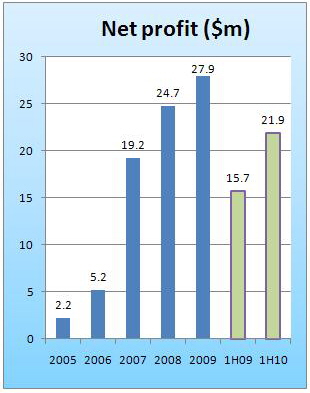

PROPERTY DEVELOPER Roxy-Pacific Holdings has just reported yet another record half-year profit – of $21.9 million – which places it on track for another record year of profit.

Its 1H profit of $21.9 million surpassed the profit for the full year of 2007, the year just prior to its IPO in 1Q of 2008.

However, in terms of stock price performance, Roxy-Pacific has barely budged above its IPO price. It closed yesterday at 32.5 cents, up by 0.5 cent, on volume of 1.425 million shares.

The stock price is now just a little above its IPO price of 30 cents some 2.5 years ago.

It is currently trading at a big discount to its Revalued Net Asset Value (RNAV) of 57.03 cents a share. On a PE basis, it trades at 4.7X based on annualized earnings per share of 6.88 cents for this year.

Asked to comment on the apparent mispricing and undervaluation of the shares, Mr Teo Hong Lim, executive chairman and CEO of Roxy-Pacific, told an analysts’ briefing yesterday:

“External parties tell us one of the reasons is the relatively low free float of our shares. Another thing is the stock is a penny counter. I look at it this way: As business owners, we are here for the long term and to grow the business. If our RNAV reaches 70-80 cents, for example, I don’t think our stock price will stay at 32 cents.”

Highlights of 1H2010 results:

* Revenue rose 42% to S$116.3 million, mainly from a 50% rise in contribution from property development.

* Going forward, there is strong revenue flowing in. Progress billings of $227.5 million will be recognized (as the construction of launched projects get under way) from 3Q this year to FY2012.

Mr Teo (centre) speaking with analysts Chan Kah Ling of Standard & Poor's and Goh Han Peng of Tecity Group. Photo: Leong Chan Teik

There was more cheer recently when Roxy-Pacific launched two projects last month (July), and sold out 100% of Haig 162 and 77% of Straits Residences.

At least two more residential projects are slated to be launched over the next few months and before year-end.

A third project to be developed on the site of Dragon Mansion in Spottiswoode Park may be launched by year-end. If not, it would be early next year.

Some highlights from the Q&A session:

* On the Roxy-Pacific consortium’s purchase of Marina House at 70 Shenton Way for S$148 million from the Hong Leong Group for redevelopment.

Mr Teo said that since the purchase in April this year, he has noted that office property prices have continued to rise. The project would be launched next year.

Contrary to some market talk that the consortium had failed to obtain the authority’s agreement to top up the site’s lease to 99 years, Mr Teo said “We have not been rejected.”

Executive director Koh Seng Geok (centre) with analysts. Photo: Leong Chan Teik

What is happening is that the consortium is working on ideas to enhance the usage of the site, and will subsequently apply for planning permission from the Urban Redevelopment Authority (URA). Only after the URA has given its green light will the consortium seek the Singapore Land Authority’s agreement to top up the site lease, said Mr Teo.

* On renewing Roxy-Pacific’s landbank:

Mr Teo said the company’s search is no longer focused on the eastern part of Singapore but islandwide.

“Now land is quite scarce. Most of the land coming out is from the government. But there are pockets of opportunities and most of our landbanking come from our contacts.”

The stumbling block is that prices that land owners are asking for are high these days, and Roxy-Pacific is taking a cautious view.

“Even if we can design something different, and the margin is 10% only - we don’t want to do such a product. We are still searching every day for land,” said Mr Teo. Roxy-Pacific is eyeing state land and joint ventures with other developers.

* On the development of mega site Dragon Mansion:

Mr Teo said it would a few months to secure some small parcel of state land next to the Dragon Mansion, and integrate it into the planning. The project could be launched by year-end if the URA approval comes through.

“We don’t hoard land. As soon as we get approval, we launch our projects.”

Standard & Poor's report on Roxy-Pacific's half-year results can be viewed as an attachment in our forum here.

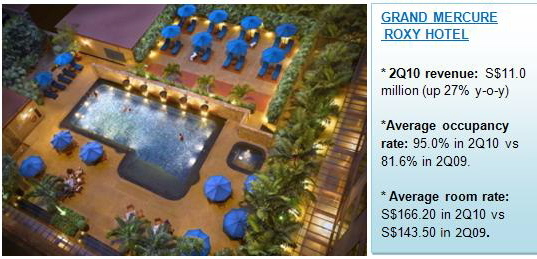

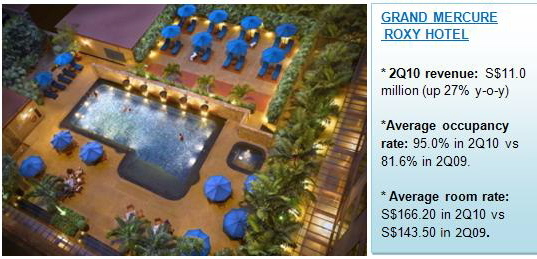

While property development brings in big bucks, Roxy-Pacific also owns a hotel in the East Coast that is enjoying growing business.

Recent story: ROXY-PACIFIC'S Q1 profit 'beat my expectations'

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors