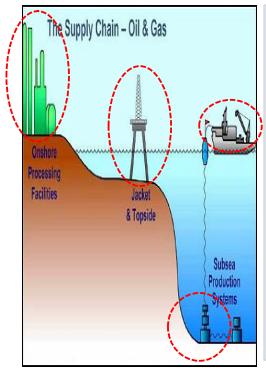

It provides fabrication, precision machining, construction and integrated services to numerous natural resource development behemoths such as Alcoa, Apache, BHP Billiton, Exxon Mobil, Rio Tinto, and Woodside.

”We are bidding for many more projects now compared to only one or two projects just six months ago,” said Ausgroup CEO John Sheridan, during an investor briefing yesterday afternoon at the Fullerton Hotel.

The competitive landscape has changed so dramatically that some customers even approached the mining resources infrastructure specialist to pre-book manpower for upcoming jobs, said the CEO.

Work in hand at end December 2010 was A$212 million.

However, 1H2011 gross profit grew only 11.3% to A$26.7 million, due to provisions for losses on two construction contracts.

Gross margins were 9.0%, down 6.1 percentage points, while net margins dropped to 1.7% from 3.2% in the previous period.

In Singapore, Ausgroup provides services to the upstream and downstream oil and gas and related sectors through fabrication and manufacturing and access (scaffolding) services.

Tendering activity has improved across all markets and business divisions, he said.

The management believes margins will recover as tendering activities improves, but expects this to be reflected only in its financial performance for FY2012.

Below is a summary of questions raised by investors at the briefing and the management’s replies.

Q: MAS has been doing some work for Exxon Mobil. How much traction has been gained over the past few months? Are you able to gain market share from traditional EPC players?

Exxon Mobil has acknowledged us as ‘best contractors’ and that is very important for us. We believe we have made progress in terms of client-relationships.

Q: Are you considering M&A to expand your capacity given the huge market at hand?

We are constantly exploring M&A opportunities. We acquired Cactus in 2006 and MAS (Modern Access Services) in 2009. However, a labor-intensive business like ours is at risk of worker exodus when the acquired company is not well integrated.

Q: How are you managing the risk of losses on future projects?

We have taken a number of measures. We have changed project managers. We have beefed up the executive management team. We have become more focused on profitability and put in more supervision. It is unlikely that we have another loss making project as we have put in place more management oversight.

Q: What were the reasons for the losses on the projects?

One project was due to poor internal execution that was overlooked by the supervision system in place at that time. The other project was clinched during the global financial crisis, with contract sum translating to very tight margins.

Q: Have sufficient provisions been made?

The projects are now 80% to 90% complete. The provisions that we made were conservative and I believe there will be no further provision in the coming quarters.

Q: What would your margins have looked like if you reverse the losses?

Normally gross margins would have been closer to ballpark estimates of 11%.

Related story: AUSGROUP: "Really good improvement in project opportunities..."