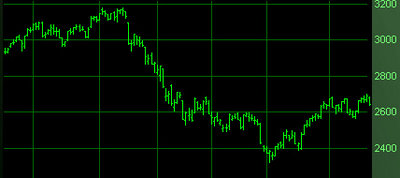

CHINA’S BENCHMARK Shanghai Composite Index dipped 0.11% to close at 2,639.37 today as shareholders took profits and further digested news of a weaker than expected US job market.

Real estate counters also took a hit as an executive from the country’s largest listed developer gave a bleak forecast for property prices going forward.

Meanwhile, shares in Hong Kong lost nearly half a percent today, closing down 0.44% at 20,889.01.

BYD: Dream Deferred?

Shenzhen-based BYD Co (HK: 1211), which is 10% held by Warren Buffett’s Berkshire Hathaway Inc, fell 3.8% today to 44.65 hkd, the lowest level in nearly a year, following a much weaker-than-expected second quarter.

The innovative automaker whose initials stand for "Build Your Dream" and is largely associated with green technology thanks to its expanding line of hybrid and fully-electric vehicles, recorded an April-June net profit of 717 mln yuan, far below the 962 mln consensus estimate by analysts earlier this year.

This came as a surprise to shareholders who had been upbeat on the Hong Kong-listed firm thanks in large part to its F3 model sedan being the top-selling car in China in the first six months.

Despite the uninspiring second quarter performance, BYD still plans to seek a domestic listing in Shenzhen this year, but only when market conditions were more inviting.

“The company hopes to be able to list on the A-share market by the end of the year,” media reported Chairman Wang Chuafu as saying at the company’s earnings release in Hong Kong today.

The automaker’s Hong Kong-listed shares have fallen some 35% in 2010, even more drastic when seen against the 4.6% decline in the benchmark Hang Seng Index since January 1.

A Shares: Machinery supports Shanghai Composite

Despite a 0.11% decline in the benchmark Shanghai Composite Index today to 2,639.37, one sector stood out for its supporting role.

Chinese machinery counters were higher as investors bet on more bullish earnings going forward on recent government pledges to boost the massive sector, especially in the less-developed hinterlands.

Sany Heavy Industry Co (SHA: 600031) and Changsha Zoomlion Heavy Industry Science & Technology Development Co (SZA: 000157) both powered up today on vibrant first half results announcements.

Sany Heavy added 3.7% to 25.95 yuan after first-half net income gained 162% from a year earlier to 2.88 bln yuan.

Changsha Zoomlion, the country's second-biggest maker of concrete-handling machinery, gained 2% to 24.84 yuan. The company said first-half net income increased 94% from a year earlier to 2.2 bln yuan.

Goldman Sachs recently jumped onboard the machinery wagon, saying sector stocks would likely benefit from the enhanced government support and investment strategy.

However, property developers and oil firms led the downward trend today.

First half oil processing margins slipped by 45% as crude costs surged 84%.

China’s top energy firm PetroChina Co (SHA: 601857) retreated 0.7% today to 10.35 yuan on crude oil declines for September delivery and concerns that less feverish economic growth will temper oil demand.

One materials standout was Beijing Shougang Co (SHA: 000959) which rose by its daily 10% limit today on major investment plans by the steelmaker in an automobile joint venture.

Meanwhile, property counters took a hit from expectations of further restrictions on speculation in the market as well as a statement in the official media today by an executive with the country’s largest listed developer.

China Vanke (SZA: 000002) Chairman Wang Shi said home prices in the country’s leading urban markets may decline 10-15%, the New Express Daily newspaper reported today, without providing a specific timeline for the forecast.

Poly Real Estate (SHA: 600048), China’s No.2 developer by market value, lost 1.5% to 12.31 yuan.

China Vanke shed 1.9% today to 8.49 yuan while China Merchants Property Development Co (SZA: 000024) dropped 3.1% to 19.76 yuan.

Read recent: CHINA SHARES: Red Letter Day For A-shares, GDP Ranking