Venue: Wilkie Edge Singapore,

Venue: Wilkie Edge Singapore,

Wilkie Road.

Time & date: 3 pm, Apr 26.

ANWELL TECHNOLOGIES last month (March) became the only player in the world which has developed its own proprietary production lines for solar panels and uses the lines for mass producing those panels.

Anwell, which is listed on the Singapore Exchange, started mass-production last month, bringing to fruition its unique vertically integrated model.

That gives it a key advantage in cost, since it doesn’t have to buy someone’s equipment. On top of that, Anwell operates in China, where its operating costs are far lower than its competitors.

Anwell also has a vertically integrated model for its other business - optical media (ie, DVD and the nascent Blu-ray discs businesses). Its media products manufacturing and trading business generated HK$624.4 million in revenue last year, accounting for 75% of the Group's revenue.

At its AGM yesterday, Anwell displayed optical media that it manufactures and a solar panel that it had shipped over from its factory.

Some highlights of the Q&A with shareholders during the AGM:

Shareholders voting for one of the resolutions at the AGM. Photo by Leong Chan Teik

Q: Where do you see your bread and butter coming from without solar? You are feeding on government grants but how are you going to make money while waiting for the promise of solar?

Franky Fan, executive chairman & CEO: I like your question. We don’t live on government grants. The grants just accelerate our engine of growth. In the next two years, I believe solar will happen. We now have a healthy disc business and it has entered into a new age – the BD (Blu-ray Disc) age – and these are high GP (gross profit) products.

Q: Sorry, I have to stop you there. I am a BD user myself. I’m very frustrated with BD. There are a lot of different standards all the time. I have to upgrade my player all the time. The disc manufacturers for videos are coming out with BD and DVD at the same time because consumers are refusing to pay the money. I don’t share your optimism about BDs.

Franky Fan: I thank you for your comment but I would like to stick to the facts. According to market research and what we are hearing from our customers, the BD-recordable growth this year compared to last year is more than 100%. This means that consumers around the world are buying into BD. If you go to Japan – Tokyo, Osaka – half of the shelf space is occupied by BD media.

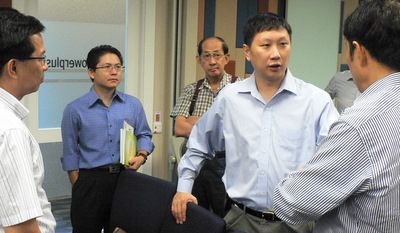

After the AGM, Anwell chairman Franky Fan (second from right) continues to field questions from shareholders. Photo by Leong Chan Teik

In Singapore, companies are expanding into the production of BD media because they really see the BD wave is coming. Some major companies in the DVD media industry are planning to expand quickly into manufacturing BD-Rom. We know that because we are equipment manufacturers and they have to talk to us.

Q: Anwell’s gross gearing has gone up from 38% to 43% in 2009. Net current assets is negative, so how do you intend to repay some of the borrowings and have enough cash for working capital?

Ken Wu, CFO & executive director: Most of the borrowings are classified under current liabilities, and they are borrowings in China. We are confident that most of the bank borrowings can be rolled over when they fall due.

Q: Due to the financial crisis, the banks themselves may have problems. If that’s the case, they may want to pull back the credit and you may have problems. Why don’t you go out and get a term loan of, say, 5 years?

Franky Fan: If you look at our company background and the usual bank practice in China, you will feel much more comfortable.

Q: You took in government grants and deferred tax credit into your 2009 income statement. I don’t know if the grants and deferred tax should rightfully be considered as your income.

Ken Wu: The accounts were prepared according to the accounting standards of Singapore.

For more on Anwell’s solar business, read our recent story: ANWELL, in historic moment, kickstarts mass-production of solar panels

Venue: Wilkie Edge Singapore,

Venue: Wilkie Edge Singapore,

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors