Excerpts from latest analyst reports…

Asiasons WFG Research expects Trek’s 2011 profit to jump to more than US$10 m

Going forward, the growth of the company is expected to be driven by its latest brainchild known as the FluCard, a form factor of the Secure Digital (SD) card.

Presently, while there are cameras or other SD cards with Wi-Fi attributes, we understand from management that these products are only able to transfer data on a limited number of networks.

The FluCard, however, is compatible with all existing digital cameras with SD card slots and has a memory of up to 30 secured networks. Furthermore, there is also an online portal for FluCard users to upload their digital content.

Key takeaways:

2) Industry Review - The IT landscape in which Trek is involved is highly competitive, thus leading to relatively low earnings for Trek in the past two years where net earnings amounted to less than US$1.5m collectively. Margins have been generally low, although we do recognize that this issue is also seen in the company's competitors as well.

Players in this industry are required to come up with their "killer products" should they wish to alter this equation, and Trek believes that its FluCard to set to take up this challenge.

3) Company Review - We surmise that Trek's previous strategy pertaining to its ThumbDrive was not well-executed as the company opted to market this innovative product without any major backing from any MNCs. However, in promoting the FluCard, Trek would be working very closely with major shareholder Toshiba where a consortium of MNCs will be formed to sell this new product. Given the robust backing from this tech heavyweight, we therefore strongly believe that it would be different for Trek this time round as Toshiba will appoint the company as the official OEM for the FluCard while overseeing its IP protection rights along with the consortium.

Our view:

We are expecting market reception for the FluCard to be highly positive and that meaningful contributions from this product should kick in during 4Q10. Therefore, we estimate that FY10 net earnings should be no less than US$4.5m as compared to the US$0.7m that was seen in FY09. For FY11, we believe that net profitability should also more than exceed the US$10m mark as it ramps up its production of the FluCard while demand is expected to be supported by the various camera makers.

Recent story: TREK 2000: NextInsight readers get 3 hours' worth of insights

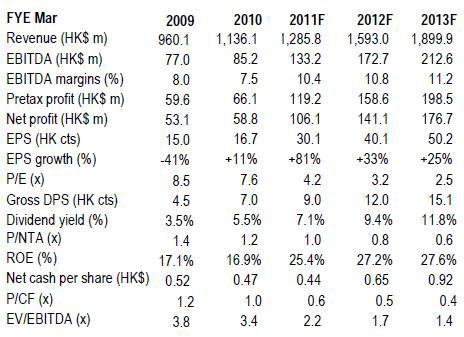

CIMB initiates coverage of Valuetronics with a 42-c target

Analyst: Gary Ng

Initiate coverage with BUY rating and target price of S$0.41, representing more than 60% upside. The stock is cheap with more than 40% of its market capitalisation backed by net cash. Our target price of S$0.41 (6.5x CY11 P/E) reflects a 50% discount to the global peers’ 13x, given that their customer base is not entirely similar and their capabilities are not identical. We believe share price undervaluation is unjustifiable given Valuetronics strong balance sheet, attractive yields, high ROEs and healthy EPS growth prospects.

Vertically integrated CM with good earnings track record and Licensing segment is the exciting new driver! We see Valuetronics as a total solutions provider covering the whole value chain of activities from branding to manufacturing and all the way to marketing. This change was facilitated at the end of FY10, as the group entered into an exclusive licensing arrangement with a renowned household appliance giant to use their established brand names to design, manufacture, market and sell portable air purifier appliances in the North American market.

Generally, working capital control has been improving drastically for global EMS players. Our observation is that most of the EMS companies with longer track record and better exposures to global clients have experienced lesser degree of inventory mismanagement. These EMS names often keep a close watch on limiting inventory accumulation, and at the same time, adopted consignment inventory methods. Thus, working capital metrics as a whole are generally better over the last three years, as compared to those in the tech-bubble years.

Strong balance sheet and cash flow to support 30% dividend payouts. VALUE had HK$193.5m of net cash as at end-FY10 from funds raised from its strong operating cash flow and conservative capex. Given its strong balance sheet and tight working-capital control, we believe Valuetronics will be able to sustain its 30% payouts moving forward. This translates into attractive prospective dividend yields of 7-12%, making this company the one of the highest yielding tech stock.