Excerpts from latest analyst reports…..

CLSA expects Baltic Dry Index to plunge 31% by 2012

Analysts: Philip Chow & Robert Bruce

The tide is out for dry-bulk stocks in 2011/12 and we forecast rates to remain submerged until 2013. Good operators have timed the cycle well by chartering vessels out at top-of-the-market rates, but as contracts expire, even quality companies will see margin and return erosion.

Consensus expects just 0.9% operating margin contraction in 2011. We believe this is unrealistic and fails to consider operating leverage and cost inflation.

In this report, we initiate on China Shipping Development and U-Ming with SELL calls and on Sincere Navigation with an Underperform rating. We prefer container shipping.

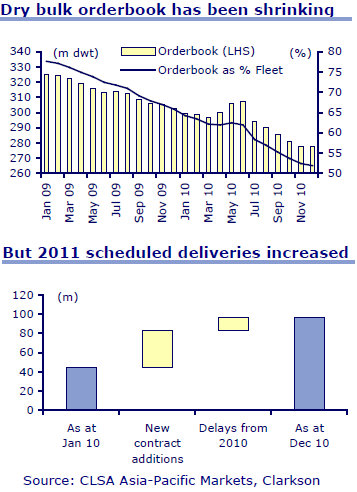

The severity and earnings ramifications of dry-bulk oversupply are underestimated. Supply conditions are still deteriorating. Effective 2010 cancellations only ran at 10% of scheduled deliveries and some 30% of the orderbook has been rolled over to 2011-14. This implies that rates will remain depressed for longer.

China has aggressively expanded its tanker fleet over the past 10 years because of national resource security concerns. The same build-out could occur in dry-bulk as Beijing becomes increasingly uneasy with its reliance on foreign-shipping capacity. Some Chinese shipping groups may plan a five-year 30% Cagr for their fleets. Further new vessel orders could present potential downside risks to our already pessimistic supply estimates.

We expect the Baltic Dry Index to slip 31% by 2012. We forecast rates to ease 24% and 10% in 2011 and 2012, averaging 2,102/1,903. We remain bullish on demand (8% YoY), but find cost inflation and return compression inevitable ahead of the record capacity glut as supply grows at an unprecedented 13% per annum.

Our earnings forecasts are at the low end of consensus for most of the stocks that we cover.

Kim Eng Research says HU AN CABLE looks cheap at 4.3X forecast FY11 earnings

Analyst: Yeak Chee Keong

Supported by infrastructure spending. Demand for cables in China is supported by strong domestic infrastructure development plans by the government, especially for high voltage and ultra high voltage cables. Rural power grid upgrade spending is estimated to reach RMB200b between 2010 and 2012. Hu An Cable has close ties with state‐owned grid companies and should continue to benefit strongly from the capex spending.

Aggressive expansion plans. Hu An Cable is investing RMB338m in a new factory to double its cable production capacity and for production of high voltage and ultra high voltage cables. It is also investing another RMB88.9m in a copper production plant to triple its annual copper rods production capacity.

Cheap valuation with strong growth potential. 9M10 net profit was impressive, having surpassed that of FY09 already. Capacity expansion could potentially improve its topline and bottomline figures over the next few years.

Supported by strong demand, the stock appears relatively cheap given that it is trading at consensus FY10F & FY11F PER of only 7.4x and 4.3x respectively.

However, we are watchful of the increase in receivables (due to increase in revenue) which has contributed to negative operating cashflow of RMB286m for 9M10. All of its borrowings of RMB570m are short‐term in nature but management is confident that the loans could be renewed.

Recent story:HU AN CABLE, WILMAR: What analysts say now....